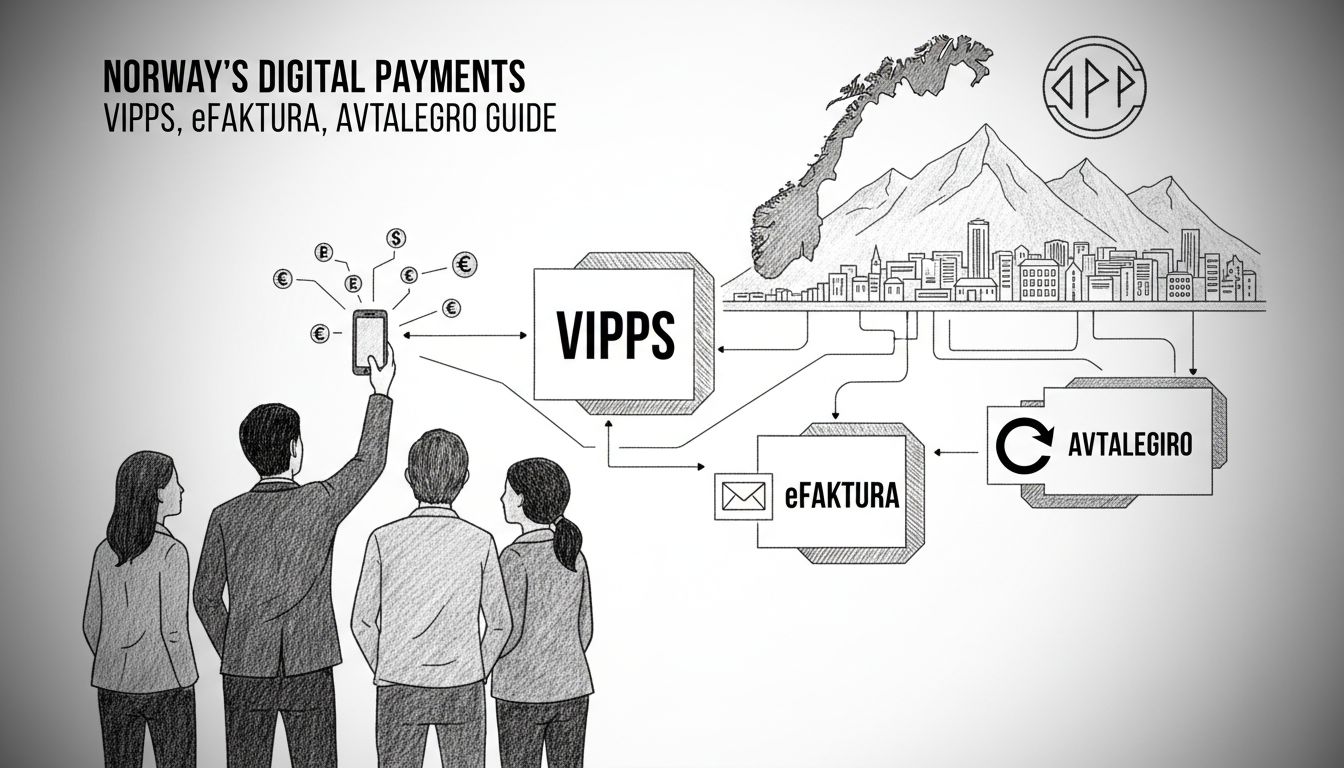

Norway processes over 90% of its consumer payments digitally. Cash transactions now account for less than 4% of the total. This creates a streamlined but specific system for managing bills. Newcomers and residents must navigate three primary methods. Understanding Vipps, eFaktura, and AvtaleGiro is essential for daily life in this Scandinavian tech hub.

The Foundation of a Cashless Society

Norway's banking infrastructure enables near-universal digital adoption. Nearly all adults possess a BankID for secure online identification. This system underpins every major payment platform. The country's high smartphone penetration drives mobile-first solutions. Businesses and government agencies now expect digital payments. Paper invoices are increasingly rare and often incur extra processing fees. This environment reflects broader Nordic technology trends favoring efficiency and security.

"The success isn't just about the technology," said Lars Bjørnstad, a fintech analyst based in Oslo. "It's built on a foundation of high digital literacy and significant trust in institutions. People believe the systems are safe. That trust allows for rapid adoption of tools like BankID, which then unlocks everything else."

Vipps: The Mobile Payment Juggernaut

Vipps dominates person-to-person payments in Norway. Over 4.2 million Norwegians use the app regularly. It also handles bill payments for thousands of companies. Users link Vipps directly to their Norwegian bank account. The app sends a push notification for each incoming invoice. A single tap confirms the payment. This method requires no manual entry of account numbers. Vipps is free for consumers to receive and pay bills. Businesses pay a small transaction fee to the platform.

Major utility providers like Hafslund Strøm use Vipps. Telecom giants Telenor and Telia also rely on it. The app works seamlessly for public services like the Norwegian Tax Administration. Its simplicity drives its massive adoption. For many, it has replaced cash for splitting restaurant bills or paying a friend. The app's design focuses on speed and user experience, hallmarks of Norwegian tech startups.

eFaktura: The Secure Bank Channel

eFaktura sends invoices directly into your online bank. This system bypasses email and paper entirely. You log into your bank's website or app. Invoices appear in a dedicated eFaktura section. You review details like amount and due date. Then you approve the payment with BankID verification. The bank transfers funds on your chosen date. This method offers high security through direct bank integration. It provides clear records within your banking history.

Most major Norwegian banks support eFaktura. This includes DNB, Nordea, and SpareBank 1. Setting it up requires registering your email address with each biller. Some companies charge a small fee for sending paper invoices. eFaktura avoids this extra cost completely. It is particularly favored for irregular but important bills. These might include healthcare invoices or annual membership fees.

"eFaktura reduces errors and fraud," explained Anette Hansen, CTO of a Oslo-based billing software firm. "The invoice never travels through insecure email. It goes from the company's system directly to the bank's secure environment. The user authenticates with BankID. This creates a verifiable chain of custody for every transaction."

AvtaleGiro: Set-and-Forget Automation

AvtaleGiro sets up automatic deductions for regular bills. You authorize a company to withdraw fixed amounts from your account. This is ideal for subscriptions with stable monthly pricing. Common examples include streaming services like Netflix and Spotify. Gym memberships and some insurance payments also use it. The payment occurs on a predetermined date each period. You receive a notification beforehand, typically via your bank.

The system offers convenience for predictable expenses. It ensures payments are never forgotten or late. Users can cancel or modify agreements through their online bank. This maintains control over automated payments. The process reflects Norway's drive for efficient digital solutions. It removes a routine task from monthly financial management.

Choosing the Right Tool for the Bill

Norwegians typically use all three systems for different purposes. Vipps is ideal for one-off bills and person-to-person payments. Its speed and notification system make it perfect for urgent or casual invoices. eFaktura suits important bills requiring review and secure payment. Users often employ it for larger, less frequent amounts from official entities. AvtaleGiro is the default for fixed, recurring subscriptions where the amount rarely changes.

This tripartite system forms the backbone of Norway's bill payment landscape. Its efficiency is a key part of the country's digital transformation. The systems rarely compete directly. Instead, they complement each other to cover all payment scenarios. This collaborative ecosystem is a signature of the Scandinavian tech hub model.

The Engine Behind the Shift: Trust and Infrastructure

Experts point to several factors enabling this digital leap. High levels of public trust in banks and government are fundamental. Widespread digital literacy across age groups is another. Strong government support for technological infrastructure provided the foundation. The early and unified adoption of BankID created a secure identity standard. This standard is used by nearly all digital services.

"The collaboration between banks was crucial," said Bjørnstad. "They agreed on common standards like BankID and the infrastructure for eFaktura. This prevented a fragmented market. It meant businesses could develop one solution that worked for all customers, regardless of their bank. That's a powerful incentive for adoption."

This environment has fostered a thriving scene for Norwegian tech startups in the fintech sector. Oslo innovation news frequently highlights new apps and services built atop this reliable payment infrastructure. The predictable digital environment reduces risk for entrepreneurs.

Navigating the System as a Newcomer

For new residents, the first step is obtaining a Norwegian bank account and BankID. These are prerequisites for the entire digital payment ecosystem. Next, download Vipps and link it to your bank account. It will become your most-used payment app. Then, explore your bank's online portal or mobile app. Locate the sections for eFaktura and AvtaleGiro management. When you receive a new bill, check which payment method the sender prefers.

Many companies offer a choice between Vipps and eFaktura. Some may push for AvtaleGiro for subscription services. Do not ignore paper invoices that arrive initially. They often contain codes necessary to set up digital versions. Take the time to register for eFaktura with each new provider. This upfront effort saves time and money later.

The Future of Payments in Norway

The trajectory points toward further integration and automation. Open banking regulations could allow for even more seamless connections between apps. Vipps continues to expand into new services, including international remittances. The underlying Nordic technology trends suggest a move toward even greater data-driven personal finance.

However, the core trio of Vipps, eFaktura, and AvtaleGiro will likely remain central. They solve the fundamental problems of bill payment with clarity and security. Their widespread adoption is a testament to their effectiveness. Norway's experience offers a case study in how to build a widely trusted, efficient digital payment society. The question for other nations is not just about copying the technology, but about fostering the same level of systemic trust and cooperation that made it possible.