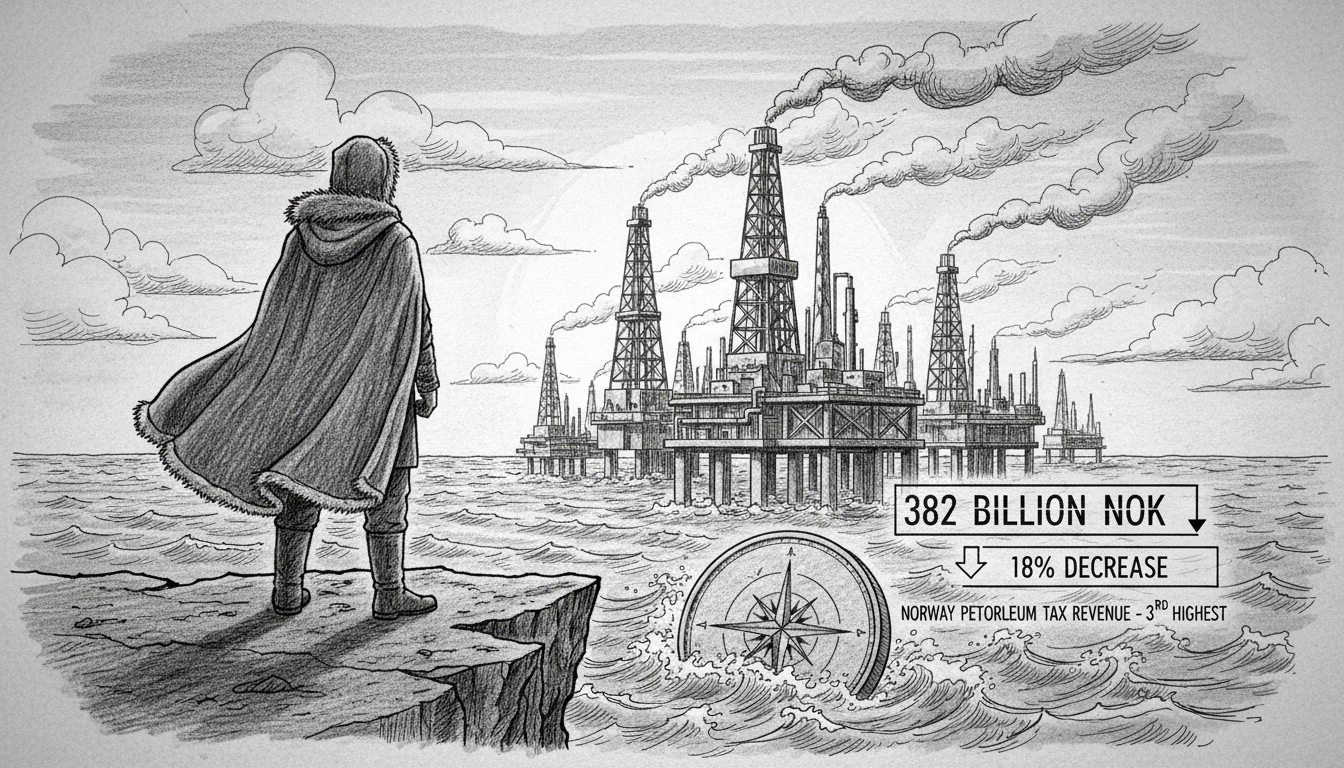

Norwegian authorities have confirmed petroleum companies will pay 382 billion kroner in special taxes this year. The Tax Administration released these figures today showing an 18 percent decrease from last year. This represents a reduction of 83 billion kroner compared to the previous period.

Despite this decline, the current petroleum tax revenue stands as the third highest in Norwegian history. Total production has reached its highest level since 2008. Norwegian continental shelf gas production has never been higher than current levels.

Petroleum companies operating in Norway face a complex tax structure. They pay standard corporate tax at 22 percent plus a special tax on shelf activities. The combined effective tax rate reaches 78 percent for petroleum operations. This system ensures substantial public revenue from resource extraction.

Energy analysts note the apparent contradiction between declining tax revenue and record production. Several factors explain this phenomenon. Companies have increased investment deductions and operating costs. International gas price fluctuations have also affected profitability calculations.

Major Norwegian oil fields like Johan Sverdrup and Snorre continue expanding production. These developments in the North Sea contribute significantly to national revenue. The Norwegian Parliament maintains careful oversight through the Standing Committee on Energy and the Environment.

The government's petroleum tax policy directly impacts national budget planning. Oil and gas revenues fund Norway's massive sovereign wealth fund. This fund currently exceeds 1.4 trillion dollars, making it the world's largest.

Industry representatives express concern about the high tax burden. They argue it could discourage future investment in Norwegian waters. The Norwegian Oil and Gas Association has repeatedly called for tax stability.

Political parties in the Storting remain divided on petroleum taxation. Conservative parties generally advocate for industry-friendly policies. Left-wing and environmental parties push for maintaining high tax rates. They argue this properly compensates the public for resource extraction.

Norwegian petroleum taxation represents a balancing act. The system must generate public revenue while maintaining industry competitiveness. Current figures suggest this balance remains largely intact despite recent fluctuations.

The Arctic region presents new challenges for Norwegian oil industry regulation. As exploration moves northward, environmental considerations grow more complex. The Barents Sea represents both opportunity and responsibility for Norwegian authorities.

International observers closely monitor Norway's petroleum management. The country serves as a model for resource-rich nations worldwide. Its approach combines substantial public benefit with responsible industry development.

Future tax revenues will depend on multiple factors. International energy prices, production levels, and exploration success all play crucial roles. The Norwegian government must navigate these variables while maintaining stable fiscal policy.