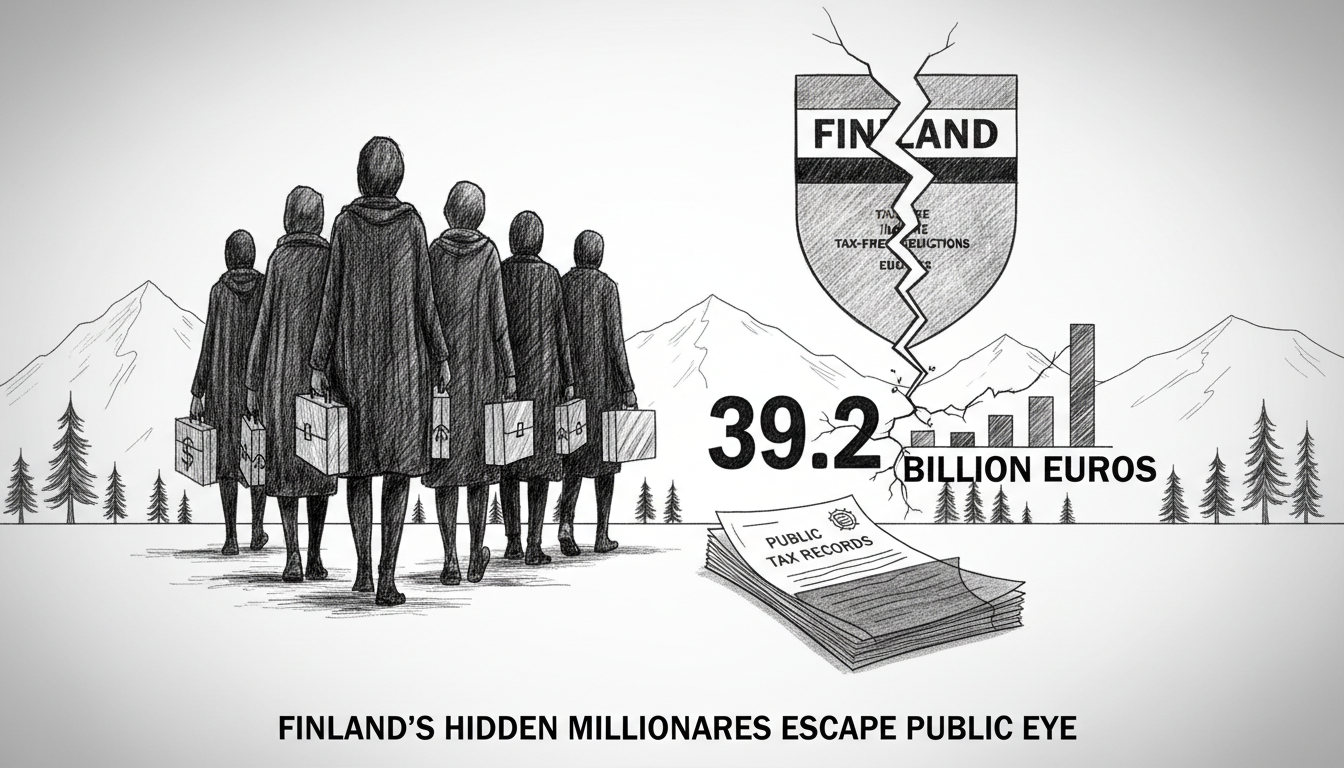

Over 250 Finnish millionaires remain invisible in official tax records. Nearly one-third of Finland's highest earners escape public millionaire lists due to tax-free income provisions. Official 2023 data shows 950 taxpayers reported taxable income exceeding one million euros. But the actual number of millionaire earners reached 1,208 when including all income sources.

The gap between public records and reality totals 39.2 billion euros in unreported income. Tax-free earnings include various benefits, tax-exempt portions of capital gains, interest income, and deductions from earned income. Lottery winnings also qualify as tax-free revenue for recipients.

Aki Savolainen from the Finnish Tax Administration explained the discrepancy. He said deductions largely explain differences between actual earnings and publicly visible income. The specific deduction amounts remain confidential information. This means public data cannot directly reveal someone's actual salary from specific work.

Common earned income deductions include travel expenses, income acquisition deductions, plus pension and unemployment insurance payments. Capital income also allows deductions for costs related to acquiring and maintaining income, along with losses.

This situation reveals structural aspects of Finland's progressive tax system. The Nordic model emphasizes transparency but contains legal loopholes. Wealthy individuals can legally minimize their public tax profile while remaining high earners.

International readers should understand this occurs within one of Europe's most egalitarian societies. Finland typically ranks high in income equality measurements. These hidden millionaires represent exceptions rather than the norm.

The tax authority will release 2024 tax data this Wednesday. This annual disclosure typically generates public discussion about wealth distribution. The ongoing pattern of hidden millionaires raises questions about tax system fairness.

Expats and international observers might find this particularly relevant. It demonstrates how even transparent systems contain opacity. The Finnish case shows that public tax records worldwide might underrepresent true wealth concentrations.

This matters because it affects public perception of wealth distribution. It also influences policy debates about tax fairness. Understanding these gaps helps contextualize discussions about economic inequality in Nordic societies.