Denmark MobilePay processes over 100 million transactions monthly, a testament to its role in the country's cashless economy. For expats arriving in Copenhagen or Aarhus, mastering this app is not a convenience—it is a necessity for daily commerce and social integration. How do you navigate a society where physical money has all but disappeared? This guide explains the essentials, backed by data and expert insight into Denmark's digital payment landscape.

The Rise of a Payment Giant

MobilePay launched in 2013 as a Danske Bank initiative. It capitalized on high digital trust and smartphone penetration. Today, over 4 million Danes use it, representing a massive portion of the population. A 2021 study confirmed over 90% regular usage. This dominance stems from early mover advantage and deep integration with major banks like Nordea and Jyske Bank. The 2022 merger with Norway's Vipps created one of Europe's largest mobile payment providers, positioning the Nordic region as a leader in fintech innovation. For expats, this means encountering a mature, universally accepted system.

Economists point to network effects. The more people used MobilePay, the more essential it became for businesses and social interactions. Lars Tronsgaard, a Copenhagen-based fintech analyst, notes, 'The app succeeded because it solved a simple problem: making peer-to-peer payments easy. Its integration with Danish banking infrastructure made adoption swift.' This ecosystem is now part of Denmark's economic fabric, influencing retail trends in areas like Strøget and the Øresund region.

Getting Started: Non-Negotiable Steps

First, download MobilePay from your app store. You must have a Danish phone number. Linking a Danish bank account or debit card is mandatory; foreign credit cards typically fail. Setup takes about 10 minutes with a text message verification code. Upon registration, create a profile using your real name. Friends find you via phone number. Switch the app language to English in settings immediately—this is crucial for navigation. The app is free for personal use, while businesses pay a small fee per transaction.

This process underscores a key point for newcomers: financial integration begins with local banking. Without a Danish account, daily transactions become challenging. Major banks facilitate this, but expats should initiate account setup upon arrival. The ease of use is a direct result of Denmark's advanced digital infrastructure, which supports such efficient systems.

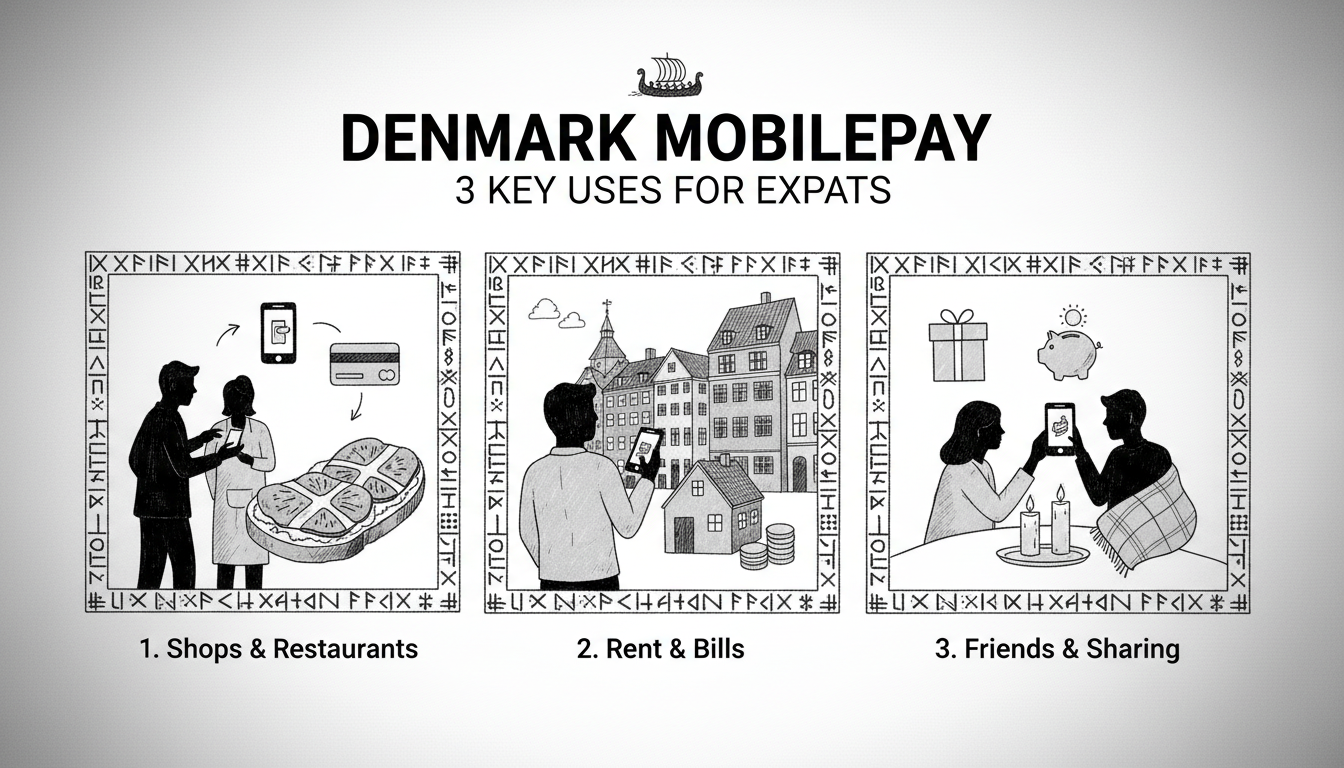

Three Essential Use Cases Explained

Splitting bills at restaurants is a quintessential Danish practice. Diners at popular spots like Gasoline Grill or Höst often have one person pay the full bill. Others then send their share via MobilePay instantly. For example, a 600-kroner meal for three sees each person sending 200 kroner. This method eliminates cash handling and exact change calculations. It reflects a cultural preference for efficiency in social settings.

Paying at small shops and markets relies heavily on MobilePay. At Copenhagen flea markets or farmers' stalls, vendors frequently display QR codes for scanning. You enter the amount and confirm with a PIN or biometrics. Payment completes in seconds. Always ask if card payment is available, as many small operators prefer MobilePay or cash. This trend supports local commerce, keeping transaction costs low for vendors.

Sending money to friends and landlords is routine. Rent splits, gift contributions, and shared costs flow through the app. Landlords may request rent via MobilePay on the first of each month. For group gifts, friends collect money digitally, with one person coordinating the transfer. This system reduces reliance on slow bank transfers. Transactions appear on bank statements within a day, aiding personal finance management.

Security, Limits, and Economic Impact

MobilePay employs bank-level security. Each payment requires PIN or biometric confirmation. Notifications arrive for every transaction. Users can set daily spending limits, often defaulting to 10,000 kroner, adjustable in settings. If a phone is lost, contact your bank immediately to block access. Never share your login details. These features build trust, which analysts cite as critical for adoption in a risk-averse market.

The app's popularity affects Danish trade figures. By reducing cash handling costs for businesses, it contributes to operational efficiency. Niels Kristensen, a retail sector consultant, says, 'MobilePay has standardized small-value payments, boosting sales velocity in cafes and boutiques across Copenhagen.' This digital shift aligns with Denmark's export strengths in renewable energy and tech, showcasing innovation in service sectors.

Expert Analysis: Why This Model Works

Experts attribute MobilePay's success to several factors. Early mover advantage allowed it to establish a strong user base. Network effects meant that as more people joined, the utility increased for everyone. High digital literacy among Danes accelerated acceptance. The merger with Vipps is a strategic move to compete with international platforms like PayPal or Apple Pay. This consolidation aims to capture more of the Nordic payment market, which is valued in billions of kroner annually.

For expats, understanding this context is vital. It's not just about using an app; it's about participating in a societal norm that drives economic interaction. Failure to adopt can lead to social exclusion and practical hurdles in daily life. The app's design, with its straightforward interface, minimizes barriers, but cultural adaptation is key.

Implications for Newcomers and the Future

Expats must view MobilePay as a tool for integration. It facilitates everything from paying for a coffee to contributing to office collections. The learning curve is shallow, but the implications are deep. As Denmark pushes forward with green energy and digital solutions, MobilePay exemplifies the country's commitment to technology-driven efficiency.

Looking ahead, the merged MobilePay-Vipps entity may expand services, potentially including cross-border transactions within the EU. This could further simplify life for expats moving between Nordic countries. However, the core function—enabling easy, secure payments—will remain central. For now, mastering MobilePay is the first step toward navigating Denmark's cashless reality.

In a nation where even street vendors expect digital payments, embracing this system is unavoidable. The question for expats isn't whether to use MobilePay, but how quickly they can make it a habit. As Danish commerce continues to evolve, this app stands as a gateway to both economic participation and social belonging.