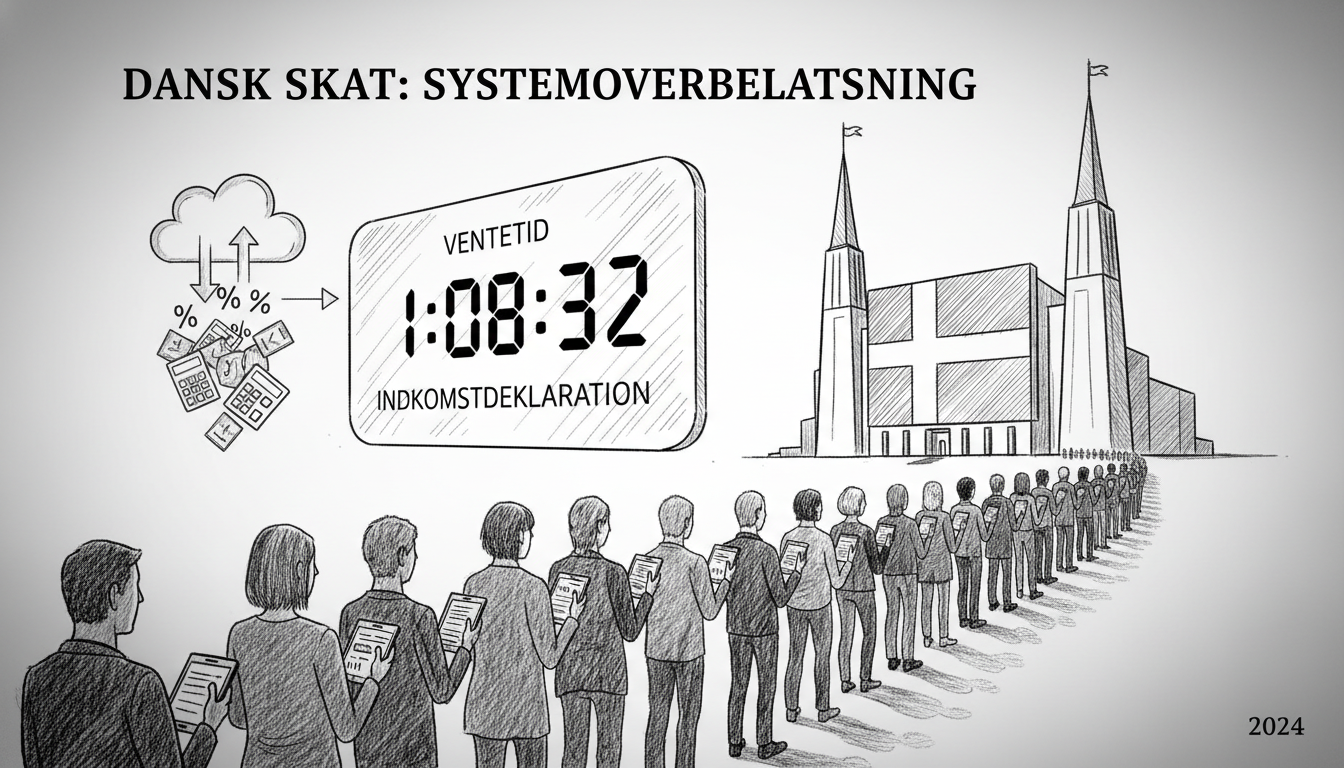

Danish taxpayers encountered significant delays accessing the country's tax declaration system this week. More than 30,000 citizens waited in digital queues exceeding one hour to review their preliminary tax assessments.

The preliminary tax statement serves as a budget for expected income and taxes, while the annual tax return available in March shows actual income, deductions, and taxes from the previous year. The annual return typically attracts more attention because many Danes anticipate tax refunds.

This year's preliminary declaration introduces several important changes affecting different taxpayer groups. Workers within five years of retirement age should pay special attention to new senior employment deductions taking effect. The additional deduction equals 1.4 percent of employment income up to 6,100 Danish kroner.

The senior deduction expansion represents part of broader tax reforms. The current system will transition from a single top tax rate to three tiers: a middle tax, new top tax, and highest-tier tax. Most Danes will keep more of their earnings under this structure, while highest earners will contribute more.

Only individuals with personal incomes exceeding 2,592,700 kroner after labor market contributions will pay the five percent highest-tier tax on amounts above that threshold. Younger workers also benefit from changes starting in 2026, when those under 18 will no longer pay labor market contributions on their income.

The Danish tax authority typically experiences high traffic during declaration periods, but Tuesday's queue lengths surprised many observers. The digital bottleneck highlights both public engagement with tax matters and potential system capacity issues.

Tax professionals note that early engagement with preliminary declarations helps taxpayers avoid surprises and plan their finances more effectively. The Danish system encourages citizens to update expected incomes and deductions throughout the year rather than waiting for the annual settlement.

For international residents in Denmark, understanding these tax changes remains crucial for financial planning. The Nordic country's comprehensive welfare system relies heavily on tax revenue, making accurate declarations important for both individuals and public services.

The queue situation improved throughout the day, but officials acknowledged the initial surge overwhelmed their systems. Similar congestion has occurred during previous tax season openings, suggesting ongoing challenges in managing peak demand periods.

Danish tax authorities process millions of declarations annually through their digital platforms. The system generally receives praise for user-friendliness despite occasional capacity issues during high-traffic periods.