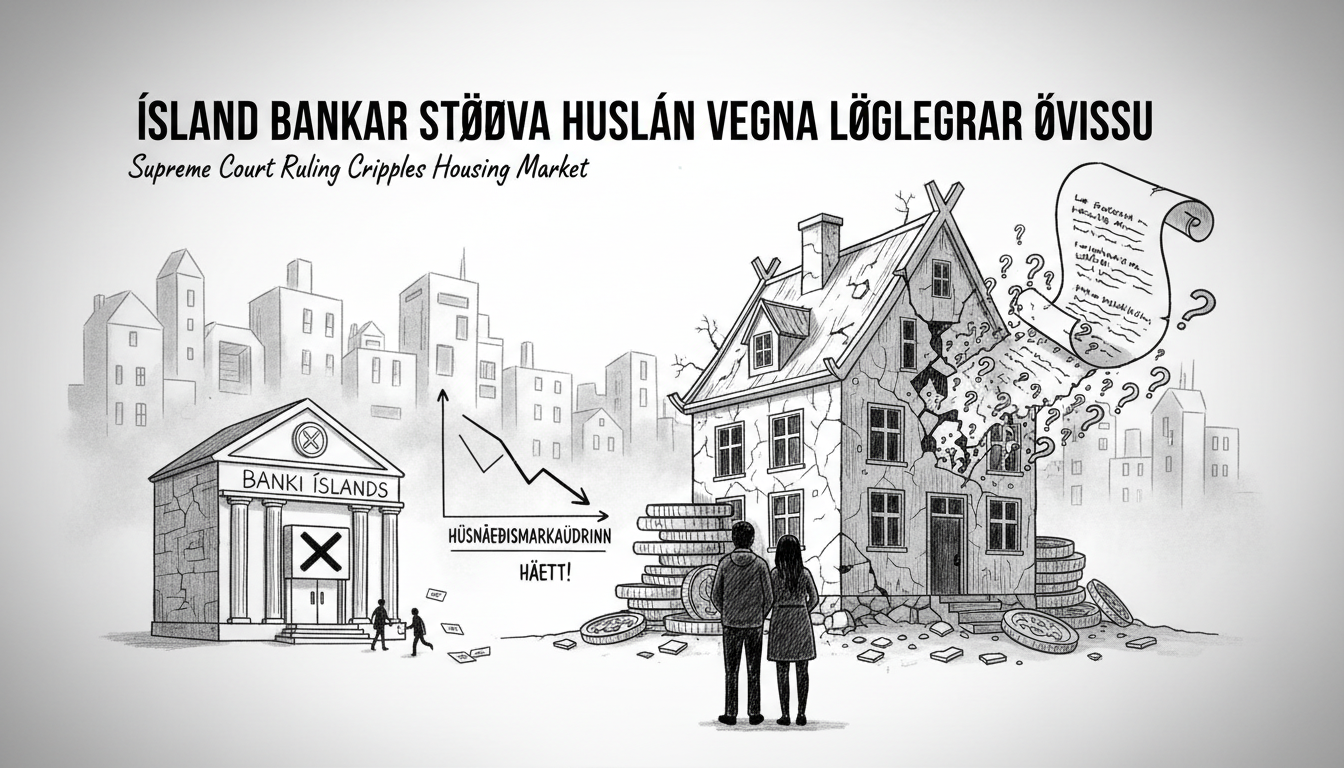

Iceland's housing market faces immediate disruption after financial institutions paused processing inflation-linked mortgage applications. Banks have started rejecting qualified buyers who previously received payment assessments. Real estate agents report fewer inquiries and poor attendance at open houses.

The Supreme Court recently ruled certain terms of Iceland's indexed housing loans unlawful. Arion Bank, Landsbankinn, and several pension funds have now limited new mortgage approvals. Other financial institutions are considering their positions.

Experienced real estate agent Páll Pálsson confirms the legal uncertainty affects Iceland's mortgage market. He expects resolution within days. "Colleagues in the banking system say this should be solved soon," Pálsson stated in a radio interview. "But currently, if you apply for an indexed loan, you get a no."

Iceland's unique indexed mortgages adjust with inflation, protecting lenders but increasing borrower costs during high inflation periods. This system has long been controversial.

The sudden lending freeze reveals how quickly Iceland's small, interconnected economy reacts to legal changes. Homebuyers now face uncertainty during what's typically an active spring market season.