Norwegian bank customers must regularly verify their identities under strict financial regulations. When banks cannot obtain sufficient customer information, accounts face closure and funds transfer to Norway's central bank.

Terje Sæterbø discovered this system when helping a family member manage finances. He found a letter showing approximately 28,000 kroner had been transferred to Norges Bank.

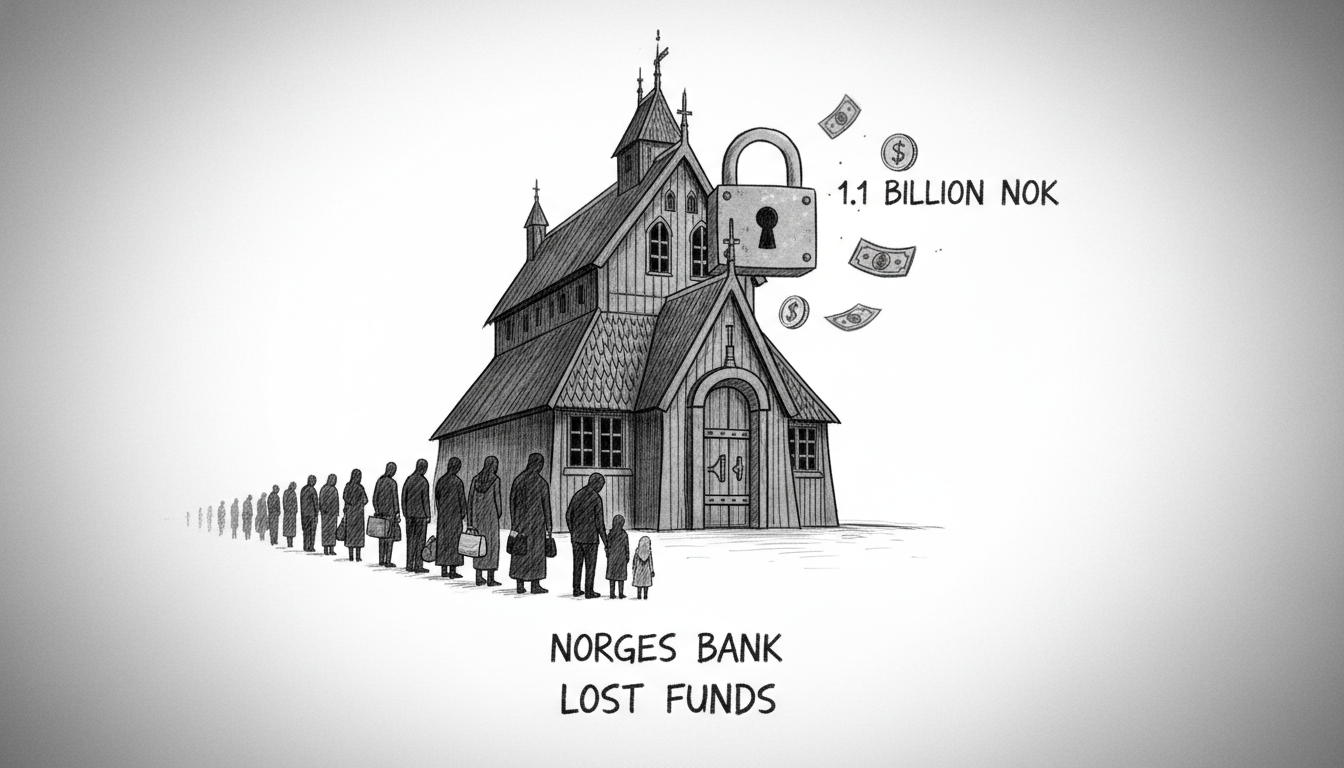

This situation occurs frequently across Norway. Approximately 31,000 private customers have seen their accounts transferred to the central bank in the current year alone. The total amount held in Norges Bank's deposit account reaches 1.1 billion kroner.

Sæterbø emphasizes this represents a widespread issue affecting many Norwegians, not just his relative.

DNB, Norway's largest bank, transferred his family member's funds to the central bank. Bank officials state they cannot discuss individual cases but explain their procedure through email communication. When repeated contact attempts fail through letters, SMS, email, phone calls, and online banking messages, banks must terminate customer relationships.

A bank communications advisor explained the process. Banks first close accounts and place funds in temporary internal accounts. Most customers still retrieve their money by contacting the bank at this stage. Only when banks completely lose contact do funds transfer to Norges Bank.

Financial industry organization Finans Norge identifies two main reasons for account deposits to the central bank. Their communications director defends the strict verification requirements.

He clarifies that banks request identification not because they suspect wrongdoing but to help society identify actual criminals. Proper identification makes banking operations more efficient and contributes to a better society, he states.

Once funds reach Norges Bank, they remain in a deposit account for 20 years. A Norges Bank specialist explains the recovery process. Customers can apply through Norway's Altinn digital platform or contact the bank directly with required information if they lack Bank ID.

If no one claims the money within two decades, the funds transfer to the state treasury.

Following media attention to this case, DNB contacted Sæterbø's family member to arrange fund return. Sæterbø acknowledges this solves his family's situation but expresses concern for the 31,000 other affected customers.

He worries particularly about society's most vulnerable members who struggle with bank verification processes. The system disproportionately impacts those with limited financial literacy or resources, creating what he calls a major social problem.

This situation highlights the tension between financial security measures and customer protection. While anti-money laundering regulations serve important purposes, their implementation sometimes harms legitimate account holders. The substantial funds held by Norway's central bank suggest verification systems may need refinement to better balance security and accessibility.

Norwegian banking customers should ensure their contact information remains current with financial institutions. Regular monitoring of bank communications helps prevent unexpected account closures. Those assisting elderly relatives or vulnerable individuals might consider establishing formal authorization to help manage their financial affairs.