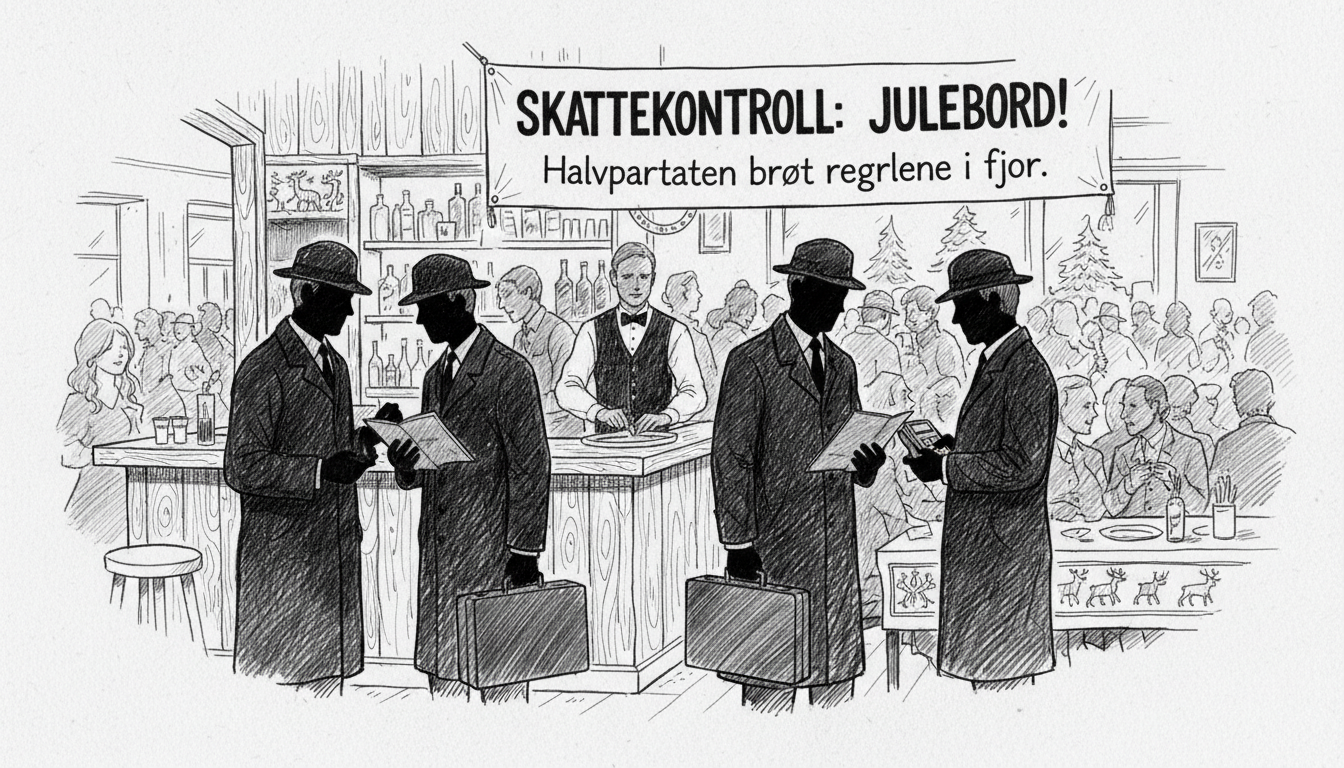

Norwegian tax authorities are intensifying inspections of restaurants and bars nationwide during the busy Christmas party season. This enforcement campaign follows last year's findings that revealed widespread compliance issues across the hospitality industry.

Last year's inspections uncovered violations at half of all establishments checked. Tax officials discovered problems at 84 out of 168 venues during their seasonal compliance drive. These results demonstrate the ongoing need for regulatory oversight in this sector.

Erik Nilsen, head of tax crime investigation, confirmed the renewed focus. "We unfortunately continue to find too many errors in the industry," he said in an official statement. "We will therefore also inspect the restaurant and nightlife business during this year's holiday party season."

The Norwegian hospitality sector faces particular challenges during the julebordsesong, or Christmas table season. This period from late November through December generates substantial revenue for restaurants and bars. Many companies host annual holiday parties for employees, creating peak demand for venue services.

Tax authorities typically focus on several key compliance areas during these inspections. They verify proper registration of cash transactions and check for accurate reporting of employee hours. Officials also examine whether establishments correctly handle value-added tax on food and beverage sales.

This enforcement approach reflects Norway's broader commitment to tax compliance. The country maintains one of Europe's highest levels of tax transparency. Regular industry inspections help ensure all businesses operate on a level playing field.

International visitors and expatriates should note that Norway's dining establishments generally maintain high standards. The current enforcement actions target specific compliance issues rather than food safety or service quality. Tourists can expect normal operations at most restaurants during their visits.

The timing of these inspections coincides with the industry's most profitable period. Restaurant owners must balance increased customer demand with strict regulatory requirements. Those found violating tax rules face potential fines and increased scrutiny.

Norwegian authorities have not disclosed the specific criteria for selecting inspection targets. Previous patterns suggest they focus on establishments with prior compliance issues and those showing unusual financial patterns. The campaign aims to protect government revenue while maintaining fair competition.

This year's inspections will likely follow similar protocols to previous operations. Tax officials typically visit establishments during peak hours to observe actual operations. They review point-of-sale systems, employee records, and financial documentation.

The hospitality industry represents a significant portion of Norway's service economy. Proper tax collection from this sector helps fund the country's extensive social welfare programs. These seasonal enforcement actions underscore the government's commitment to maintaining system integrity.