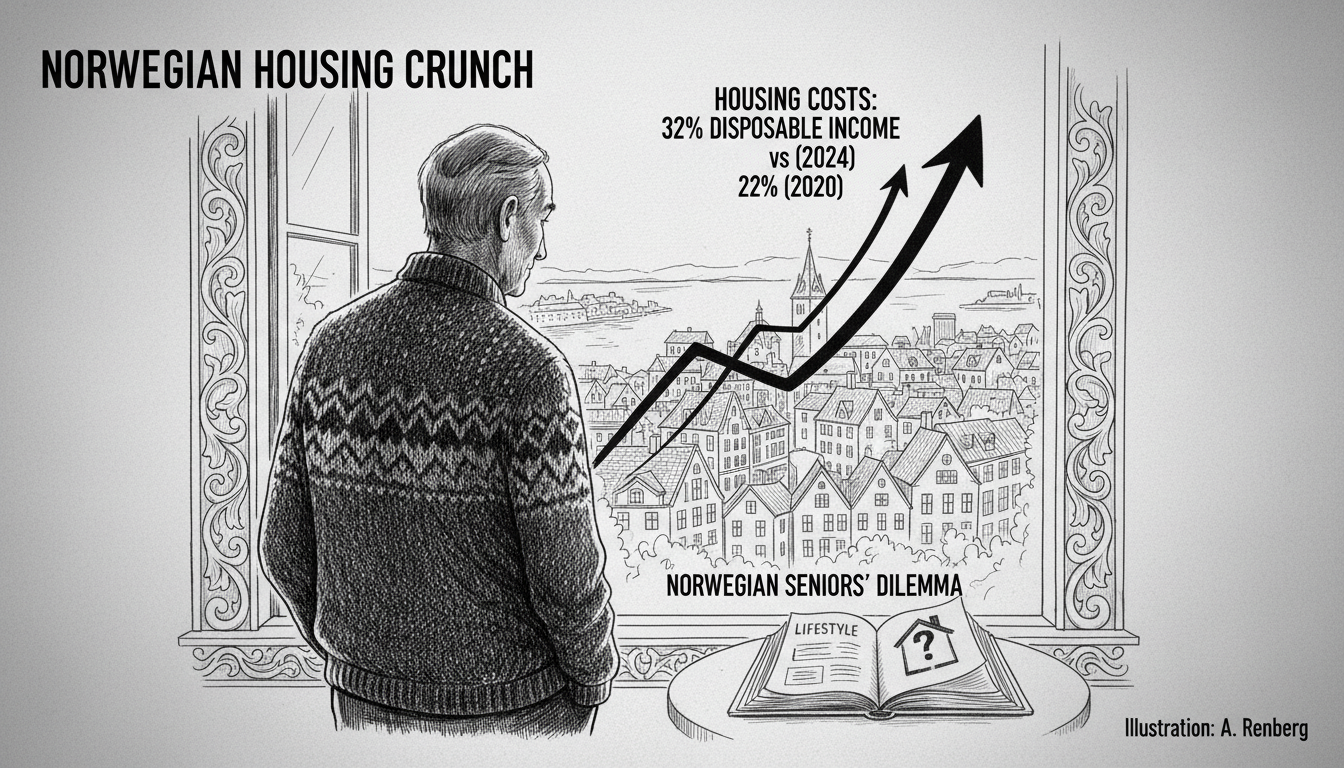

Norwegian households now face mounting financial pressure as housing expenses consume larger portions of disposable income. Recent data reveals housing costs now absorb 32 percent of post-tax income, a sharp increase from 22 percent just four years ago. This trend affects hundreds of thousands of Norwegians across income brackets.

Steinar Nygård, a recent retiree from Strømmen in Lillestrøm municipality, exemplifies this challenge. He maintains his single-family home himself to save money but still struggles with rising municipal fees and property expenses. Nygård would prefer allocating his pension toward travel and leisure rather than basic housing costs.

The situation reflects broader economic pressures within Norway's housing market. Property values have increased substantially while wages have not kept pace with rising municipal charges and maintenance expenses. Many Norwegian homeowners now face difficult choices between necessary home maintenance and discretionary spending.

This housing cost squeeze comes despite Norway's strong energy sector performance. The country remains Europe's second-largest natural gas exporter and a major oil producer, with fields like Johan Sverdrup and Troll contributing significantly to national revenues. Yet these energy sector successes have not insulated ordinary citizens from domestic economic pressures.

The Storting faces growing calls to address municipal taxation structures and housing policy. Several parliament members have raised concerns about intergenerational equity as younger Norwegians struggle to enter the housing market while retirees face fixed incomes against rising costs. The government must balance municipal funding needs against household budget constraints.

Norwegian housing policy has traditionally emphasized home ownership through various support mechanisms. Current trends challenge this approach as maintenance costs and local taxes increasingly burden middle-class homeowners. The situation in communities like Lillestrøm mirrors challenges across Oslo's surrounding municipalities.

Retirees represent a particularly vulnerable demographic as they transition from employment income to pension payments. Many Norwegian seniors own homes mortgage-free but face escalating municipal fees and maintenance requirements. This forces difficult trade-offs between housing upkeep and quality of life expenditures.

The government's upcoming budget negotiations will likely address municipal financing structures. Any changes to property taxation or local government funding could significantly impact household budgets across Norwegian cities and towns. The challenge remains balancing adequate municipal services with affordable housing costs.

International observers should note that Norway's housing cost pressures occur despite the country's substantial sovereign wealth fund and energy revenues. This demonstrates how global economic trends affect even well-resourced nations. The situation bears watching as other developed economies face similar housing affordability challenges.