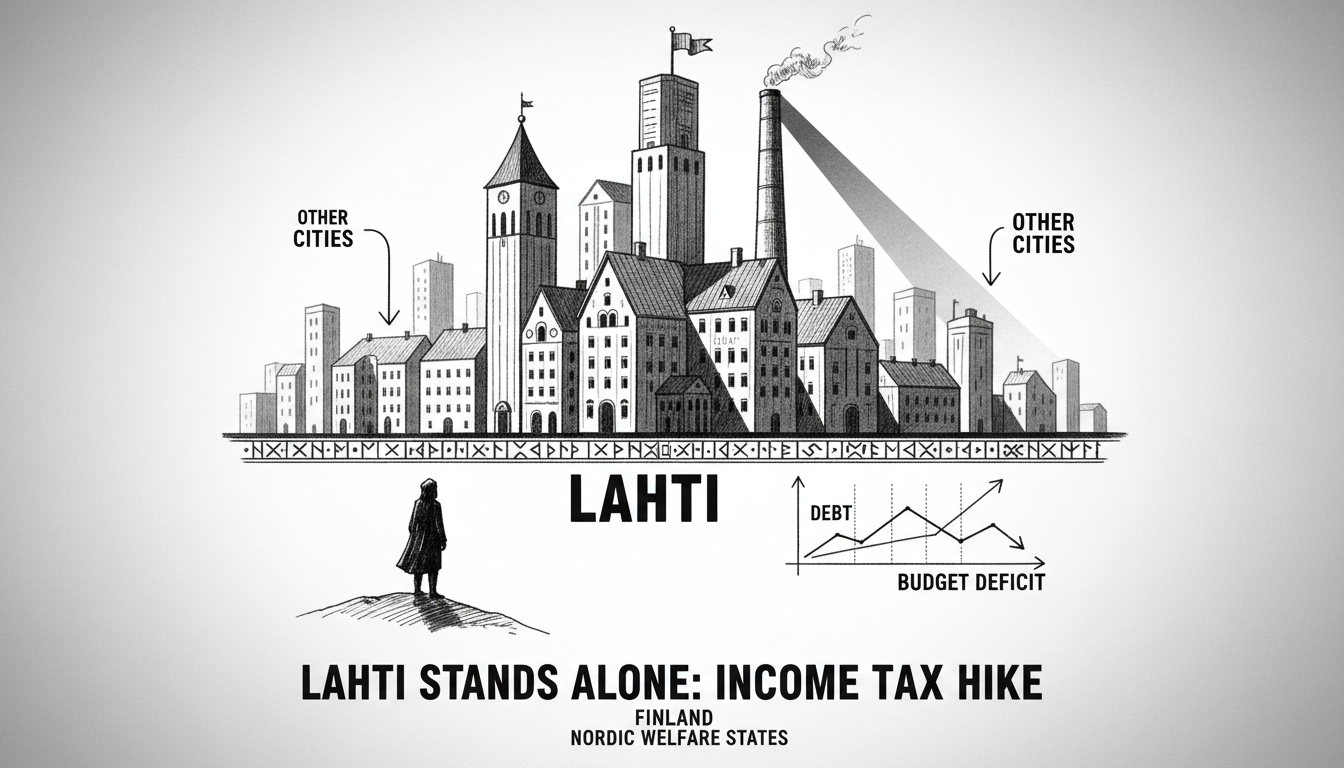

Lahti has become the only major Finnish city to increase its municipal income tax percentage for the coming year. This decision separates Lahti from Finland's other 20 largest urban centers. Most cities have already finalized their tax rates through city council decisions.

The Federation of Finnish Municipalities chief economist Minna Punakallio notes this represents an unusual situation. She said in a statement that very few large municipalities are currently raising tax percentages.

Punakallio explained the broader financial context facing Finnish municipalities. She stated that municipal debt continues to grow while budget deficits expand this year and next. The economist predicted challenging times ahead as municipalities must launch new adjustment programs.

Finnish municipal taxation operates differently than many other countries. Each municipality sets its own income tax rate within the national framework. This creates varying tax burdens across different regions. The system gives local governments financial autonomy but also responsibility for balancing their budgets.

Lahti's decision comes during a period of economic pressure for Finnish municipalities. Rising costs for social services, healthcare, and education have strained local government finances nationwide. Many municipalities face difficult choices between raising taxes or cutting services.

International readers should understand that Finnish municipal taxes fund local services directly. These include schools, healthcare centers, public transportation, and cultural facilities. The tax rate directly impacts the quality and availability of these services for residents.

What does this mean for Lahti residents? Households will see slightly reduced take-home pay next year. The increase might seem small percentage-wise, but it adds to the overall tax burden during inflationary times. For the city government, it provides additional revenue to maintain services without deeper cuts.

Other major cities like Helsinki, Tampere, and Turku have chosen different approaches. They're likely implementing spending reductions or relying on reserves instead of tax hikes. Each municipality must balance political feasibility with financial necessity.

The situation reflects broader trends in Nordic welfare states. Even in traditionally high-tax countries, governments face resistance to further increases. Municipal leaders must navigate between maintaining service quality and managing taxpayer burden.

Looking forward, other Finnish cities might follow Lahti's example if economic conditions worsen. The coming year will test whether current financial strategies prove sufficient or if more municipalities turn to tax increases.