Denmark's 90% online banking rate underpins a bill payment system that often puzzles new arrivals. The shift from global norms to a streamlined, mandatory digital-first model presents a significant initial hurdle for English-speaking professionals and students. This guide, drawing on interviews with banking experts and expatriates, details the crucial steps to navigate Denmark's efficient yet unique financial infrastructure.

The Mandatory Digital Gateway: From CPR to MitID

Your Danish financial life begins with the CPR number, the personal identification code issued upon legal residency. This number is your key to everything. Immediately after, you must secure MitID, the national digital signature that replaced the older NemID system in late 2023. Over 5 million Danes used NemID, and its successor is now mandatory for accessing public services and, critically, online banking. "Without MitID, you are essentially locked out of the formal economy," explains a Copenhagen-based advisor for expatriates at a major Danish bank. "It is the single most important tool to organize upon arrival." This system requires a code app on your smartphone, authenticating your identity for every significant online transaction.

Your Digital Mailbox: The e-Boks Imperative

Once MitID is active, setting up your digital postbox, e-Boks, is the next critical move. By law, all public authorities and most private companies—from the tax authority (SKAT) to utility providers like Norlys and telecom giants like TDC—send official invoices and documents here. Paper statements are rare. Failure to check your e-Boks regularly can result in missed bills and late fees. "I tell my international clients to check e-Boks as routinely as they check their email," says the financial advisor. This system, while highly efficient, places the onus of administrative diligence squarely on the individual.

Automating Everything: The Power of Betalingsservice

The core of Danish bill management is automation. For recurring expenses, Danes overwhelmingly use a direct debit system called Betalingsservice. Through your online bank, you authorize companies to withdraw funds directly on a set date. This covers utilities, internet, insurance, and some subscriptions. The system processes millions of transactions monthly, ensuring predictability. For a standard two-person apartment in Copenhagen, expect automated monthly withdrawals averaging 2,000 DKK for bundled services like heat, power, water, and broadband. Setting it up requires logging into your bank’s portal via MitID, navigating to the payment services section, and approving each company individually. This move from manual payment to automated permission represents a fundamental shift in financial management for many newcomers.

The Daily Payment App: MobilePay's Dominance

For person-to-person payments and smaller bills, MobilePay is ubiquitous. With over 4.5 million users in a nation of 5.9 million, its market penetration is staggering. Landlords frequently request rent via MobilePay, and tradespeople or casual service providers use it for invoicing. The app links directly to your Danish debit card, and transactions under a certain threshold are instantaneous and free for personal use. Its prevalence underscores a commercial culture built on high digital trust and convenience. However, experts caution against using it for very large transactions due to transfer limits and to always double-check the recipient's registered name before sending funds.

Challenges and Solutions for the Initial Phase

The system's efficiency assumes you have a Danish bank account and MitID. The interim period before these are secured can be challenging. Some larger utility companies may accept international bank transfers, but these incur high fees and poor exchange rates. Fintech solutions like Wise offer viable stop-gaps. Wise’s borderless account allows you to hold and manage Danish kroner, often with better exchange rates and lower fees than traditional banks. This can be crucial for paying your first deposit or utility bill while your local account is being established. The Danish government's push for digital inclusion is strong, but the initial onboarding process remains a steep curve for those unfamiliar with its components.

Expert Analysis: Efficiency Versus Exclusion

Financial technology analysts point to Denmark as a leading example of successful digital public infrastructure. "The high level of societal trust and reliable digital ID has allowed Denmark to streamline transactions dramatically, reducing administrative costs across the economy," notes a Copenhagen Business School researcher specializing in fintech. This infrastructure supports Denmark's competitive edge in trade and commerce, enabling businesses to operate with remarkable financial fluidity. However, the same expert highlights a critical caveat: "The system works exceptionally well for those inside it, but the barrier to entry is real. Digital exclusion is a risk for new residents and less tech-confident individuals, despite public support resources." This creates a paradox of a hyper-efficient system that can initially feel exclusive to outsiders.

The Bottom Line for International Professionals

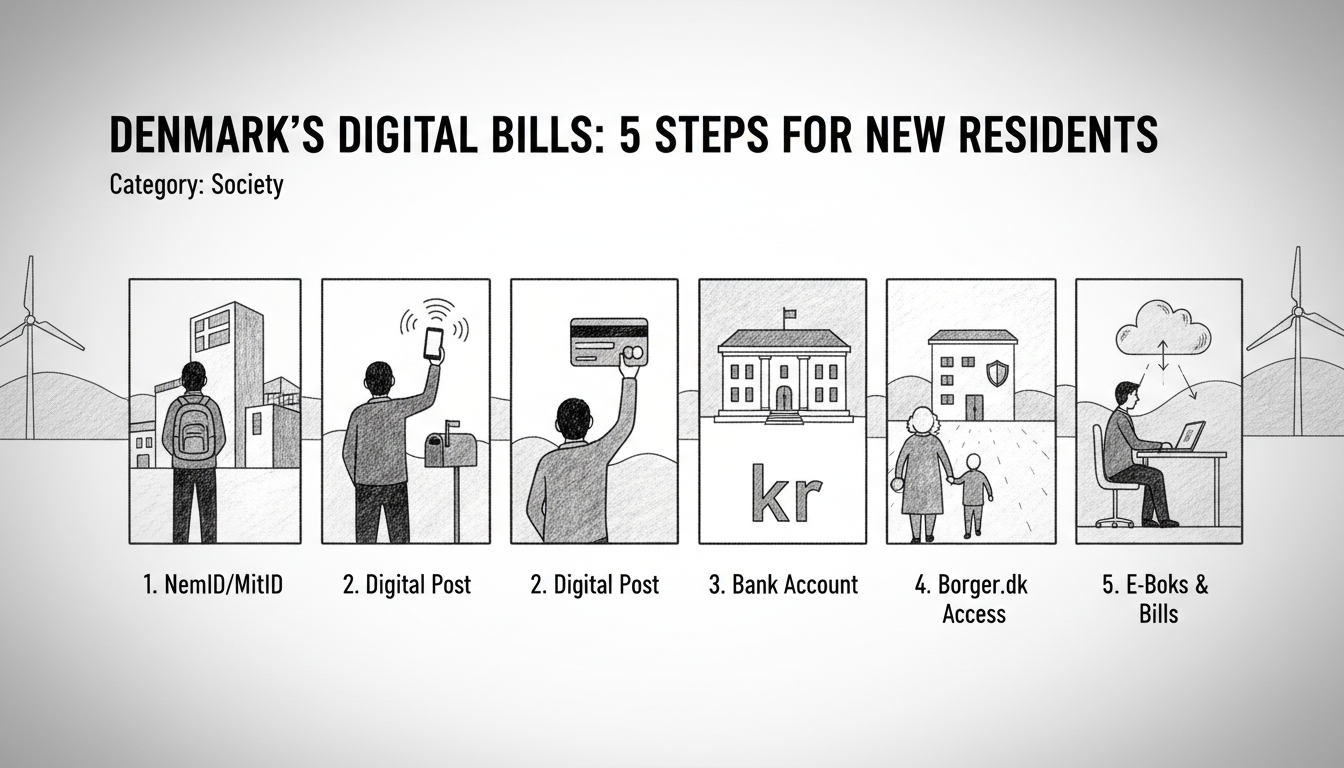

Adapting to Denmark’s payment ecosystem is a non-negotiable aspect of settling in. The sequence is clear: obtain your CPR, activate MitID, open a bank account, set up e-Boks, and then automate payments via Betalingsservice while adopting MobilePay for daily use. While the upfront learning commitment is significant, the payoff is a largely hassle-free financial routine. The Danish model, which has evolved over two decades, demonstrates how digital integration can simplify commerce and trade. For the international business community in the Øresund region, mastering this system is the first step toward operating effectively in one of the world's most digitally advanced economies. The question for Denmark now is how it can further smooth this digital onboarding process to maintain its attractiveness to the global talent that fuels its key industries.