Opening a bank account in Iceland takes minutes. Getting a credit card requires months of patience. The country's conservative lending practices surprise many newcomers. Banks treat credit history from abroad as irrelevant. They start everyone from scratch.

The Icelandic Credit System Explained

Icelandic banks use a centralized credit scoring system. This system tracks every resident's financial behavior. It includes loan payments, utility bills, and mobile contracts. Foreign credit scores from Experian or Equifax hold no weight here. Banks want proof you can manage Icelandic kronur.

Arion Bank and Landsbankinn dominate the market. Both require six months of local employment history. They need three consecutive pay slips showing steady income. Self-employed applicants face stricter requirements. They must provide two years of audited accounts.

Tools

Best next step

Use a trusted tool mentioned in this guide.

Links may be monetized via affiliate partners.

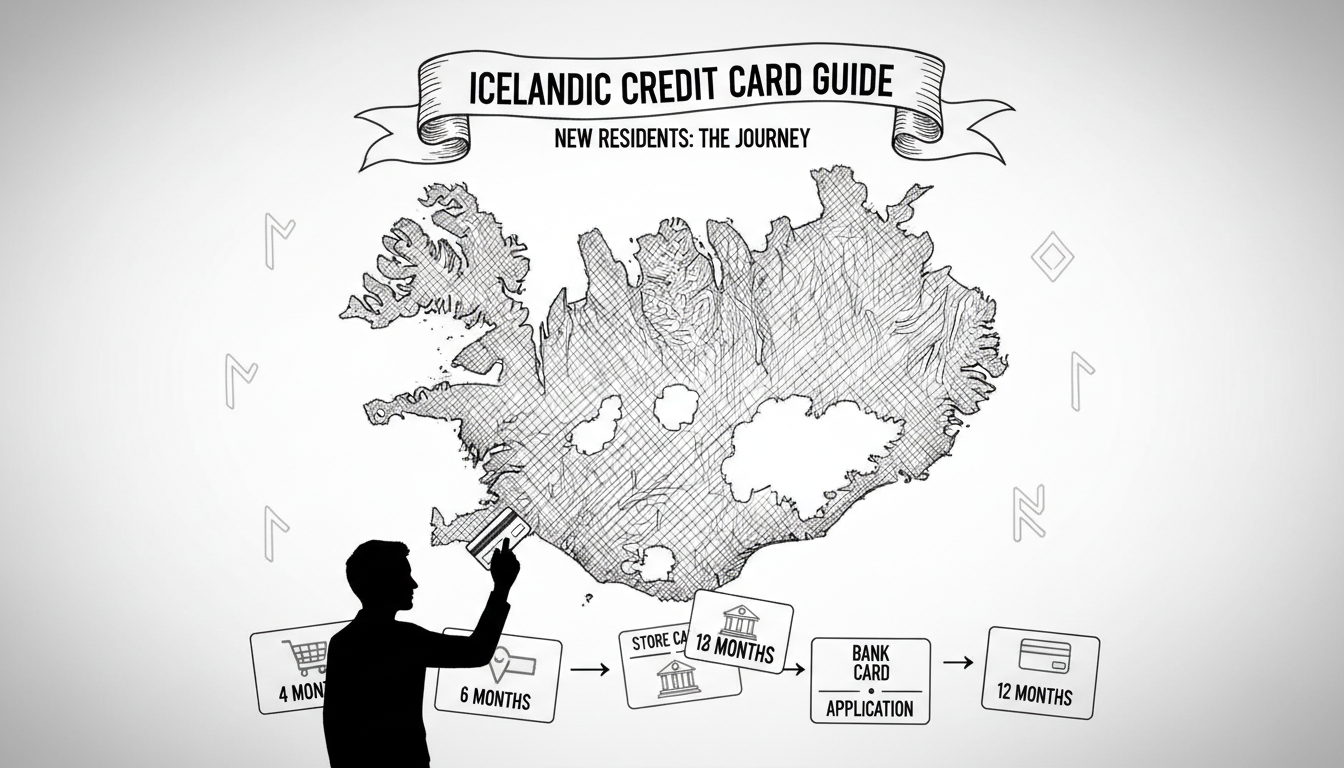

Practical Steps for Your First Card

Start with a debit card from your Icelandic bank. Íslandsbanki offers a basic Visa Debit with no monthly fee. Use this card for all daily purchases for three months. Pay all bills through your Icelandic account. This builds your local transaction history.

Apply for a store credit card after four months. Elko and IKEA offer entry-level cards with 50,000 ISK limits. These cards report to the credit bureau monthly. They cost 990 ISK annually. Approval rates for residents with six months of history exceed 70%.

Monitor your credit report through Creditinfo Iceland. The service costs 1,290 ISK per report. Check it quarterly for errors. Dispute any inaccuracies within 30 days.

When to Apply for a Major Card

Wait eight months before applying to major banks. Arion Bank's Visa Classic requires 400,000 ISK monthly income. The card offers 300,000 ISK credit limit. It includes travel insurance for 2,990 ISK monthly fee.

Landsbankinn's Mastercard Gold needs one year of residency. Applicants must show 500,000 ISK monthly income. The card provides purchase protection and airport lounge access. The annual fee is 5,990 ISK.

Always apply in person at bank branches. Bring your kennitala, passport, and employment contract. Include your three most recent pay slips. Prepare for a 20-minute interview about your spending habits.

Common Pitfalls to Avoid

Never miss a payment on any Icelandic bill. A single late payment stays on your record for three years. It reduces your credit score by 40 points immediately.

Do not apply for multiple cards simultaneously. Each application triggers a hard inquiry. Three inquiries in six months signal financial distress to lenders.

Keep your credit utilization below 30%. Maxing out your Elko card hurts your score. Banks see high utilization as risky behavior.

Frequently Asked Questions

How long does it take to get a credit card in Iceland?

Expect a six to twelve month process. Start with a debit card immediately. Apply for store cards after four months. Major bank cards require eight to twelve months of residency.

Can I use my foreign credit card in Iceland?

Yes, but with limitations. Most foreign cards work for purchases. They fail for recurring payments like gym memberships. Icelandic systems often reject non-local cards for automated billing.

What income do I need for a credit card?

Store cards require 250,000 ISK monthly income. Bank cards need 400,000 to 500,000 ISK. Self-employed individuals need higher documented earnings.

Do Icelandic banks check foreign credit history?

No. They ignore foreign credit reports completely. Your financial history starts from your arrival date. Bring documentation of foreign accounts for reference only.

What documents do I need to apply?

Bring your kennitala, passport, and residence certificate. Include your employment contract and three pay slips. Self-employed applicants need tax returns and business licenses.

Can students get credit cards in Iceland?

Yes, with restrictions. Students can get prepaid cards from banks. These require 50,000 ISK security deposit. After one year, they may qualify for low-limit store cards.

What fees do Icelandic credit cards have?

Annual fees range from 990 ISK to 15,990 ISK. Foreign transaction fees average 2.5%. Late payment fees start at 1,500 ISK. Always read the full fee schedule before applying.