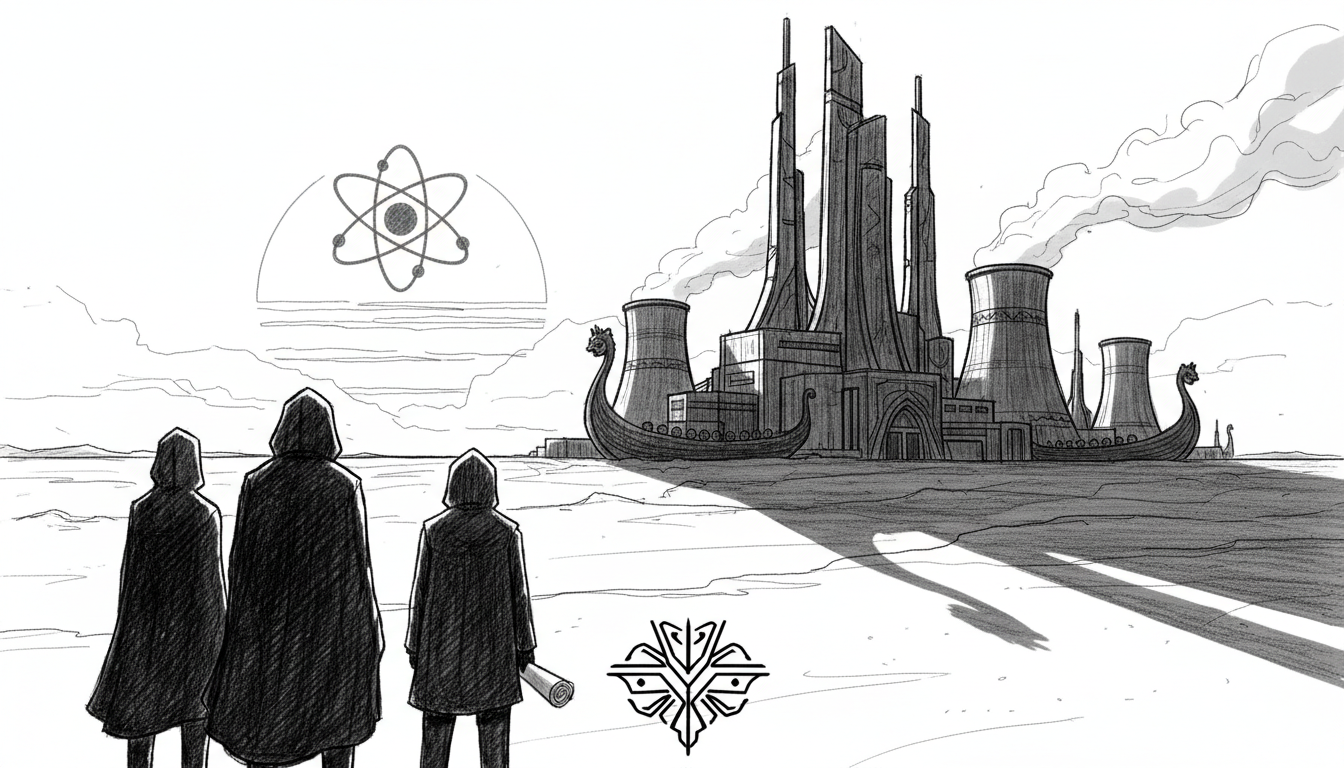

Sweden has received its first application for state-supported nuclear power construction in 52 years, marking a historic energy policy shift. Videberg Kraft AB, a subsidiary of state-owned Vattenfall, submitted the request to build on the Värö Peninsula in Varberg Municipality. This move directly supports the Swedish government's strategy to expand fossil-free electricity amid growing industrial demand.

Deputy Prime Minister Ebba Busch of the Christian Democrats hailed the application as an early Christmas gift. Prime Minister Ulf Kristersson emphasized its role in electrifying Sweden's transport and industry sectors. Their statements from Rosenbad, the government headquarters, underscore a cohesive coalition drive for nuclear revival.

The Väröhalvön Proposal: Coastal Power Ambitions

Videberg Kraft AB plans to construct new nuclear reactors on the Värö Peninsula, a coastal site in western Sweden. Desirée Comstedt, Vattenfall's nuclear chief and CEO of Videberg Kraft, stated the application enables critical investment steps. The project aligns with national goals for stable, carbon-free baseload power, though specific reactor numbers and capacities remain undisclosed. Location selection reflects strategic planning for grid connectivity and cooling water access.

This application triggers formal reviews under Sweden's nuclear regulatory framework, managed by the Radiation Safety Authority. Success depends on rigorous safety, environmental, and economic assessments over coming years. The process will involve consultations with Varberg Municipality and regional stakeholders, highlighting local governance roles.

Political Consensus from Rosenbad to Riksdag

Government ministers celebrated the application as a tangible outcome of their energy policy agenda. Ebba Busch posted on social media that coalition partners are delivering from promise to implementation. Ulf Kristersson's office issued a statement linking nuclear expansion to climate targets and energy security. Both leaders referenced Riksdag decisions in 2023 that amended laws to permit new reactor construction beyond existing sites.

The Swedish Parliament previously approved investment support mechanisms for nuclear power through legislative packages. These measures aim to mitigate high upfront costs and long construction timelines, estimated at 10-15 years per project. Coalition agreements between the Moderate Party, Christian Democrats, and Liberals prioritize nuclear as part of a diversified energy mix.

From Phase-Out to Revival: Policy Evolution

Sweden's nuclear history features dramatic fluctuations, from rapid expansion in the 1970s to a phasedown after the 1980 referendum. Six reactors at three plants now provide about 30% of national electricity production. Political consensus fractured post-Fukushima, but recent years saw renewed cross-party support. The 2016 energy agreement allowed replacement reactors at existing sites, yet no new applications emerged until now.

Policy reversals gained momentum with the 2022-2023 government formed under Ulf Kristersson. Its program explicitly endorsed new nuclear power to meet climate goals and ensure industrial competitiveness. The Ministry of Climate and Enterprise, led by Ebba Busch, crafted support schemes to attract private investment, acknowledging nuclear's capital-intensive nature.

Economic Framework and State Support

The application invokes state support mechanisms designed to share financial risks between taxpayers and investors. Details remain confidential but likely involve loan guarantees or price guarantees per kilowatt-hour produced. Sweden's National Debt Office may manage backing, with Riksdag oversight ensuring budgetary discipline. This approach mirrors models used in other European countries for nuclear and renewable projects.

Experts note that without such support, new nuclear projects struggle against cheaper renewables like wind and solar. However, nuclear offers reliable output unaffected by weather, crucial for Sweden's expanding data center and manufacturing sectors. The government estimates electricity demand could double by 2045, necessitating all available fossil-free sources.

Expert Analysis: Costs, Timelines, and Grid Impact

Energy analysts emphasize that this application tests the viability of Sweden's nuclear ambitions. Professor Lars J. Nilsson of Lund University states that construction costs often exceed €10 billion per reactor, requiring robust state involvement. Lead times from application to operation typically span 15 years, demanding long-term political stability. The Swedish Energy Agency monitors progress, with regular reports to the Riksdag on energy mix developments.

Nuclear advocates argue that new small modular reactor (SMR) technologies could reduce costs and timelines. Videberg Kraft's plans may incorporate SMR designs, though Vattenfall has not confirmed specifics. Opponents highlight waste disposal challenges, as Sweden's existing repository at Forsmark faces capacity questions. Public acceptance surveys show divided opinions, with support rising among younger demographics concerned about climate change.

Local and Environmental Considerations

Varberg Municipality must approve zoning changes for the Värö Peninsula site, involving public hearings and environmental impact assessments. The area currently hosts industrial facilities, but new nuclear infrastructure requires enhanced safety buffers. Swedish law mandates consultation with residents and environmental groups, a process likely to take several years.

Radiation safety and waste management plans will undergo scrutiny by the Swedish Radiation Safety Authority. Existing nuclear waste policy relies on deep geological storage, funded by reactor operators. Each new reactor increases waste volumes, prompting debates in the Riksdag on long-term storage solutions. The Environmental Code sets strict conditions for protecting Baltic Sea ecosystems near the site.

The Road to a Fossil-Free Future

This application represents a critical milestone in Sweden's energy transition, aiming to phase out fossil fuels entirely. Government policy targets 100% renewable and nuclear electricity by 2040, with nuclear providing baseline stability. Subsequent applications may follow from other operators, potentially at existing nuclear sites in Ringhals or Forsmark.

The Swedish government's commitment will be tested during the review process, requiring sustained parliamentary support. International observers watch closely, as Sweden's model could influence European energy security debates. Ultimately, the Väröhalvön decision will shape whether nuclear power regains a central role in Nordic electricity markets.

As Sweden navigates this complex policy area, the balance between climate urgency, economic pragmatism, and democratic oversight remains paramount. The coming years will reveal if historic applications translate into tangible power plants, securing electricity for future generations.