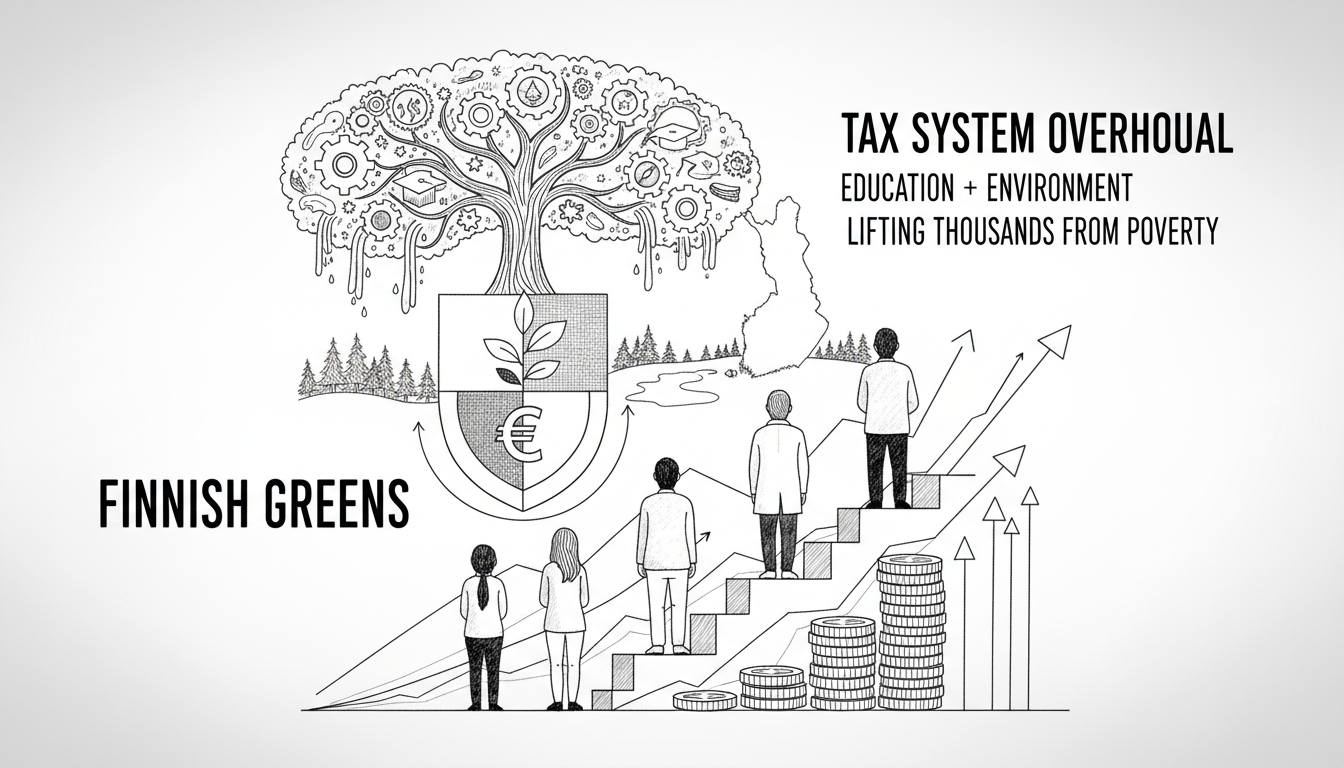

Finland's Green Party has unveiled its alternative budget proposal, challenging the government's fiscal approach with what party leader Sofia Virta calls a complete overhaul of the taxation system. The opposition party presented its financial plan on Thursday, offering a different path to balancing state finances while protecting social services.

The Greens claim they would achieve the same level of fiscal adjustment as Prime Minister Orpo's government but through fundamentally different methods. Their proposal rests on cutting corporate subsidies by over 800 million euros and implementing tax reforms expected to generate 1.7 billion euros in revenue.

Education emerges as a major winner in the Green alternative, receiving 700 million euros more than in the government's budget. Nature conservation funding would more than double with an additional 300 million euros. The party also plans stronger investments in early childhood education and culture.

Virta emphasized that fiscal responsibility doesn't require cutting services for children and youth. She stated that politics involves value choices rather than inevitabilities. The Greens argue their approach would lift 44,000 low-income individuals out of poverty based on parliamentary research service calculations.

The proposed tax reforms target what the party calls a green tax revolution. Wealthy Finns would see their tax cuts canceled, while low and middle-income earners would receive larger income tax reductions than under the current government's plan. All but the top two income deciles would see increased disposable income compared to government policy.

Environmental taxation forms a cornerstone of the proposal. The Greens want to introduce new taxes on mining waste and raw materials extraction. They propose expanding and increasing mining taxes to generate 150 million euros. Packaging taxes, waste charges, and incineration taxation also feature in their revenue plans.

Transportation taxation would undergo significant changes. The Greens would maintain current electric vehicle tax policies while increasing levies on fossil fuel imports. Public transport taxes would decrease, and municipalities could implement congestion charges to fund transit improvements. Road usage fees are also under consideration.

In social and healthcare sectors, the Greens would reverse hospital network cuts and cancel planned increases in client fees. Primary care guarantee periods would return to 14 days, and wellbeing services counties would gain taxation rights.

The party would restore unemployment security protections and child supplements while maintaining tax deductions for trade union membership fees. Development cooperation cuts would be reversed with increased funding, and refugee quotas would rise to 3,000.

This alternative budget represents the Greens' vision for Finland's economic future. It reflects growing debate about taxation's role in funding welfare services while addressing environmental challenges. The proposal shows clear ideological differences between government and opposition approaches to fiscal management.

Political observers note the difficulty of cutting corporate subsidies, which have proven politically challenging in past governments. The Greens' ambitious tax reform package faces significant hurdles without parliamentary majority support. Yet it provides voters with a clear alternative in ongoing debates about Finland's economic direction.