Finland’s shift to a cashless society is nearly complete, with over 3 million people using the MobilePay app for more than 10 million transactions each month. For any newcomer arriving in Helsinki, mastering this digital payment tool is not a luxury but a necessity for daily life. How does one navigate a society where a smartphone has replaced the wallet for everything from a market hall coffee to splitting a restaurant bill?

Setting Up Your Digital Wallet

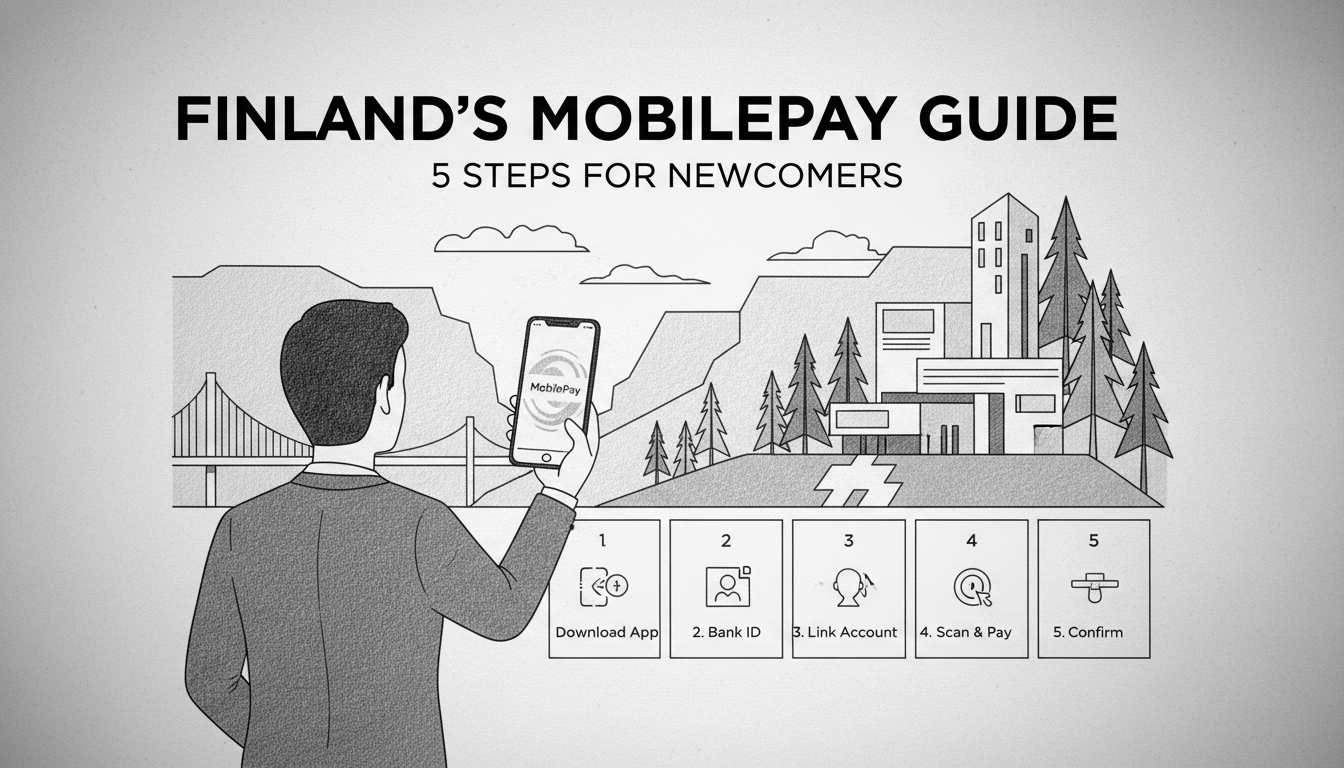

Downloading the MobilePay app from the App Store or Google Play is the first of five straightforward steps. The crucial requirement is a Finnish or Danish bank account, which gates access to the system. Major financial institutions like Nordea, OP Financial Group, and Danske Bank integrate directly with the service.

During the setup, you will link your debit card. The app verifies your identity using your bank's secure login credentials, a process typically taking five minutes. You then create a secure four-digit PIN, which must be stored carefully and never shared. Upon completion, the app generates a unique QR code that acts as your payment identity.

This seamless integration with the national banking infrastructure is a key reason for the app's dominance. It transfers the existing trust in financial institutions directly to the digital payment space.

Navigating Daily Transactions

In Finnish supermarkets like K-Citymarket or S-Market, the payment terminal displays a QR code. To pay, you simply open the MobilePay app, select 'Pay', and scan the code. After confirming the amount and entering your PIN, the transaction is complete. The money moves from your bank account instantly.

The system's reach extends far beyond large chains. At Helsinki's historic Hakaniemi Market Hall, individual stalls display printed QR codes. Coffee chains like Robert's Coffee and Espresso House accept it. For person-to-person payments, you tap 'Send', enter the recipient's Finnish mobile number, add an amount and an optional message, and confirm with your PIN.

This ease of use for splitting costs, paying a friend back, or contributing to a office gift collection has embedded MobilePay into the social fabric. It eliminates the awkwardness of needing exact cash.

Understanding Fees and Limits

For personal use, MobilePay is free. Businesses bear the cost, paying a transaction fee of 1.4% plus a small fixed charge. This model has encouraged widespread merchant adoption.

Personal payment limits are set by your bank, not MobilePay. Standard daily limits often range from 1,000 to 5,000 euros, with monthly limits potentially reaching 15,000 euros. These thresholds are security measures. If you need higher limits, you must contact your bank directly to negotiate new terms.

All transaction history is stored within the app, allowing for easy export and expense tracking. A significant advantage for travelers is the app's Nordic-wide functionality; the same account can be used for payments in Denmark, reflecting its origins.

Security and Common Solutions

MobilePay employs bank-grade encryption. The app automatically logs out after periods of inactivity, adding a layer of security. Your PIN is the primary key, and it should never be shared with anyone.

If your phone is lost or stolen, you should immediately report it to your bank. You can also disable MobilePay payments remotely through your bank's online banking service. For common issues like failed transactions, users are advised to check their internet connection and ensure their linked card has sufficient funds.

Keeping the app updated is crucial. For payment disputes or unauthorized transactions, you must contact your bank. Finnish strong consumer protection laws also cover these digital payments.

The Analysis: Why MobilePay Defines Finland

The success of MobilePay in Finland is a story about convergence. It brought together high digital literacy, profound trust in banks, and a cultural readiness to abandon cash. Launched in Denmark in 2013, the service found fertile ground in neighboring Finland, where society was already primed for digital solutions.

‘The application succeeded because it solved a real need with extreme simplicity,’ says a Finnish fintech analyst. ‘It wasn't just a payment tool; it became a social utility. The merger with Norway's Vipps in 2022 created a Nordic payments giant, further cementing its stability and future.’

This analyst points to the Nordic model of digital identification as the bedrock. ‘Users already trusted their bank credentials for logging into government services. Using that same trust for payments was a natural, secure progression. It removed the friction of creating entirely new digital identities.’

The implications are profound. For newcomers, failure to adopt MobilePay creates immediate practical barriers. It can mean being unable to pay at a small boutique, struggling to contribute to a group gift, or delaying reimbursements to colleagues. Its role extends beyond commerce into social cohesion.

Looking ahead, the landscape continues to evolve. The European Union's push for open banking and instant payment systems may introduce new competitors. Yet, MobilePay's deep integration and first-mover advantage give it a formidable position. For the foreseeable future, understanding this app remains the most important step for financial and social integration into Finnish life. The question is no longer if you will use it, but how quickly you can adapt.