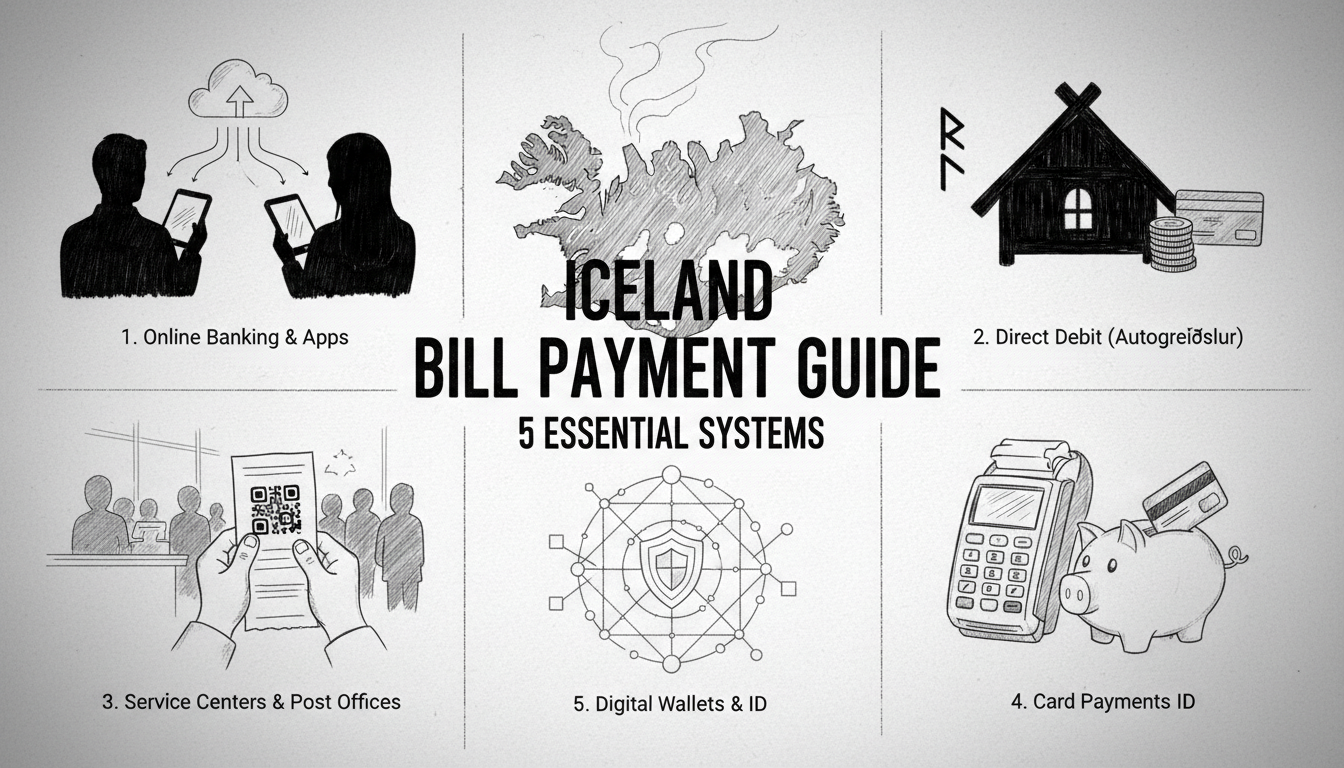

Iceland's bill payment system processes over 90% of household transactions electronically. This digital-first reality, while efficient, presents a steep learning curve for newcomers. Navigating it requires understanding a centralized infrastructure built on national identity numbers and online banking. Failure to adapt can lead to immediate late fees and service disruptions in one of the world's most connected societies.

The Digital Backbone of Icelandic Life

Iceland's journey to near-total electronic billing is rooted in its rapid 20th-century modernization and small, tech-literate population of roughly 370,000. The system hinges on two pillars: the kennitala (national ID number) and the Netgíró platform. The kennitala is your key to Icelandic society, required for everything from opening a bank account to registering a phone. Netgíró acts as the central nervous system for invoices, connecting businesses, banks, and consumers. Most companies send bills directly to your online banking portal or email. Paper invoices are now rare, reserved primarily for initial official government correspondence.

"The efficiency is remarkable, but it assumes a level of digital integration from day one," says financial advisor Eva Jónsdóttir. "For new residents, the immediate pressure to secure a kennitala and online banking access is the first major hurdle. There is no graceful, paper-based transition period."

Banking: Your Payment Command Center

Iceland's major banks—Íslandsbanki, Landsbankinn, and Arion Bank—are not just financial institutions; they are the mandatory gateways for managing economic life. Setting up online banking is the critical first step after receiving your kennitala. These banks provide mobile apps and websites where the vast majority of bills are received, viewed, and paid. The system is designed for automation and speed. Without this access, you cannot pay utilities, telecoms, or most government fees. This central role makes choosing a bank one of the most consequential early decisions for any resident.

Decoding Essential Monthly Outgoings

Utility bills offer a clear window into the system's operation. Reykjavík Energy (Orkuveita Reykjavíkur) typically provides combined electricity, water, and geothermal heating bills. For a standard two-bedroom apartment in the capital, these costs average between 25,000 and 40,000 ISK monthly. The company, like most, issues invoices electronically with a standard payment period. The recommended strategy is to set up automatic deductions (greiðsluáætlun) through your bank. Opting for manual payment requires diligent monthly logins.

Telecommunications follow the same pattern. Providers like Síminn, Nova, and Vodafone Iceland use electronic invoicing. A basic home fiber internet package can cost around 6,990 ISK per month. Invoices are typically sent 10 to 15 days before the due date. The system's efficiency has a strict counterpart: enforcement. Late payments commonly incur interest charges immediately, often at 1.5% per month. There is little leniency for missed deadlines.

Navigating Rent and Housing Fees

Housing costs operate under slightly different mechanisms. Most landlords prefer setting up a standing order (fastagreiðsla). This involves authorizing your bank to make a fixed monthly transfer to the landlord's account, requiring their bank details and kennitala. Rents in Reykjavík vary widely, with one-bedroom apartments often ranging from 180,000 to 300,000 ISK monthly.

For those in apartment buildings, housing associations (íbúðafélög) add another layer. These associations charge monthly fees for maintenance, cleaning of common areas, and potential renovations. Fees can range from 15,000 to 25,000 ISK per month. Crucially, these invoices are usually sent quarterly via the Netgíró system. Residents must budget for these larger, less-frequent payments to avoid cash flow problems and potential collection actions.

Government Systems: Taxes and Healthcare

Interactions with the state are fully digitized. The Icelandic Revenue and Customs (Skatturinn) manages all tax affairs through its online portal. Annual income tax statements are issued in March. The system allows for payment in installments over six months, with a minimum monthly payment of 10,000 ISK. All correspondence is digital, making regular portal checks essential.

The healthcare system involves a co-payment model. After visiting a doctor or specialist, you receive an invoice for your portion of the fee. This bill arrives electronically via the healthcare system's platform or your bank. Prompt payment is necessary to avoid reminders and potential administrative blocks on future services. The integration across sectors means a late payment in one area can quickly complicate other administrative processes.

Analysis: Efficiency Versus Accessibility

Iceland's system is a testament to national digital cohesion. It reduces administrative costs for companies and provides real-time financial tracking for individuals. The environmental benefit is also significant, aligning with Iceland's broader sustainability goals by minimizing paper use. However, this model presents clear challenges. It can marginalize new residents, the elderly, or those less comfortable with technology. The assumption of universal, high-speed internet access and digital literacy creates a high barrier to entry.

From a Nordic perspective, Iceland is ahead of its regional neighbors in bill payment digitization. While Sweden, Denmark, and Norway are also highly digital, Iceland's small, homogeneous population allowed for a more unified and rapid rollout of systems like Netgíró. The flip side is less flexibility and fewer alternative payment pathways compared to larger Nordic nations.

Practical Steps for New Residents

Success hinges on a structured approach. First, prioritize obtaining your kennitala. Second, immediately open a bank account and activate online banking services. Third, for predictable bills like rent, utilities, and internet, establish automatic payments to avoid late fees. Fourth, maintain a dedicated email for official invoices and check it alongside your banking portal regularly. Finally, budget for quarterly and annual bills, like housing association fees and taxes, which can disrupt monthly financial planning.

Financial advisors here stress that building a good financial record in Iceland starts with flawless bill payment. "The system is automated and unforgiving," notes Eva Jónsdóttir. "A single late payment can trigger interest and affect your standing. Automation is not just a convenience; it's a defensive financial strategy."

The ultimate question for Iceland is whether its peak efficiency model can accommodate increasing diversity. As the population grows through immigration, will the system adapt to offer more onboarding support? Or will the burden of adaptation remain solely on the newcomer? Iceland's bill payment network is a marvel of modern infrastructure, but its human interface demands equal attention.