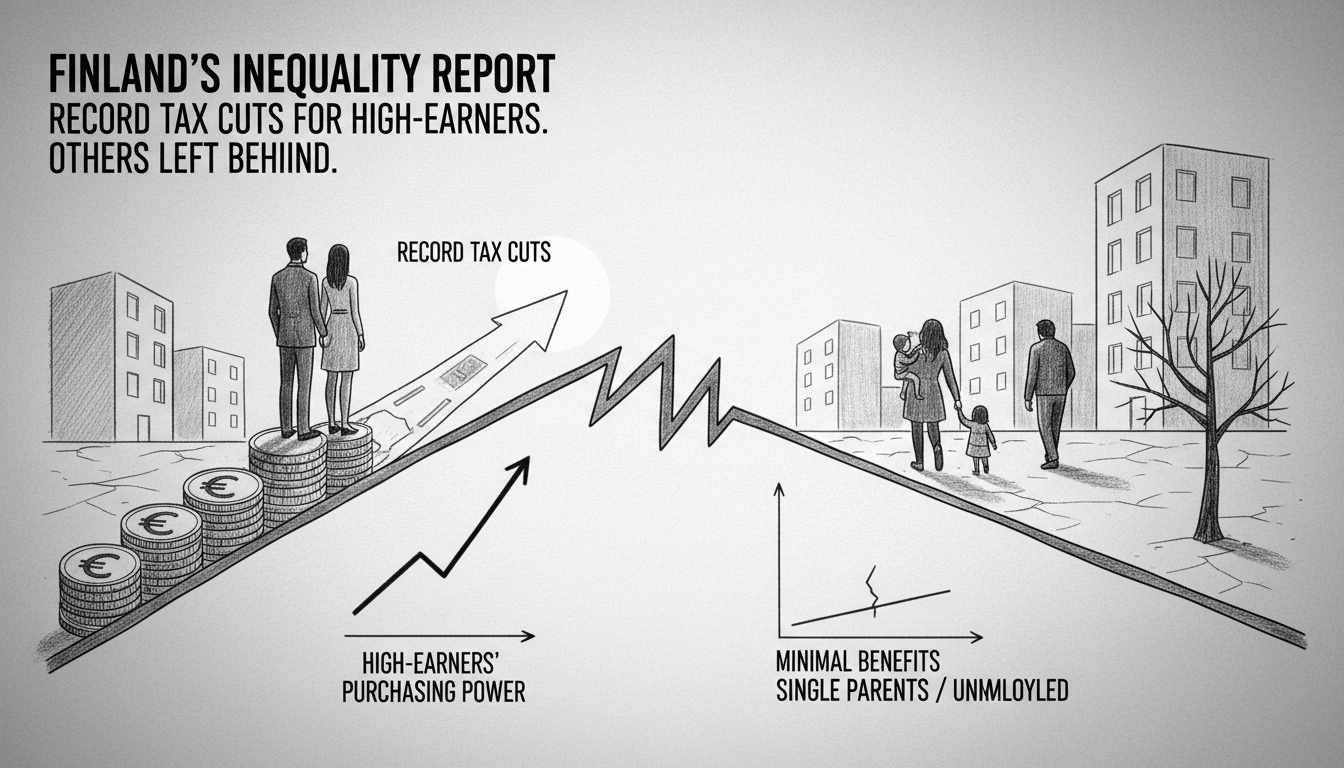

A new economic report shows Finland's tax reforms will create clear winners and losers. High-income households without children will receive record tax relief while single parents and unemployed residents see minimal benefits.

Research institute Labore tracked eight hypothetical families' income and purchasing power. Their analysis reveals wage growth will continue through 2027, though more moderately than previous forecasts.

Average wage incomes will increase 2.6% next year, 3.0% the following year, and 2.7% in the third year.

Social benefit cuts implemented earlier have negatively impacted households receiving government support. Single parents and unemployed residents saw their nominal income levels drop significantly.

Single parents' available income will continue declining next year while other families experience positive income growth.

High-income childless couples will see their total tax burden drop by over 1.4 percentage points next year. This represents the largest tax reduction observed across all family types from 2014 through 2027.

A single highly-educated childless resident gains practically nothing from the 2026 tax cuts. They receive no child-related increases or other substantial tax relief.

For pensioner households, proposed changes to additional pension income taxation won't affect purchasing power. Most pensioners' incomes remain below the threshold where impacts occur.

Pensioners will see minor tax rate decreases in 2026-2027 due to index adjustments for pension-related deductions. These amount to only about ten euros monthly per pensioner.

Available nominal incomes will grow most significantly for high-earners between 2025-2027, both in absolute and percentage terms.

Over the longer 2015-2027 period, white-collar families saw the strongest income growth at 32%. Single parents and unemployed residents experienced the weakest development at 18%.

Purchasing power is recovering strongly for more affluent employee families after weak 2022-2023 performance.

Not everyone benefits equally. Unemployed individuals and single parents will see little purchasing power improvement through 2027. Social benefit cuts particularly hurt these groups, and substantial tax relief doesn't target them starting in 2026.

These families average negative purchasing power growth of -0.5% to -0.7% over three years.

Long-term analysis since 2015 shows employee families experienced the best purchasing power development. Unemployed individuals receiving labor market support and retired couples also saw favorable development.

These three household types will have higher purchasing power in 2027 than in 2015. High-income couples join this group in 2027.

The remaining four family types show weakened purchasing power compared to 2015 levels.

This paints a stark picture of Finnish household purchasing power over the past decade. Negative development affects a broad and diverse group including homeowners and benefit recipients alike.

The reasons differ between groups. Employees suffered from rapid inflation and rising interest rates while benefit recipients were hit by cuts and freezes to social benefits.

The data clearly shows Finland's tax reforms disproportionately benefit high-earners while leaving vulnerable groups behind. This widening gap raises questions about equitable economic policy.