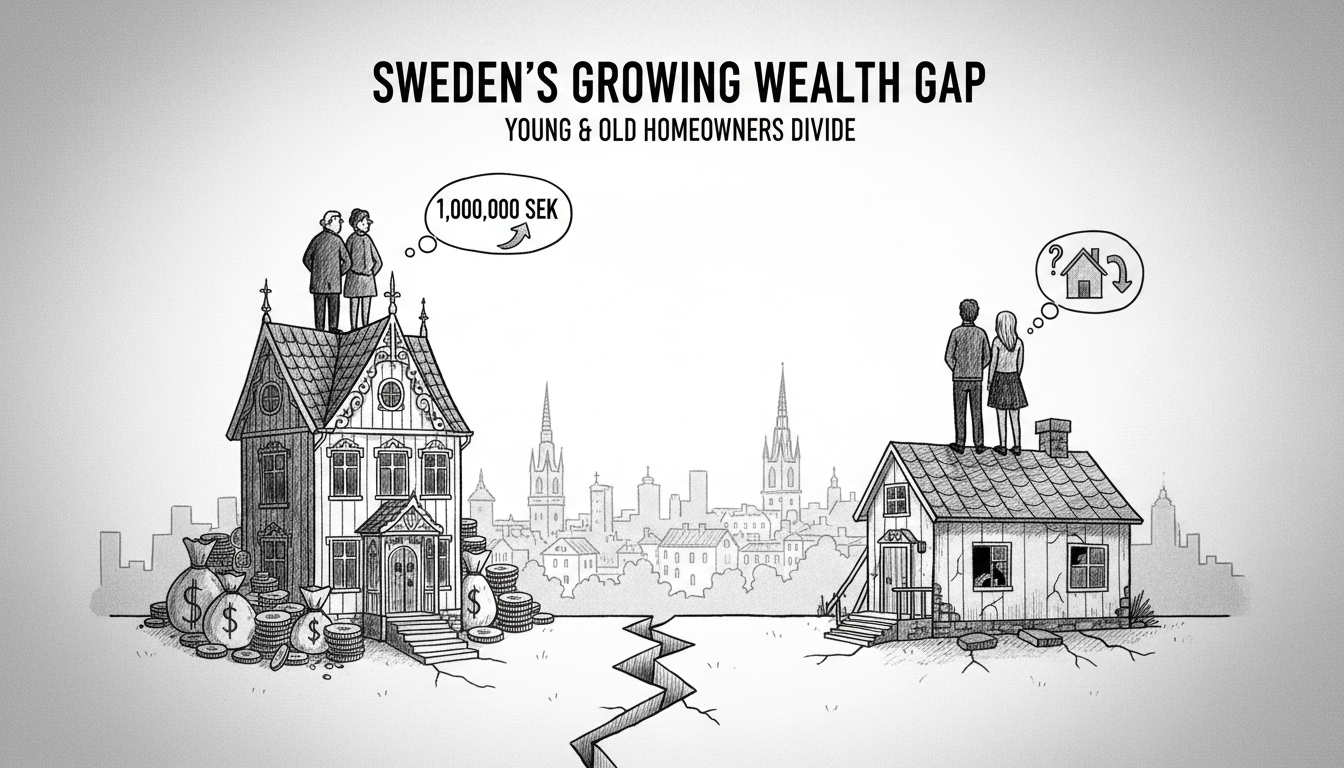

A new survey reveals Sweden's economic divide between generations continues to widen. Older homeowners overwhelmingly believe they would make substantial profits selling their properties today. Younger property owners express much less confidence about potential gains.

The study asked more than 1,000 Swedish homeowners about their expected profits or losses from selling their current residences. The results show a clear generational split in financial outlook and property market expectations.

This growing wealth gap reflects deeper structural issues in Sweden's housing market. Property values have surged dramatically over recent decades, creating massive wealth for those who bought homes earlier. Younger Swedes face much higher entry barriers with soaring prices and stricter mortgage requirements.

Sweden's housing market operates differently than many other countries. The system combines rent-controlled apartments, cooperative housing associations, and privately owned homes. This complex structure creates unique challenges for new market entrants.

Many older Swedes purchased properties during periods of rapid economic growth and favorable lending conditions. They benefited from decades of steady appreciation and generous tax deductions on mortgage interest. Recent regulatory changes have made home ownership more difficult for younger generations.

The survey results matter because housing wealth represents the largest component of Swedish household net worth. This generational wealth gap could have long-term consequences for retirement security and economic mobility. Younger Swedes may struggle to accumulate similar assets over their lifetimes.

International readers should understand this isn't just about property prices. Sweden's housing situation affects everything from family formation to labor mobility. People often hesitate to move for jobs if they cannot find affordable housing in new locations.

The Swedish government faces pressure to address housing affordability while protecting existing homeowners' investments. This balancing act creates political tensions between different age groups and economic interests.

What happens next? Market analysts predict continued price adjustments in some urban areas while rural properties may see different trends. The fundamental mismatch between housing supply and demand suggests these generational divides will persist without policy interventions.

For expats considering Sweden, understanding this housing landscape proves crucial. The market presents both opportunities and challenges depending on your financial situation and long-term plans. Renting remains more common for newcomers before committing to property ownership.

The survey clearly shows how different generations experience Sweden's economy through their housing situations. This reality affects spending patterns, investment decisions, and overall financial security across age groups.