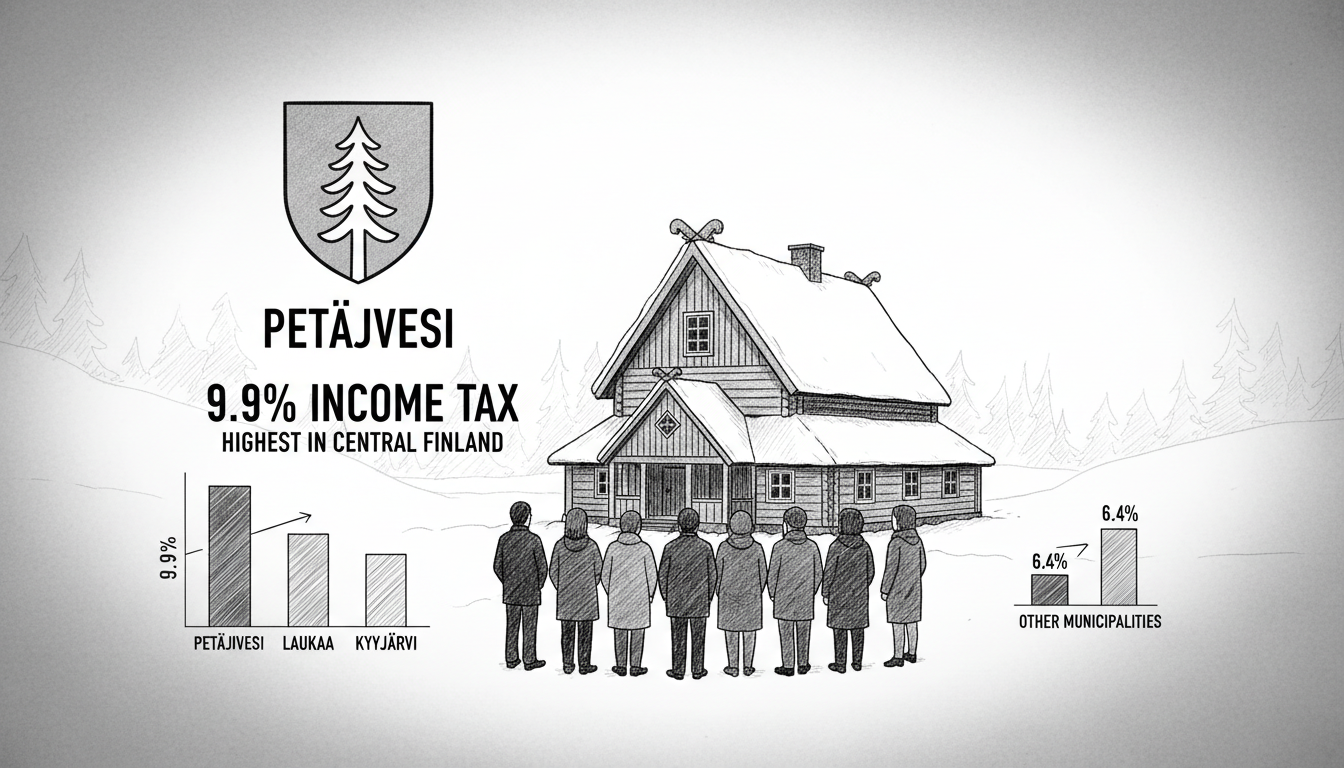

Petäjävesi municipal council has confirmed tax rates for the coming year. The decision keeps income tax at 9.9 percent for the third consecutive year. This rate represents the highest income tax percentage in Central Finland region. Petäjävesi shares this top position with two neighboring municipalities, Laukkaa and Kyyjärvi.

Tax rates across Central Finland municipalities show considerable variation. They range from a low of 6.4 percent to the maximum 9.9 percent. This 3.5 percentage point difference creates substantial variation in take-home pay across the region.

Municipal tax decisions directly impact residents' disposable income. Higher rates typically fund more extensive local services. Lower rates may indicate different service level priorities. The consistent 9.9 percent rate in Petäjävesi suggests stable municipal budgeting approach.

Finnish municipalities enjoy significant autonomy in setting local tax rates. This system allows communities to determine their preferred balance between services and taxation. The current structure dates back to reforms in the 1990s that strengthened municipal financial independence.

For international readers, understanding Finnish municipal taxation provides insight into local governance. Municipal taxes fund essential services like education, healthcare, and infrastructure. The rate variation reflects different political priorities and economic conditions across municipalities.

What does this mean for Petäjävesi residents? A person earning 40,000 euros annually pays approximately 1,400 euros more in municipal tax than someone in the lowest-tax municipality. This difference represents real money that could otherwise go toward household expenses or savings.

The decision to maintain the highest rate indicates municipal leadership's confidence in their service delivery. Residents effectively vote with their feet through migration patterns. Stable populations in high-tax municipalities suggest acceptance of the trade-off between taxes and services.

Looking forward, demographic pressures may challenge this tax structure. Aging populations increase healthcare costs while potentially reducing tax bases. Municipalities across Finland face similar challenges in maintaining service quality without excessive tax burdens.

Central Finland municipal tax rates demonstrate the diversity within Finland's welfare state model. Different communities make different choices based on local priorities and circumstances. The Petäjävesi decision represents one approach to balancing community needs with individual tax burdens.