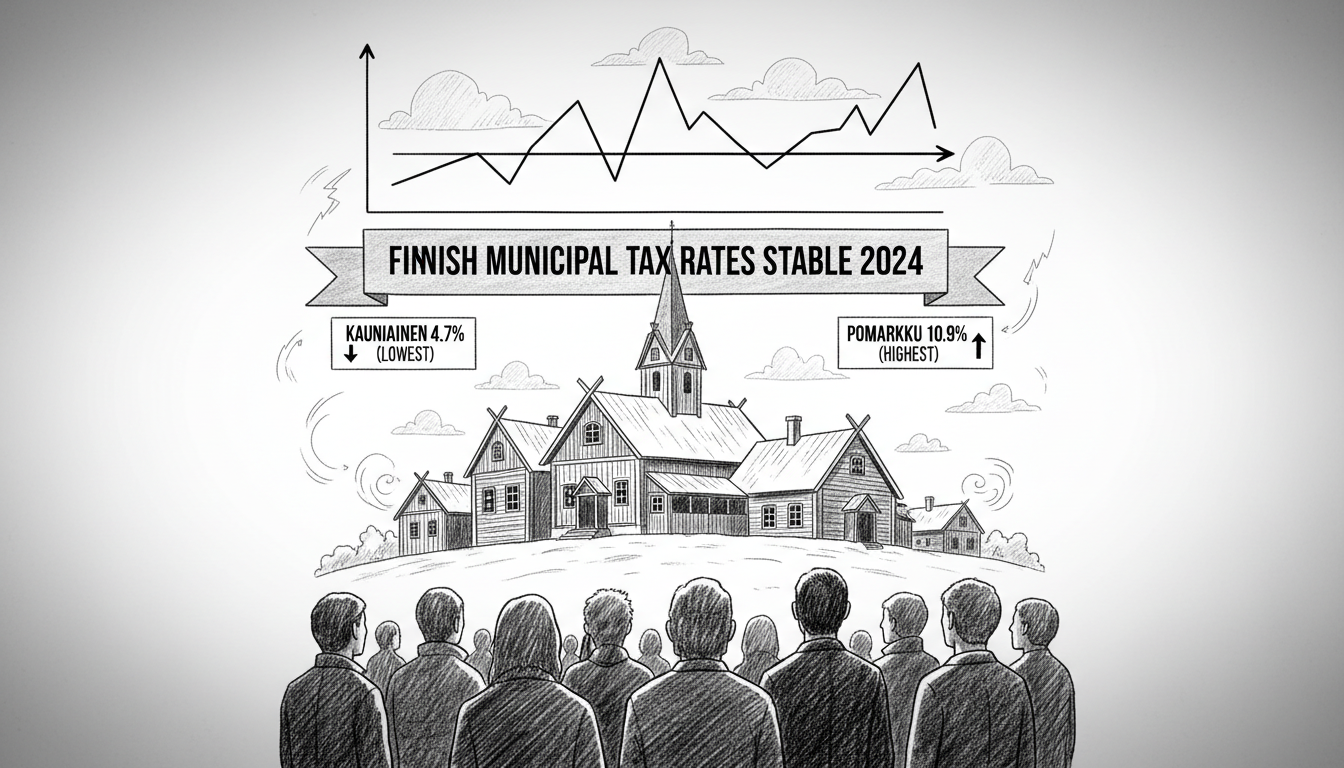

Most Finnish municipalities are keeping their income tax rates unchanged for the coming year despite economic challenges. Only 38 municipalities will increase their tax percentages, affecting over half a million residents across the country. Meanwhile, 265 municipalities maintain current rates while five communities actually lower their tax burdens.

The highest municipal income tax rate in mainland Finland remains in Pomarkku at 10.9 percent. Kauniainen continues to hold the distinction of Finland's lowest municipal tax rate at just 4.7 percent. This wealthy Helsinki suburb has maintained this position for years, creating a notable disparity between Finland's highest and lowest municipal tax rates.

Timo Reina, deputy CEO of the Association of Finnish Municipalities, expressed surprise at the moderate number of tax increases given current economic conditions. He noted that municipalities appear to be seeking solutions to budgetary pressures from sources other than tax hikes, especially as new municipal councils begin their terms.

This trend marks a departure from recent patterns. Earlier this year, 68 municipalities raised their tax rates following the implementation of Finland's social and healthcare reform. The current wave of increases primarily affects small and medium-sized municipalities and cities facing particular financial strain.

Sanna Lehtonen, director of municipal financial affairs, observed that municipal economic situations continue to diverge significantly. Some municipalities now confront substantial financial challenges that may require more drastic measures in the future.

The stability in tax rates reflects careful political calculation by municipal leaders. With new council terms beginning, many local politicians appear reluctant to immediately raise taxes despite genuine budget pressures. This approach suggests municipalities are exploring alternative cost-saving measures or banking on economic recovery to improve their financial positions.

For international residents and businesses considering Finland, these tax variations between municipalities represent important financial considerations. The nearly 6-percentage-point difference between highest and lowest rates can significantly impact disposable income and business operating costs across different regions.

Municipal tax decisions ultimately reflect local priorities and economic realities. Wealthier municipalities like Kauniainen can maintain low rates due to their strong tax bases, while smaller communities with aging populations or industrial transitions face tougher choices between service cuts and tax increases.