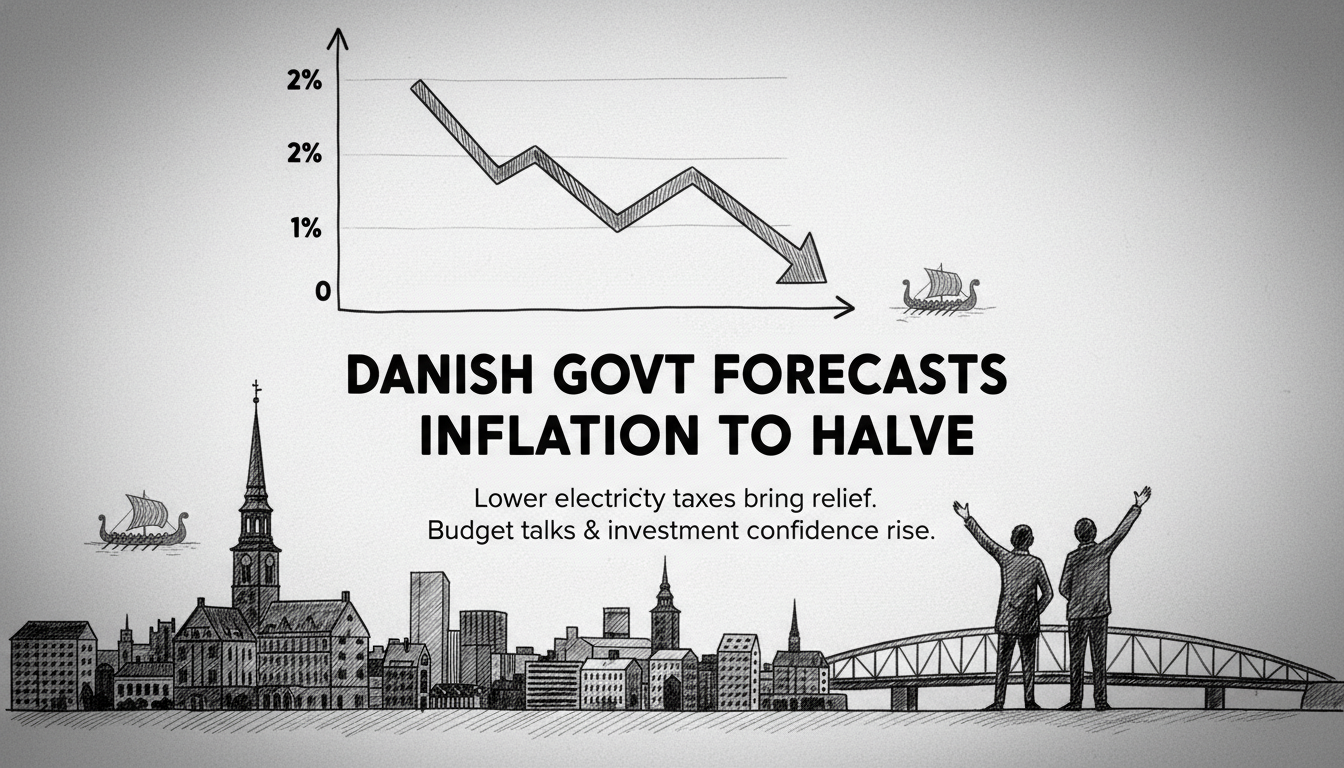

The Danish government expects inflation to fall sharply next year, according to its latest Economic Survey. The report, published this Thursday, predicts inflation will drop from 1.9 percent to 1 percent. A key driver is the planned reduction in electricity taxes. This marks a significant shift in the economic outlook for Copenhagen businesses and the broader Øresund region.

The Economic Survey is a foundational document for Danish fiscal policy, released three times annually. The previous report in August projected an even lower inflation rate of 0.9 percent for the coming year. The government maintains its expectation that inflation will continue to decline in the following years.

This forecast has immediate implications for trade and commerce. Lower inflation typically strengthens consumer purchasing power and business investment confidence. For Danish exporters like Vestas and Ørsted, stable domestic costs can improve competitive margins in international markets. Companies in Copenhagen's financial district and the industrial hubs of Greater Copenhagen are watching these figures closely.

Finance Minister Nicolai Wammen has consistently emphasized price stability as a core policy goal. The government's strategy relies on controlled fiscal measures rather than aggressive interest rate moves by the central bank. This approach aims to support growth in key sectors like renewable energy and maritime trade while managing the cost of living.

The projected decline is not guaranteed. It depends heavily on global energy prices and supply chain stability. Denmark's economy remains tightly integrated with European and global markets. Any external shock could alter this trajectory. Business leaders are cautiously optimistic but aware of these risks.

For international investors, this news signals relative stability in the Danish economy. The Copenhagen Stock Exchange often reacts positively to firm inflation control. Sectors like pharmaceuticals, with Novo Nordisk and Lundbeck, and industrial goods, with Danfoss and Grundfos, benefit from predictable operating costs. This environment supports long-term planning and capital expenditure.

The report's timing is critical. It sets the stage for the upcoming budget negotiations. Business groups will lobby for tax relief and investment incentives based on this improved inflation outlook. The government now has more fiscal space, but political pressures for increased spending on welfare and green transition are also rising.

In plain terms, the government is betting its reputation on this forecast. If inflation falls as predicted, it validates their economic management. If it does not, they face credibility questions. The coming months will test the accuracy of their models and the effectiveness of their policies. The data from the first quarter will be the first real indicator.