Finnish tax authorities released public income data for the third quarter this week. The information became available Wednesday morning at 8 AM local time. This annual transparency measure shows earnings across Central Finland.

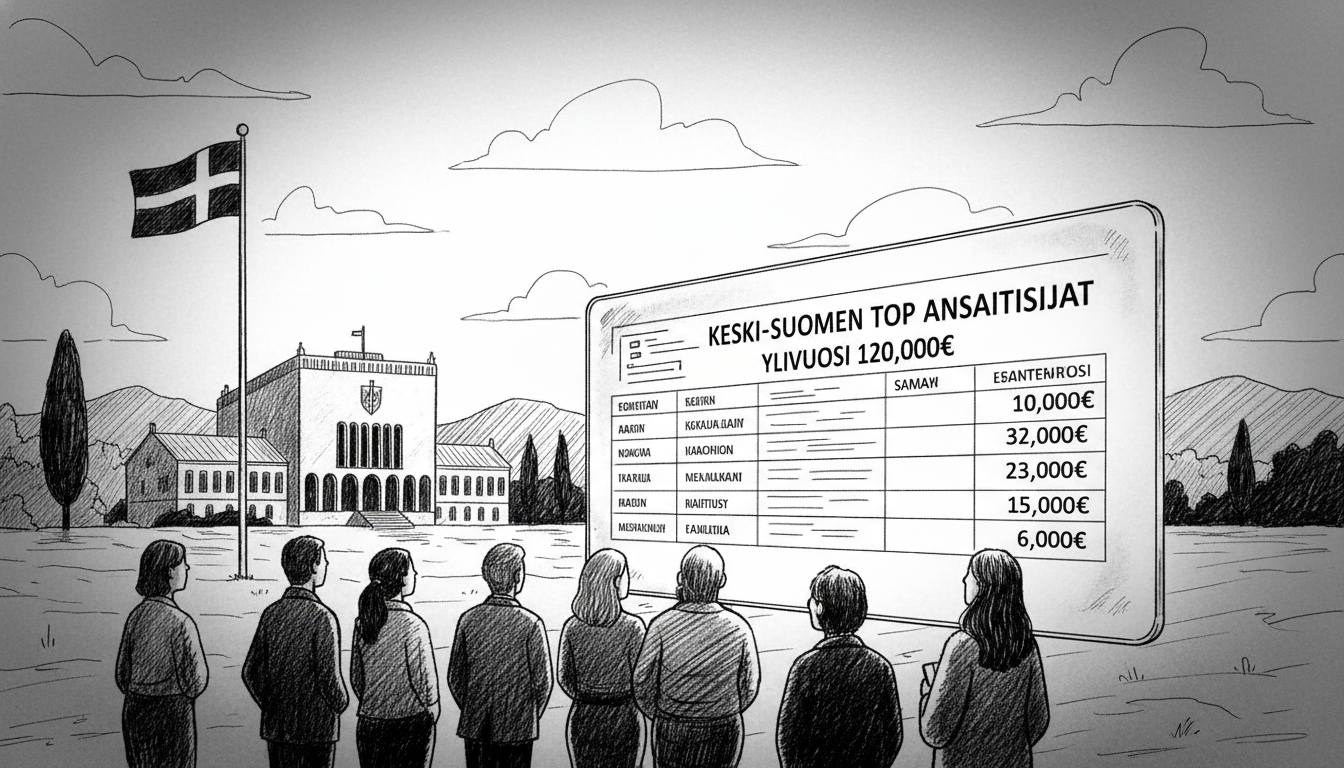

Residents can now search for individuals earning over 120,000 euros annually. The database allows filtering by municipality and personal names. Users can sort results by capital income, earned income, or total income figures.

Minors remain protected in the system. Their names and earnings do not appear in public records. This safeguards young people's privacy while maintaining transparency for adult earners.

Finland maintains one of Europe's most transparent tax systems. The public can access neighbor's salary information each year. This tradition dates back decades and reflects Nordic values of openness.

Many foreigners find this practice surprising. Most countries treat income as private information. In Finland, tax transparency fights corruption and promotes fairness.

The current release covers Central Finland specifically. This region includes cities like Jyväskylä and Äänekoski. Local businesses dominate the high-earner lists each year.

What does this mean for international residents? Expats working in Finland should understand their salaries become public. This can create uncomfortable situations but also promotes wage equality.

The system reveals interesting patterns about Nordic society. Income disparities appear smaller than in many countries. Top earners typically include doctors, executives, and successful entrepreneurs.

Tax transparency serves multiple purposes in Finnish society. It helps combat tax evasion and promotes social trust. Citizens can verify everyone pays their fair share.

Some critics question whether the practice invades privacy. Supporters argue the public benefit outweighs privacy concerns. The system has operated this way for generations.

International companies operating in Finland must adapt to this transparency. Their compensation structures become visible to competitors and employees alike. This can influence salary negotiations and business strategies.

The data release occurs simultaneously across Finland. Each region publishes local earnings information. Journalists and researchers often analyze the numbers for economic trends.

This quarter's data shows continuing economic stability in Central Finland. The region maintains steady income growth despite global uncertainties. Manufacturing and technology sectors drive local prosperity.