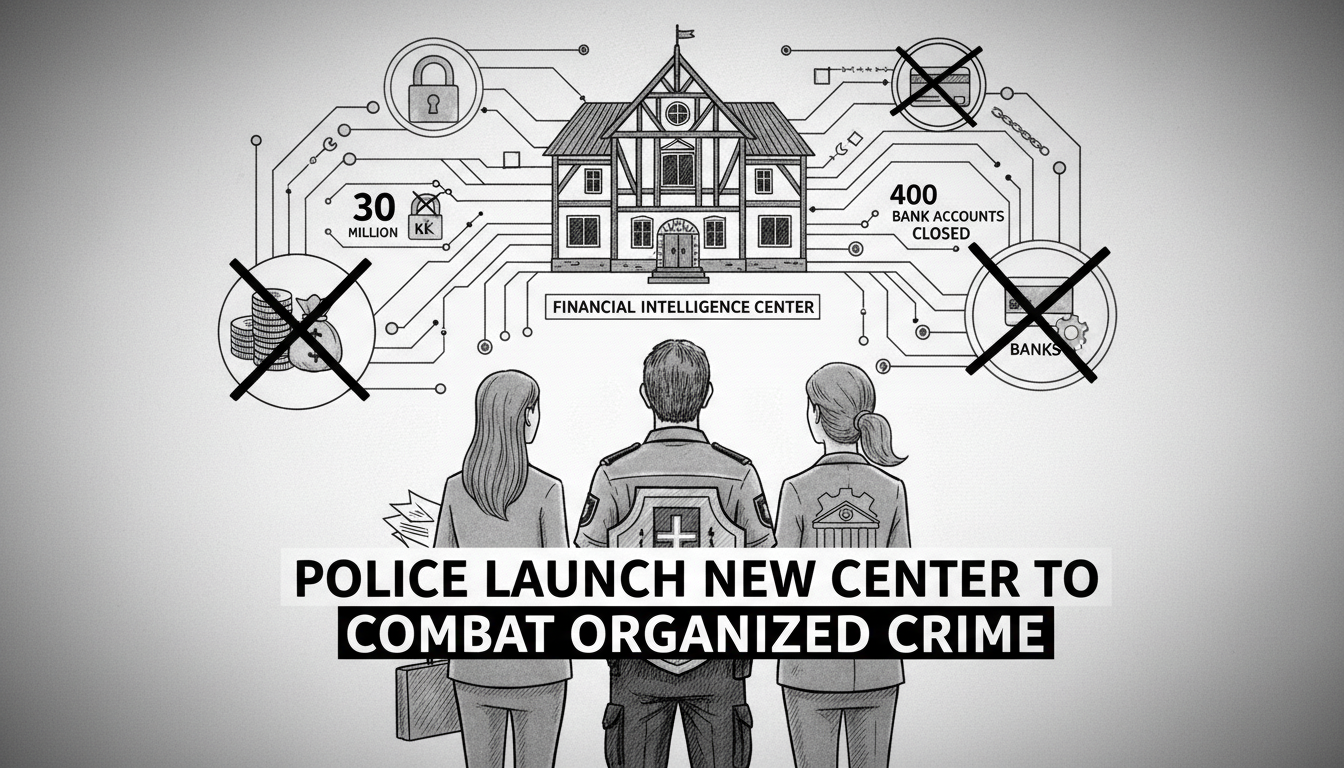

Sweden's new Financial Intelligence Center began operations in April. The center represents a groundbreaking collaboration between police, tax authorities, and banks. Its mission targets the criminal economy through coordinated action.

Authorities have already launched three major operations against serious financial crime. These efforts have recovered approximately 30 million Swedish kronor through asset seizures and new forfeiture laws. Banking institutions have closed 400 accounts linked to suspicious activity.

Operations leader Marcus Willner emphasized the critical role of banking partners. He said in a statement that account closures serve as important preventive measures. These actions make it harder for organized crime to use the financial system for illegal activities.

Several criminal investigations have been initiated with multiple suspects. While Willner declined to provide specific details, he confirmed money laundering represents a common thread across all operations. The targeted criminal networks represent various forms of organized crime.

Willner explained that all three operations impact Sweden's broader organized crime landscape. The Financial Intelligence Center marks the first time agencies and banks work together directly against criminal finances. The complexity of financial crime requires coordinated efforts across institutions.

We cannot work separately on this problem, Willner stated. We need to collaborate for better tools and information sharing. This approach gives us deeper understanding and enables more effective action. We believe this cooperation is completely decisive.

The criminal economy operates largely invisibly, but awareness has grown recently. Willner noted that targeting visible crime requires addressing the underlying economic drivers. Criminal groups depend on financial infrastructure to operate and expand their activities.

Sweden has intensified its focus on economic crime following increased gang violence. The country faces challenges with organized crime networks using sophisticated money laundering methods. International financial crime networks often exploit cross-border banking systems.

The new approach reflects global trends in financial crime enforcement. Countries worldwide are strengthening cooperation between law enforcement and financial institutions. Sweden's centralized system enables rapid information sharing between agencies.

Financial crime experts note that targeting criminal economies can disrupt multiple illegal operations simultaneously. When authorities seize criminal assets, they reduce funding for drug trafficking, human smuggling, and other illegal enterprises. The recovered funds can be redirected to social programs or law enforcement initiatives.

This coordinated strategy represents a significant shift in how Sweden tackles organized crime. Previous efforts often focused on individual arrests rather than systemic financial disruption. The new center aims to create lasting impact by attacking criminal profitability.

The operations demonstrate tangible results within months of establishment. The 30 million kronor recovery shows immediate financial impact. Account closures prevent future criminal use of banking services.

International observers will monitor Sweden's experiment with multi-agency financial enforcement. Success could influence similar approaches in other Nordic countries facing comparable organized crime challenges. The model represents an innovative response to increasingly sophisticated criminal financial operations.