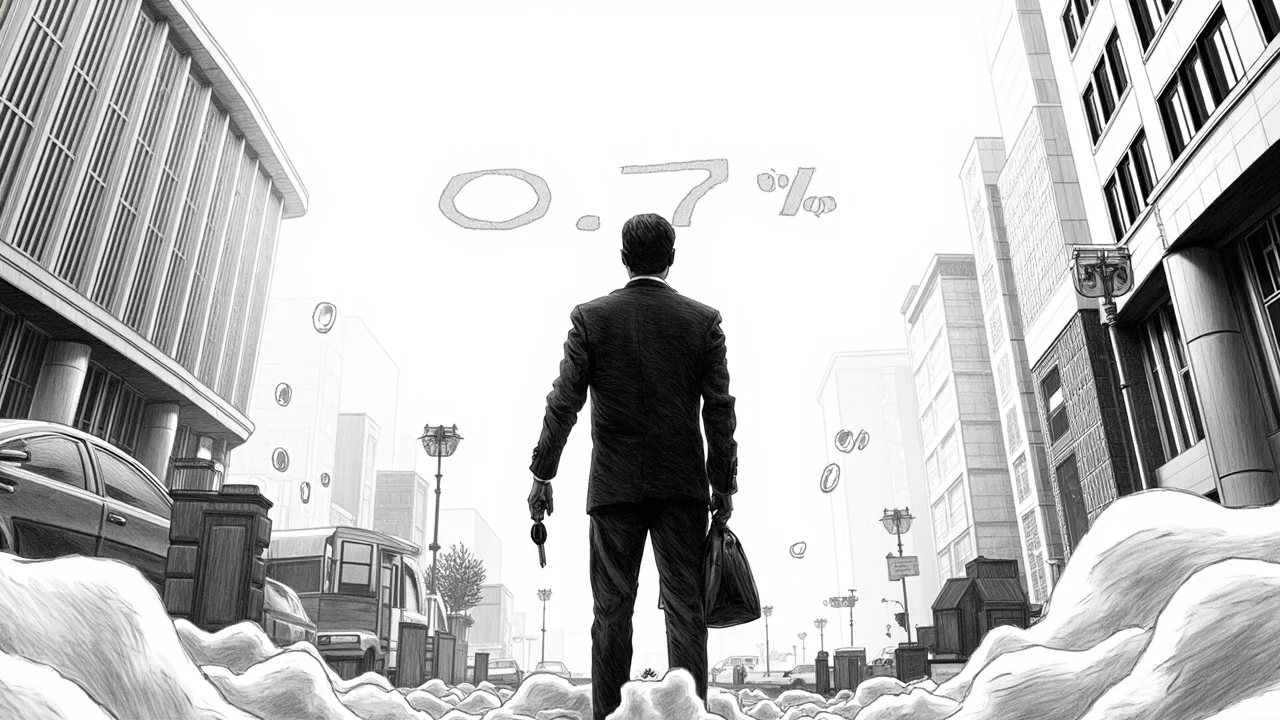

Iceland's Finance Ministry has significantly underestimated the inflationary impact of new vehicle taxes. Minister Daði Már Kristófersson admitted the government's forecast was wrong after a Landsbankinn analysis predicted a 0.7% inflation spike. The ministry had projected a mere 0.1% to 0.2% increase from the policy change.

"This is now somewhat more than we anticipated," Kristófersson told reporters after a cabinet meeting. He confirmed he would not dispute the bank's forecast. The admission reveals a major miscalculation in a country where inflation control is a primary economic goal. It raises immediate questions about the government's modeling and the real cost of its environmental policies for Icelandic households.

A Policy Miscalculation with Real Consequences

The core of the issue lies in changes to how the state collects fees on vehicle operation and purchases. While the government framed these as targeted environmental measures, the financial impact is proving broader and deeper. Landsbankinn's analysis department suggests the full effect may hit in January or spread over coming months. They specifically warn it will suppress demand for cars at the start of the year.

This is not an isolated price adjustment. Kristófersson noted concurrent market-driven price increases for vehicles are compounding the tax effect. "It's also the case that car prices have been rising," he said. This combination of policy and market forces creates a perfect storm for consumers. For a nation reliant on personal transport outside Reykjavik, the cost of mobility is rising sharply.

The Political Fallout in Althing

The miscalculation hands opposition parties immediate ammunition. MPs from the Independence Party and the Progressive Party are likely to challenge the government's economic competence during the next parliamentary session. The central premise of the tax change—its manageable impact—has been publicly undermined by the Finance Minister's own words.

"I am not going to dispute the forecast," Kristófersson's statement is a rare political admission of error. It suggests the internal data from the Ministry of Finance and Economic Affairs could not support a defense. This transparency may mitigate some criticism but highlights a flawed policy process. The Althing's Economic Affairs and Trade Committee will undoubtedly summon officials for explanation.

The Nordic Context: Balancing Green Goals and Inflation

Iceland's struggle mirrors a wider Nordic dilemma. Sweden and Norway also use vehicle taxes to steer consumers toward electric vehicles. However, the scale of Iceland's forecasting error is notable. The Nordic model typically prides itself on precise, data-driven governance. This episode challenges that reputation in the economic sphere.

Unlike its neighbors, Iceland's smaller, more volatile economy is acutely sensitive to such shocks. A 0.7% inflation addition is significant in a country where the Central Bank has fought to stabilize prices. It risks complicating monetary policy and could delay interest rate cuts. This puts Iceland's economic management at odds with its ambitious climate targets, a tension felt across the region.

The Ripple Effect on Icelandic Households

The immediate impact will be felt in showrooms in Reykjavik's Skeifan district and in towns like Akureyri and Ísafjörður. Higher upfront costs will deter buyers, as Landsbankinn predicts. For those who must purchase a vehicle, the increased expense will strain household budgets. This comes amid high housing costs and elevated food prices, squeezing disposable income.

The secondary effect is on overall inflation metrics. A sustained 0.5-0.6% overshoot above government forecasts affects everything from wage negotiations to business planning. It erodes purchasing power and consumer confidence. For families in the capital's Breiðholt or Grafarvogur neighborhoods planning a car purchase in 2024, the financial calculus has just become much harder.

Questioning the Economic Models

Kristófersson's revelation that ministry models showed a 0.1-0.2% rise points to a critical failure. Were the models flawed, or were the inputs incorrectly calibrated? The discrepancy between the government's and the bank's analysis suggests either poor assumptions about consumer behavior or an underestimation of the tax's pass-through rate to final prices.

This is not just an academic concern. Accurate forecasting is essential for trust in economic policy. If businesses and consumers doubt official predictions, their long-term planning becomes more cautious, potentially slowing investment. The Ministry of Finance must now review its modeling methodology, especially for indirect taxation measures.

The Environmental Policy Dilemma

The vehicle tax changes are part of Iceland's strategy to reduce transport emissions. The government faces a difficult trade-off: aggressive green policies often carry inflationary costs. This incident shows those costs can be larger than planned. The challenge is to design policies that achieve environmental aims without disproportionate economic pain.

Could the policy be adjusted? The minister's comments did not suggest a reversal. The government may have to accept higher near-term inflation as the price of its climate agenda. This will test public support for green transitions when they directly impact the cost of living. The debate in Iceland will now focus on the pace and design of such measures.

Looking Ahead: A Test of Credibility

The coming months will test the government's economic credibility. All eyes will be on the January inflation figures from Statistics Iceland. If they confirm Landsbankinn's forecast, pressure on the Finance Minister will intensify. The Central Bank of Iceland may also need to recalibrate its outlook, potentially affecting its interest rate path.

This episode serves as a stark reminder of the interconnectedness of policy. A tax change aimed at vehicle ownership can ripple through the entire economy. For Iceland, a nation that has successfully navigated major economic crises, precision in policy-making is non-negotiable. The admission of a forecasting error is a first step, but restoring confidence requires accurate predictions and transparent communication going forward. The question for Icelanders is whether this is a one-off mistake or a symptom of a deeper flaw in economic planning.