Finland faces a surprising revelation about alcohol consumption patterns. New statistics show imported alcohol volumes significantly outpace previous government estimates. The findings emerge from updated data collection methods that replaced telephone surveys with online questionnaires.

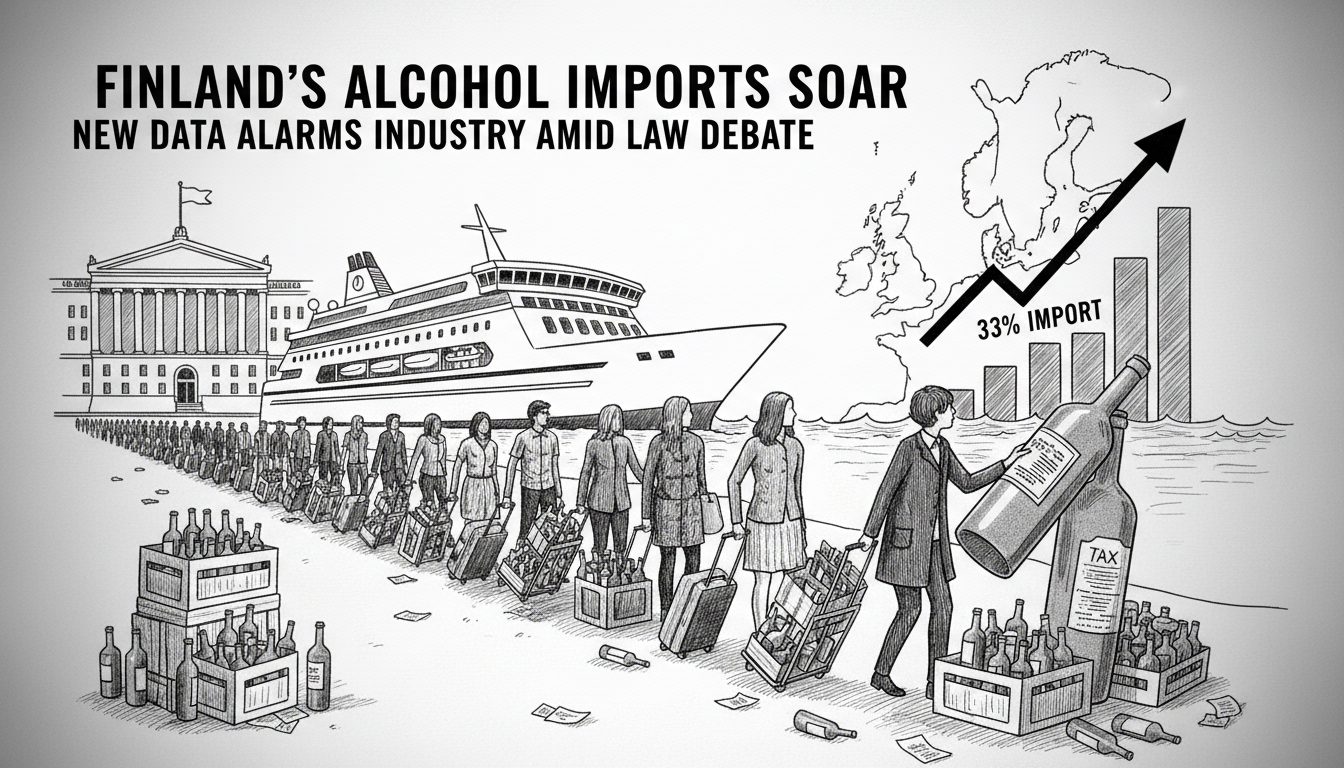

Alcohol imports for personal use now account for approximately one-third of Finland's total alcohol consumption. This marks a substantial increase from the previous estimate of just 13 percent. Travel imports alone represent about 22 percent of total consumption, up from earlier calculations of 15 percent.

Finnish Alcohol Beverage Industry Association director Lasse Pipinen expressed concern about these findings. He stated the new data reveals Finnish alcohol businesses face even tougher competition than previously understood. The high alcohol taxation in Finland creates challenging market conditions for domestic producers.

The methodology change occurred earlier this year when the Ministry of Finance switched from phone-based surveys to online data collection. Officials acknowledge the results aren't directly comparable between the two methods. The online approach proved more cost-effective for gathering consumption data.

Health authorities report conflicting numbers. The Institute for Health and Welfare recorded 4.5 million liters of pure alcohol imported for personal use in 2024. Yet the new methodology suggests nearly 7.5 million liters were imported by September of the current year.

Experts disagree about which methodology provides more accurate results. Some suggest the true figure likely falls somewhere between the two measurement approaches. The statistical discrepancy comes at a crucial time as Parliament debates alcohol law reforms.

The government's proposed changes would allow home delivery of alcoholic beverages and modify distance selling regulations. Stores and kiosks could potentially sell beverages up to 8 percent alcohol content. Stronger drinks would remain exclusive to the state-owned Alko stores.

International alcohol orders face no percentage restrictions under the proposed legislation. This has sparked considerable debate about market fairness and public health implications. Current EU internal market rules prevent Finland from banning cross-border alcohol purchases.

Tax revenue losses present another concern. The Tax Administration estimates only one percent of foreign distance sellers pay Finnish alcohol taxes. Lost tax revenue potentially amounts to hundreds of millions of euros annually. Travel imports generate no tax revenue for the Finnish state.

Pipinen criticized the government's contradictory approach. While reforms may increase alcohol imports, officials simultaneously plan to raise alcohol taxes further. He advocates for clear tax payment models and registration requirements for distance sellers.

The alcohol law reform primarily aims to clarify existing legal frameworks rather than introduce radical changes. Consumers can already order alcohol from abroad under current regulations. The proposed changes would mainly streamline and formalize these practices while addressing tax collection challenges.

The statistical revelation and ongoing legislative changes highlight Finland's complex relationship with alcohol regulation. As one of the EU's highest alcohol tax countries, Finland struggles to balance public health concerns, market competition, and cross-border trade realities within European single market rules.