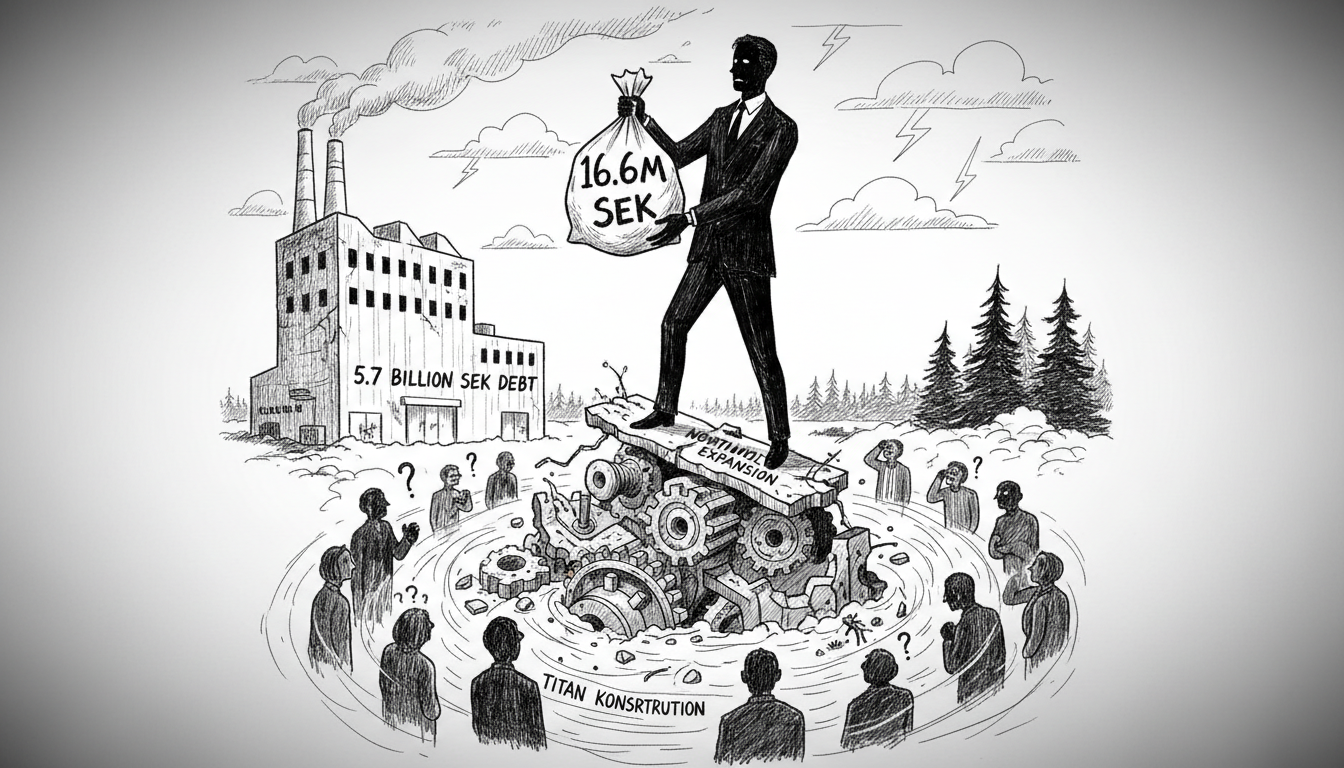

The Swedish government faces renewed scrutiny over industrial policy following revelations about substantial fees in the Northvolt bankruptcy proceedings. A bankruptcy administrator handling the insolvency of a key Northvolt subsidiary has received an advance payment of 16.6 million Swedish kronor for his work. This development raises questions about the cost of corporate failures in Sweden's strategic industries.

The subsidiary, Northvolt Ett Expansion, was declared bankrupt in October. It managed the expansion of the battery factory in Skellefteå. The company collapsed with debts of 5.7 billion kronor owed to its suppliers. This failure occurred amidst a challenging economic climate for large-scale industrial projects.

Bankruptcy administrator Jonas Premfors detailed the advance in a report submitted to the district court. The funds cover work from the start of the bankruptcy in early October through late April. In his application to the court, Premfors justified the fee. He cited the extensive scope of the bankruptcy, involving approximately forty employees. He also noted that concurrent bankruptcies of other Northvolt companies complicated the process. Premfors described the scale of the bankruptcy as 'spectacular' in correspondence with officials.

Major creditors now express uncertainty about their own recoveries. Titan Konstruktion, one of the largest Swedish creditors, is owed over 400 million kronor. The company's CEO, Henrik Mattsson, voiced frustration with the lack of transparency. 'We do not even know what he has requested for his price,' Mattsson said. He also stated his company remains in the dark about potential compensation. 'We do not know if we will receive any compensation or how large it could be,' he added.

Mattsson commented directly on the administrator's 16 million kronor advance. 'I do not know exactly what costs he has, but we really must hope that it is 16 million well-invested kronor,' he stated. The situation has taken a symbolic turn at Titan Konstruktion's offices. A Northvolt board originally displayed there is now repurposed. 'We use it as a dartboard,' Mattsson revealed.

The core assets of Northvolt Ett Expansion were sold, along with other bankrupt Northvolt entities. American company Lyten purchased them for an undisclosed sum earlier this year. This sale leaves Swedish creditors awaiting a resolution from the bankruptcy estate.

This case highlights the complex aftermath of high-profile corporate collapses supported by Swedish government policy. It underscores the tension between protecting creditors and the high administrative costs of untangling large bankruptcies. The substantial advance to the administrator, while legally justified, contrasts sharply with the uncertainty faced by Swedish suppliers owed billions. For international observers, it serves as a case study in the risks associated with state-backed industrial leaps. The final distribution to creditors will be a critical test of the system's fairness. The Riksdag may later review whether current bankruptcy laws adequately balance all interests in such spectacles of corporate failure.