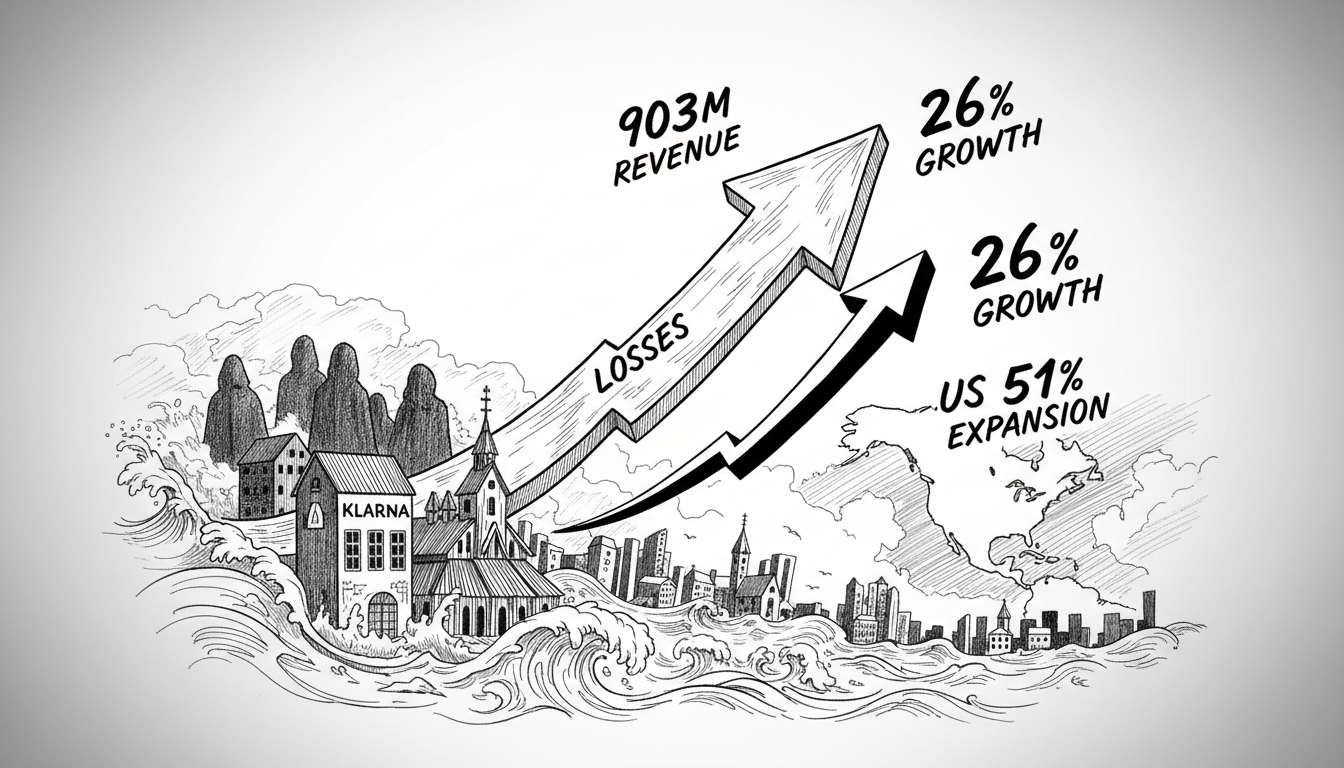

Swedish fintech giant Klarna reported surging revenue alongside deepening losses in its first quarterly report since going public. The buy-now-pay-later leader recorded $903 million in third quarter revenue, marking 26% growth compared to the same period last year. The company's US operations showed particularly strong performance with 51% growth.

CEO Sebastian Siemiatkowski described the results as the company's strongest quarter ever. He said this performance proves their AI-driven business model works at scale. The company issued this assessment in its official earnings statement.

Klarna's expanding losses come despite impressive revenue growth. The company continues investing heavily in global expansion and technology development. This pattern reflects the competitive nature of the digital payments sector.

International readers should understand Klarna's dominant position in Nordic markets. The company revolutionized consumer credit in Sweden before expanding globally. Its recent public listing generated substantial interest among investors watching the fintech sector.

The company used its earnings report to take aim at competitors. While not naming specific rivals, Klarna's leadership emphasized their technological advantages. This aggressive positioning is typical in the rapidly evolving financial technology industry.

What do these results mean for Klarna's future? The company appears focused on growth over immediate profitability. This strategy is common among tech companies expanding their market share. The substantial US growth suggests their international expansion is gaining traction.

Klarna's performance offers insights into broader fintech trends. The buy-now-pay-later sector faces increasing regulatory scrutiny worldwide. Meanwhile, consumers continue embracing alternative payment options. Klarna's results suggest strong ongoing demand for their services despite economic uncertainties.

The company's AI emphasis reflects a broader industry shift toward automated financial services. Klarna has invested heavily in machine learning to improve credit decisions and customer experience. Their quarterly results provide early evidence that this investment is delivering returns.

For Nordic businesses, Klarna's trajectory represents both inspiration and caution. The company demonstrates how regional startups can achieve global scale. At the same time, its ongoing losses highlight the costs of rapid expansion in competitive markets.