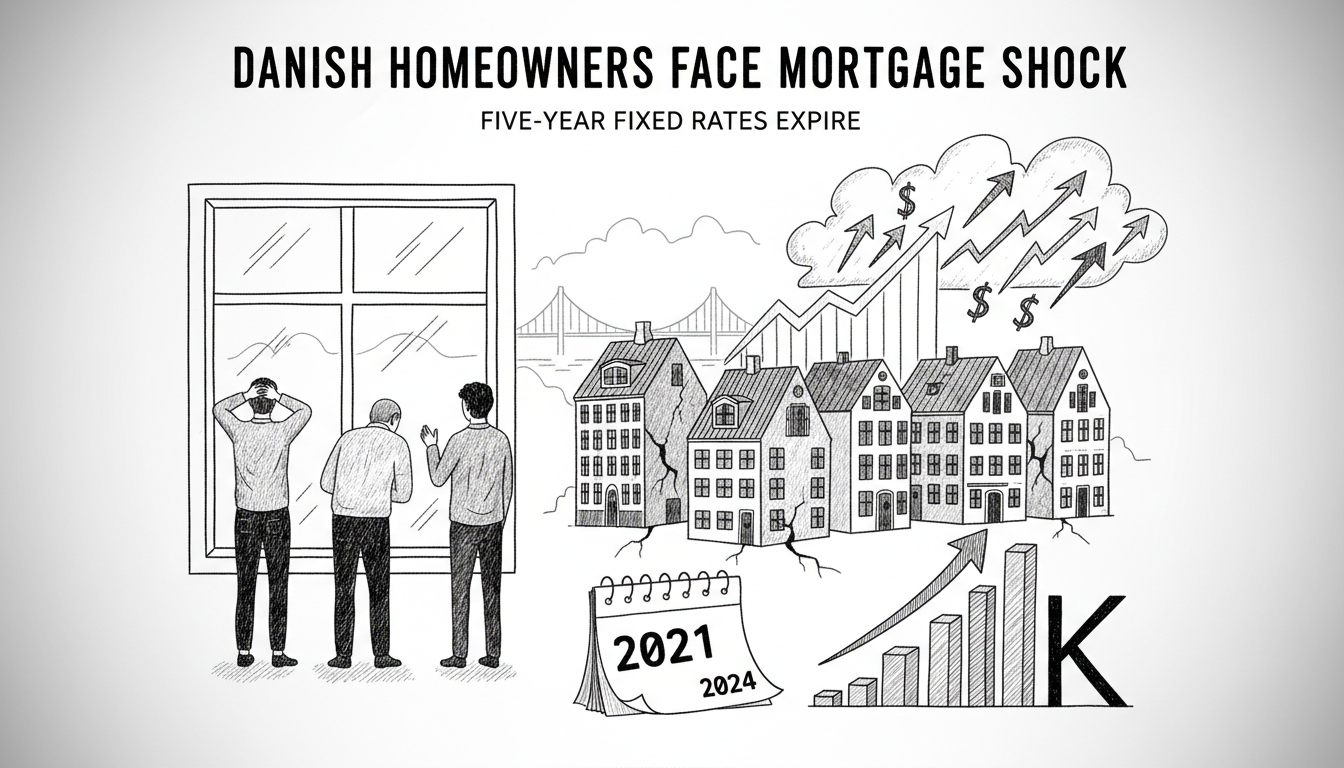

Thousands of Danish homeowners will see their mortgage payments increase substantially in the coming months. Many borrowers took out five-year fixed-rate loans in early 2021 when interest rates reached historic lows. These loans now face renewal at much higher rates.

The situation affects homeowners who secured F5 loans, a popular Danish mortgage product with rates fixed for five-year periods. In January 2021, these loans carried interest rates of negative 0.25 percent. Borrowers essentially received money to borrow during that period.

Now the financial landscape has transformed completely. The Danish central bank has raised interest rates multiple times to combat inflation. This means homeowners who enjoyed ultra-low payments must now adapt to significantly higher costs.

Many borrowers are already switching to different mortgage types. They seek to minimize the financial impact of rising rates. The shift represents a major adjustment for household budgets across Denmark.

Danish mortgage system differs from many other countries. Most homeowners use mortgage bonds through specialized credit institutions. The F5 product remains one of several options available to borrowers.

This payment shock comes during broader economic pressures. Danish families already face higher costs for energy, food, and other essentials. The mortgage increases will squeeze disposable income further.

Financial advisors recommend homeowners review their options well before renewal dates. Some may benefit from switching to variable rates or longer fixed terms. Others might consider adjusting repayment schedules.

The situation highlights the risks of timing the mortgage market. Borrowers who locked in record-low rates now face the consequences of their decisions. The party truly has ended for this specific group of homeowners.

What does this mean for Denmark's housing market? Higher mortgage costs could cool buyer demand in coming months. Potential homeowners may reconsider their purchasing power. Existing owners might cut back on other spending to accommodate higher housing costs.

The Danish economy has weathered similar transitions before. Yet the scale of this rate adjustment presents real challenges for many families. The full impact will become clearer throughout the year.