Sweden's cashless society makes credit cards essential. Expats face unique hurdles. The system relies heavily on Swedish credit history. Many newcomers find their applications rejected.

Understanding the Swedish Credit System

Sweden uses UC, a national credit bureau. UC tracks every resident's financial behavior. Banks check UC reports before approving credit. Expats start with no Swedish credit history. This creates a catch-22 situation. You need credit to build credit. Banks view foreign credit reports as unreliable. They prioritize local data.

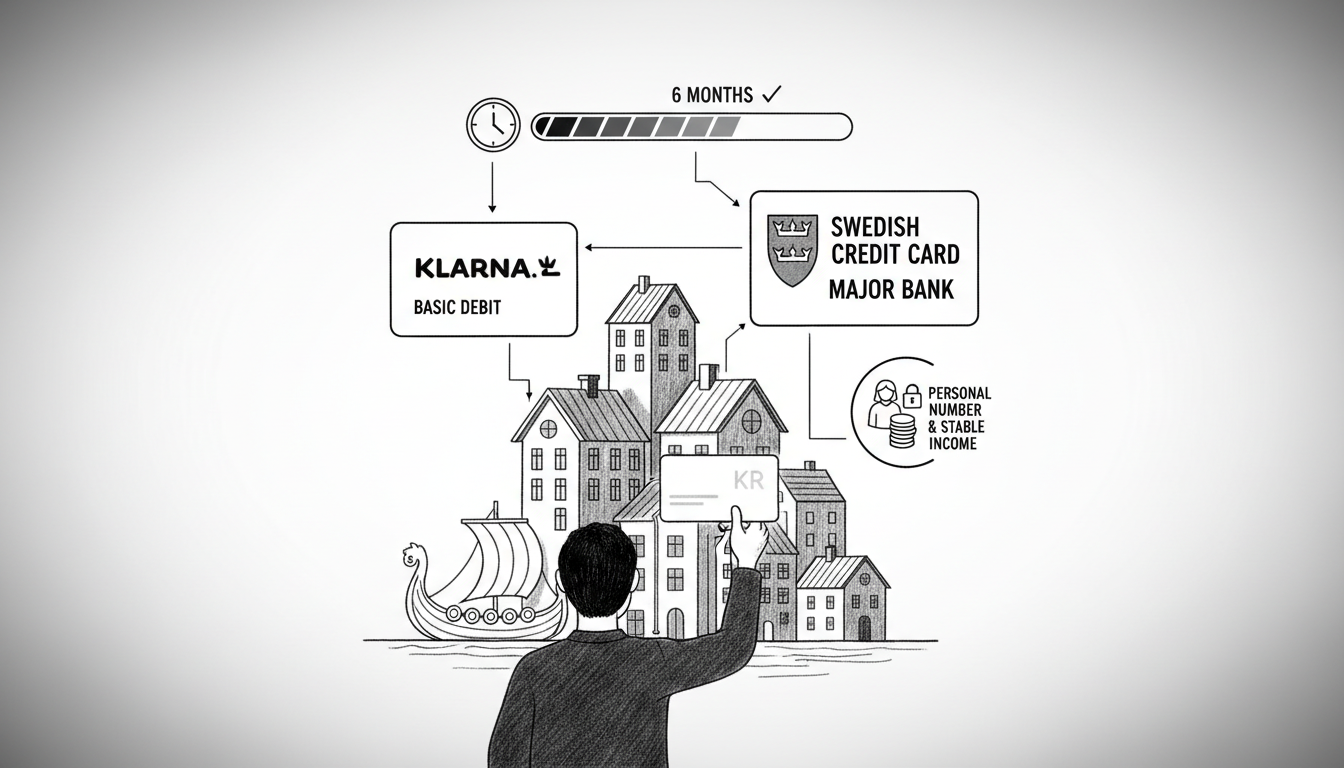

Building Credit History from Scratch

Open a Swedish bank account immediately. Use it for all daily transactions. Pay bills on time through BankID. Apply for a credit builder product first. Klarna offers a 'Pay in 30 days' service. This reports payments to UC. Use it for small purchases. Always pay the full balance monthly. After six months, apply for a basic credit card. Länsförsäkringar's Basic Mastercard accepts some expats. It has a low initial limit of 5,000 SEK.

Major Bank Options for Expats

Handelsbanken targets international clients. Their Expat Banking package includes credit cards. Requirements include a Swedish personal number. You need stable employment with a Swedish employer. Minimum income is 25,000 SEK monthly. SEB offers credit cards to EU citizens more easily. Non-EU citizens face stricter checks. Swedbank rarely approves cards without two years of residency. All banks require proof of address. Use your rental contract or population registration certificate.

Alternative Credit Card Providers

Klarna issues credit cards without traditional bank accounts. Approval depends on your shopping history with them. Use Klarna for at least three purchases first. Their credit limits start at 3,000 SEK. Lunar Bank operates fully digitally. They accept applications from Nordic residents. You need a Swedish personal number. Their card has no foreign transaction fees. Collector Bank offers cards to people with thin credit files. Interest rates exceed 20% annually. Always pay your balance in full.

Practical Application Steps

Gather these documents before applying. Your Swedish personal number is mandatory. Provide your employment contract showing salary. Include your last three Swedish pay slips. Have your Swedish ID card or passport ready. Show your population registration certificate. Prepare your Swedish bank account statements. Apply online through the bank's website. Expect decisions within five business days. Rejections are common on first attempts. Wait three months before reapplying.

Frequently Asked Questions

Can I use my foreign credit card in Sweden?

Yes, but with limitations. Most Swedish websites require BankID for payments. Many online stores reject foreign cards. Physical stores accept Visa and Mastercard. American Express faces limited acceptance. You cannot use foreign cards for monthly subscriptions. Swedish services like Spotify require Swedish payment methods.

How long does it take to get approved?

Approval takes five to ten business days. Some digital banks respond within 48 hours. Traditional banks take longer for verification. Delays happen if documents need translation. Always apply during Swedish business hours. Weekends add processing time.

What income do I need for a credit card?

Banks require 20,000 to 25,000 SEK monthly income. Some accept lower amounts for EU citizens. Provide recent pay slips as proof. Self-employed individuals need tax statements. Banks want at least six months of Swedish income history.

Which bank is best for non-EU expats?

Handelsbanken has the most expat-friendly policies. They understand international documentation. Their staff speak excellent English. SEB also serves many international clients. Avoid smaller regional banks initially. They often lack expat experience.

Can I get a card without a personal number?

No, Swedish banks require a personal number. This links to the national credit system. Some fintech companies might offer alternatives. Their credit limits remain very low. Always prioritize getting your personal number first.

What credit limit can I expect initially?

First cards offer 3,000 to 10,000 SEK limits. Banks increase limits after six months of good use. Request increases through online banking. Higher limits require income verification. Never exceed 30% of your available credit.

How do I build credit history fastest?

Use Klarna's payment services immediately. Pay all bills through your Swedish bank account. Set up automatic payments for rent. Apply for a small credit product after three months. Monitor your UC report quarterly. Dispute any errors promptly.