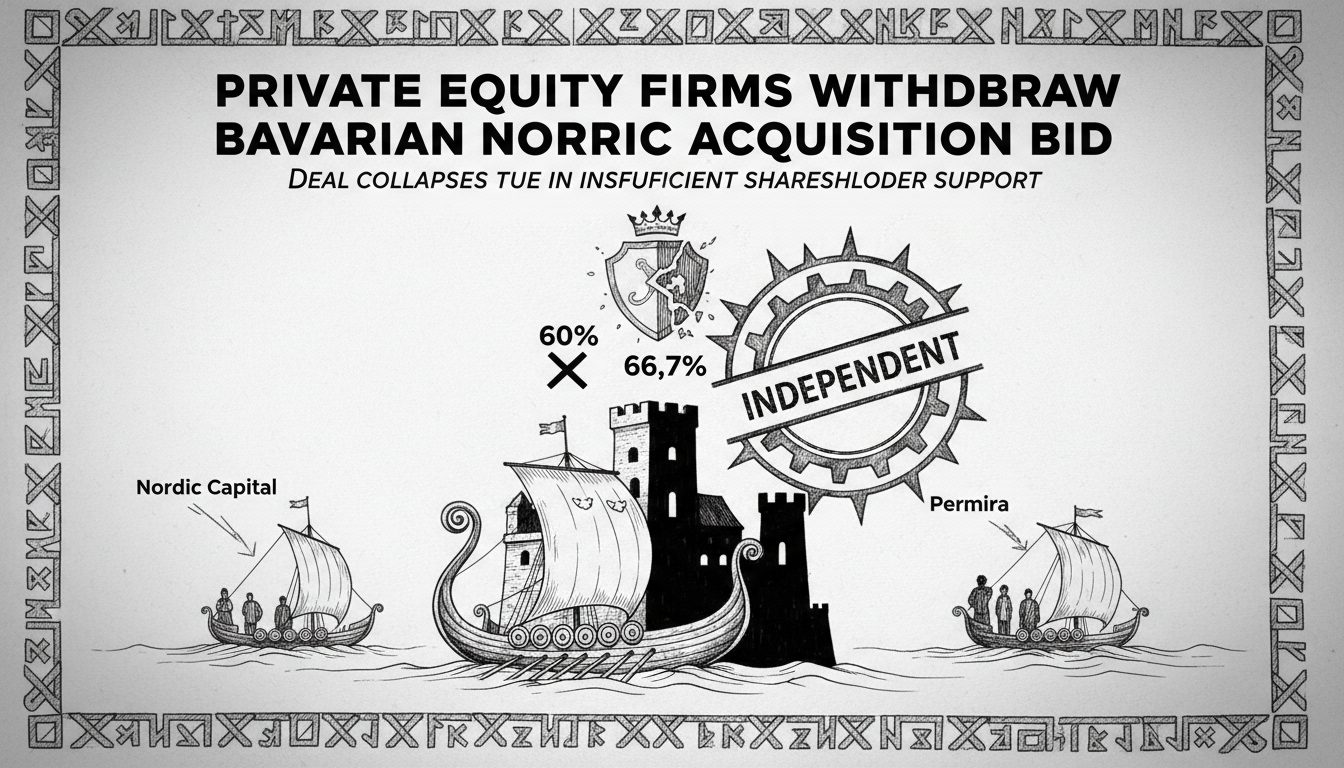

Two major private equity firms have abandoned their takeover attempt of Danish vaccine manufacturer Bavarian Nordic. Nordic Capital and Permira officially withdrew their acquisition offer after failing to secure sufficient shareholder support.

The investment consortium Innosera ApS, comprising both firms, needed approval from at least 66.7 percent of shareholders. Only 60 percent accepted the buyout proposal. This shortfall forced the permanent cancellation of the deal.

Luc Debruyne, Chairman of Bavarian Nordic's board, confirmed the withdrawal in a stock exchange announcement. He described the decision as final and irreversible.

This failed acquisition represents a significant setback for the private equity firms. They had positioned Bavarian Nordic as a strategic investment target in the growing vaccine market. The company gained international prominence during the COVID-19 pandemic with its monkeypox vaccine.

What does this mean for Bavarian Nordic's future? The company now maintains its independence but faces questions about its growth strategy. Pharmaceutical industry analysts note that Danish biotech firms often attract international investment interest. This failed bid may temporarily impact investor confidence.

The Danish pharmaceutical sector remains strong despite this development. Denmark continues to produce world-leading medical companies. The country's stable regulatory environment and skilled workforce support ongoing innovation in healthcare.

International investors watch Nordic pharmaceutical companies closely. The region offers advanced research capabilities and commercial expertise. This makes companies like Bavarian Nordic attractive targets for global investment.

Shareholders who supported the acquisition now face uncertainty. The company's stock price may experience volatility following this announcement. Market reactions will reveal how investors view the company's standalone prospects.

This situation highlights the challenges of consolidating the European pharmaceutical industry. Even attractive targets can prove difficult to acquire. Strict shareholder approval requirements often complicate takeover attempts.

Bavarian Nordic continues developing its vaccine portfolio. The company recently expanded its infectious disease research programs. Its future success will depend on commercial execution and scientific innovation.