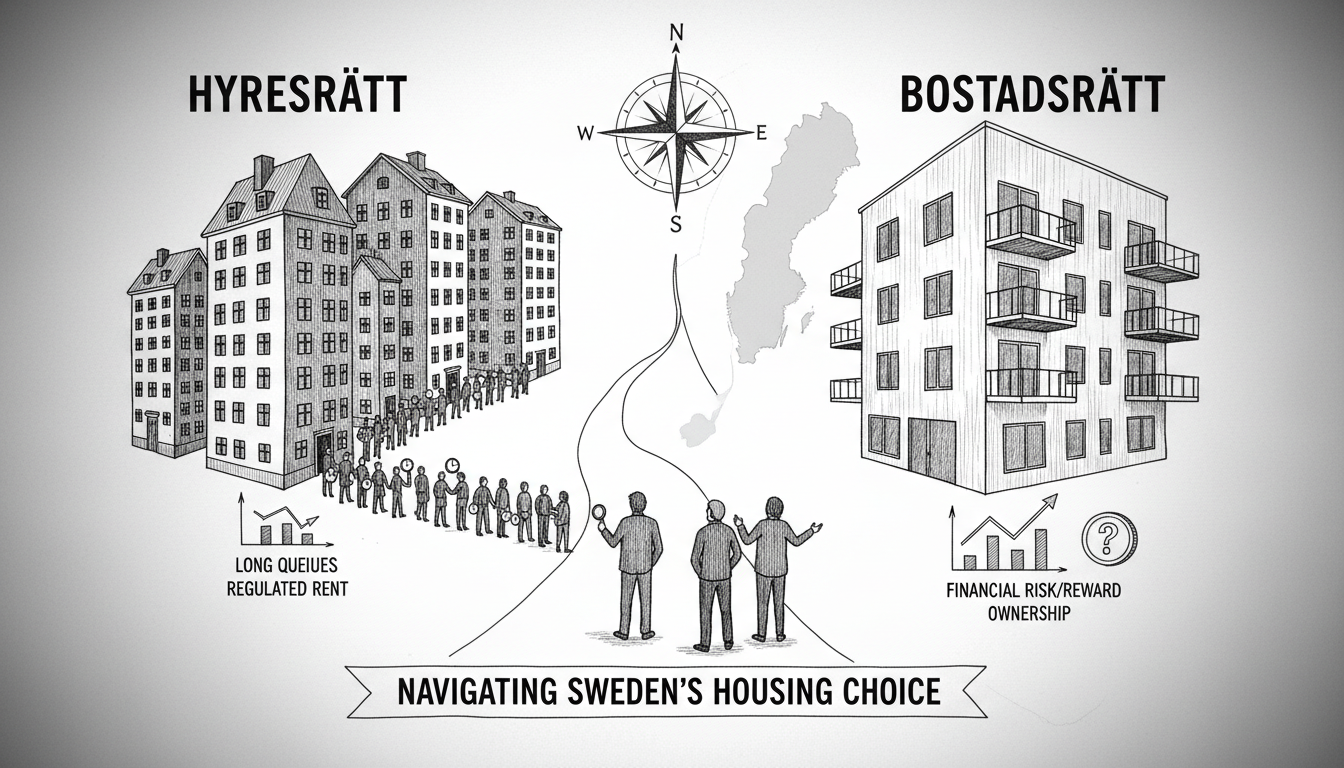

Sweden's housing market puzzles newcomers. The choice between hyresrätt (rental) and bostadsrätt (tenant-ownership) defines financial futures. This system shapes cities and personal wealth. Understanding it requires digging beyond surface comparisons.

The Hyresrätt Reality: Stability with Limits

Hyresrätt apartments offer predictable monthly costs. Tenants pay rent to municipal or private landlords. Rents follow regulated models in older buildings. Newer constructions often have market-rate rents. The average monthly rent for a two-room apartment in Stockholm hovers around 12,000 SEK. Gothenburg averages 9,500 SEK. Malmö costs about 8,500 SEK.

Queue times define the hyresrätt experience. Stockholm's main queue through Bostadsförmedlingen requires years of waiting. Central apartments demand 15-20 years of queue time. Some applicants use secondary services like Qasa for faster access. Qasa charges a monthly fee of 395 SEK plus 10% of rent. This bypasses queues but costs more.

Rental contracts provide strong tenant protections. Landlords cannot easily terminate leases. Rent increases follow annual negotiations. The system prevents sudden housing cost spikes. It also limits mobility. Finding a new rental apartment means re-entering queues.

Bostadsrätt Explained: Ownership with Strings

Bostadsrätt means buying a share in a housing association. Owners purchase the right to occupy a specific apartment. The association owns the building collectively. Monthly fees cover maintenance, insurance, and loans. These fees average 3,000-6,000 SEK monthly in Stockholm.

Purchase prices vary dramatically by location. A two-room bostadsrätt in central Stockholm costs 4-6 million SEK. The same in suburban areas costs 2-3 million SEK. Buyers need a 15% down payment minimum. Banks like Swedbank and SEB offer mortgages covering 85%.

Association rules control many aspects of ownership. Renovations often require board approval. Some associations restrict renting out apartments. Monthly fees can increase unexpectedly. Major renovations trigger special fees. These can reach 100,000 SEK or more per apartment.

Financial Comparison: Long-Term Implications

Renting offers predictable costs but builds no equity. Buying creates potential wealth through property appreciation. Stockholm apartments gained 45% in value over five years. This growth slowed recently. Prices now fluctuate more.

Calculate total costs before deciding. Include mortgage interest, amortization, and association fees. Compare these to rental costs. Use tools like SBAB's housing cost calculator. Factor in the 15% down payment requirement. This money could otherwise invest elsewhere.

Tax benefits favor owners. Mortgage interest deductions reduce taxable income. First-time buyers receive additional benefits. Renters get no similar tax advantages. The system incentivizes ownership for those who can afford it.

Practical Steps for Decision Making

Assess your financial readiness first. Calculate your borrowing capacity using banks' online tools. Swedbank's mortgage calculator provides instant estimates. You need stable employment history. Swedish banks require proof of permanent employment.

Research specific housing associations thoroughly. Review their annual reports and financial health. Check for planned major renovations. These trigger special fees. Examine association rules about subletting. Some restrict rentals to one year maximum.

Consider hybrid approaches. Some buyers purchase bostadsrätt apartments then rent them out. This requires association approval. It creates rental income while building equity. Others rent while saving for larger down payments. This strategy reduces mortgage costs later.

Navigating the Application Processes

Rental applications require queue registration. Sign up with Bostadsförmedlingen immediately. Registration costs 200 SEK annually. Also register with private portals like Heimstaden and Rikshem. These have separate queues. Check daily for new listings.

Home buying involves multiple steps. First obtain a mortgage promise from a bank. This shows sellers you can finance the purchase. Then engage a real estate agent. They charge 1-2% of purchase price. Finally submit bids through the agent.

Use digital tools for both processes. Booli tracks bostadsrätt prices and sales history. Hemnet lists most properties for sale. Blocket Bostad aggregates rental listings. These platforms provide market transparency.

Frequently Asked Questions

What is the minimum down payment for bostadsrätt?

Banks require 15% of purchase price as down payment. First-time buyers sometimes qualify for 10% down. This requires strong income and credit history. The remaining 85% comes from mortgage loans.

How long are typical rental queues in Stockholm?

Central Stockholm apartments require 15-20 years queue time. Suburban areas need 5-10 years. New developments sometimes have shorter queues. Check Bostadsförmedlingen's website for current averages.

Can foreigners buy bostadsrätt apartments?

Yes, foreigners can purchase bostadsrätt apartments. No citizenship or residency requirements exist. Banks may require Swedish personal numbers for mortgages. Some demand proof of stable Swedish income.

What costs beyond rent do hyresrätt tenants pay?

Tenants pay electricity and internet separately. These average 500-800 SEK monthly. Some apartments include heating in rent. Most require tenant insurance costing 150-300 SEK monthly. Furniture typically comes from the tenant.

How do bostadsrätt monthly fees compare to rents?

Fees average 3,000-6,000 SEK monthly in Stockholm. This covers maintenance, heating, and building loans. Add mortgage payments of 8,000-15,000 SEK monthly. Total often exceeds comparable rental costs initially.

What happens if my housing association needs major repairs?

The association board approves major renovations. All owners share costs through special fees. These fees can reach 100,000 SEK or more. Payment plans over several years are common. Owners must pay regardless of personal finances.

Can I rent out my bostadsrätt apartment?

Most associations allow temporary subletting. Typical limits are one year maximum. Some require board approval first. A few associations prohibit rentals completely. Always check association rules before purchasing.