Norway's AvtaleGiro system processes over 200 million direct debit transactions annually. For the country's growing international community, mastering this system is the first critical step toward financial integration. Without it, managing everything from a monthly rent payment to a Netflix subscription becomes a manual, error-prone chore. This guide explains how expats can set up and manage AvtaleGiro, turning a potential headache into a seamless part of Norwegian life.

The Backbone of Norwegian Bills

AvtaleGiro is not just a payment option; it is the national standard. Managed by Finance Norway, the system allows companies to withdraw authorized payments directly from your bank account. Over 80% of all invoices in Norway are paid electronically, primarily through this method. It handles recurring costs like electricity, internet, phone plans, and housing fees. The process is simple from the company's perspective: they send an electronic invoice directly to your bank, and on an agreed date, the funds are transferred. For users, it means bills are paid automatically, eliminating late fees and saving considerable administrative time. All major Norwegian banks, including DNB, Nordea, and SpareBank 1, are integrated into the system.

Your Digital Keys: Bank Account and BankID

Before touching AvtaleGiro, you need two fundamental tools. The first is a Norwegian bank account. This is non-negotiable, as foreign accounts cannot participate in the domestic scheme. The second is BankID, Norway's universal digital identification. More than just a banking tool, BankID is your digital passport for accessing tax services, healthcare portals, and signing rental contracts. Over 98% of Norwegians use online banking regularly, with BankID as the secure gateway. "For expats, obtaining BankID is the real milestone," says Lars Jensen, a financial advisor in Oslo. "It unlocks the entire digital society. AvtaleGiro is one of the first and most frequent uses you'll have for it."

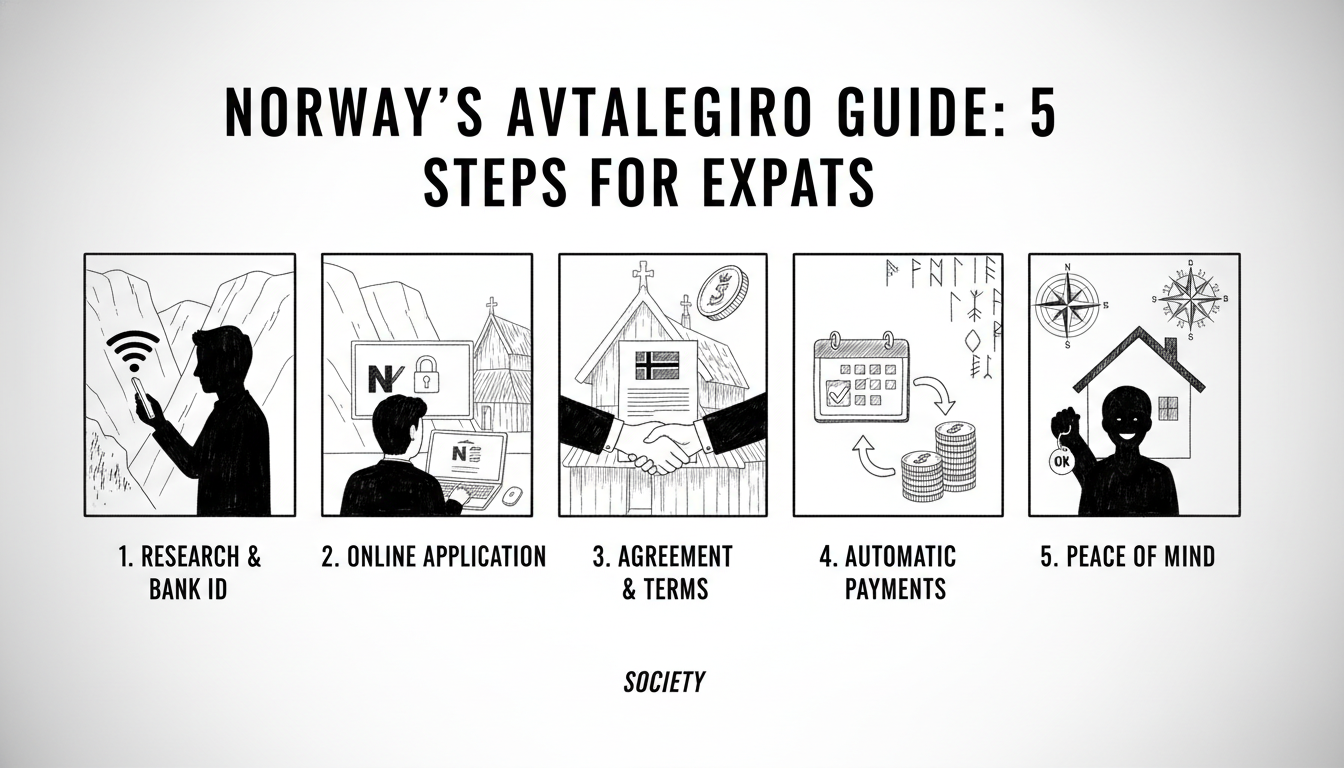

A Five-Step Setup Process

Setting up an AvtaleGiro agreement is a straightforward digital process. First, log into your bank's online portal or mobile app. Navigate to the payments section, often labeled 'Betaling' or 'Regninger.' Look for 'AvtaleGiro' or 'Direct Debit Agreements.' Second, you need the unique AvtaleGiro registration number for the company you wish to pay. This number is always listed on the paper or PDF invoices they send you. Third, enter this number into your bank's form. The bank's system will identify the company. Fourth, you will set parameters, often simply confirming the account to be debited. Some companies allow you to set a maximum withdrawal limit. Fifth, and most importantly, you sign the agreement using your BankID. This final step provides legal authorization for the company to withdraw funds. For services like Telenor or TV streaming platforms, you can often authorize AvtaleGiro directly on their website during sign-up, using a process called 'BankID på Nett.'

Managing and Monitoring Your Money

Control is a crucial aspect of AvtaleGiro. Unlike an automatic card charge, you authorize the agreement in your bank, giving you central management. You should review your active agreements every few months. This list is visible in your online banking. Here, you can see every company authorized to withdraw money. Most banks display pending AvtaleGiro withdrawals up to five business days in advance, giving you clear visibility into upcoming cash flow. To cancel an agreement, you do so directly in your bank's portal—you don't need to contact the company first. Find the agreement in your list, select 'Cancel,' and confirm with BankID. The cancellation is effective immediately for future invoices. However, you should also inform the company to stop sending invoices. A common pitfall for expats is confusing AvtaleGiro with a standing order ('autogiro'). A standing order is you sending a fixed amount regularly. AvtaleGiro is the company pulling a variable amount, as stated on each invoice.

Security, Alerts, and Expert Advice

The efficiency of AvtaleGiro requires user vigilance. While fraud is rare, monitoring is essential. Financial experts recommend using your bank's alert systems. DNB and Nordea, for instance, allow customers to set up SMS or email notifications for all direct debit transactions or for withdrawals above a certain amount. "Treat your AvtaleGiro list like your front door keys," advises Mia Larsen, a cybersecurity specialist with a focus on fintech. "You wouldn't hand out copies without thought. Regularly audit who has access to your account. The convenience is phenomenal, but it's built on a foundation of personal responsibility." This system is a cornerstone of Norway's digital efficiency, often cited in global competitiveness reports. For expats, conquering AvtaleGiro is more than paying bills. It is a rite of passage into Norway's streamlined, digital-first way of life. It transforms a complex web of due dates into a quiet, automated background process. The question for newcomers isn't whether to use it, but how quickly they can get it working. Once set up, the mental space freed up is perhaps its greatest benefit, allowing you to focus less on administrative survival and more on building a life in Norway.