OP Bank Group announced it will increase customer bonus rates next year. The company now operates under the name OP Pohjola.

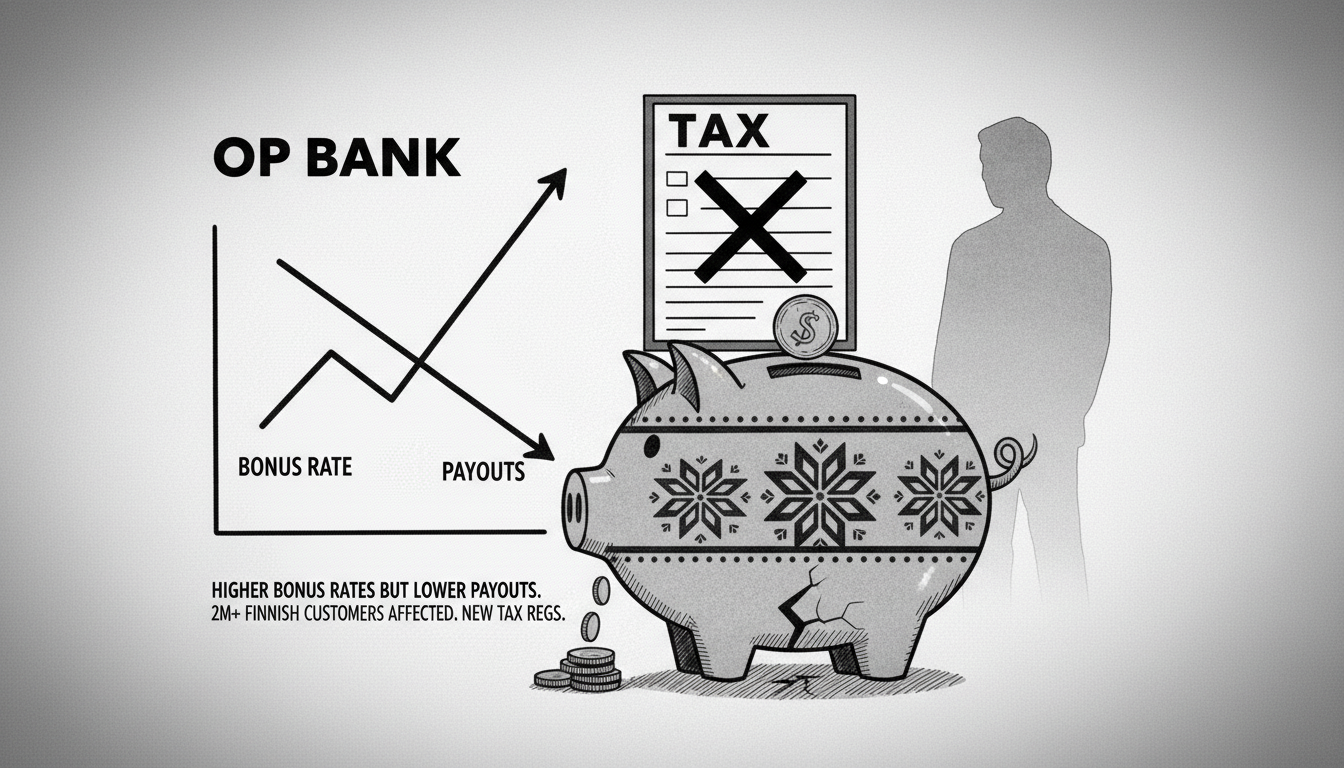

CEO Timo Ritakallio stated the after-tax bonus accumulation rate will rise to 0.28 percent. This compares to the current rate of 0.25 percent.

Despite the higher percentage, customers will actually receive smaller bonus payments. A customer spending 100,000 euros will earn 280 euros in bonuses next year. That same customer would have received 350 euros this year.

The bank clarified this represents an increase from what it calls the 2022 baseline level. They previously offered additional benefits to owner-customers during 2023-2025. These benefits were temporary and decided annually.

The normal 0.25 percent accumulation rate was last used in 2022. Every year since then has seen higher bonus payments than this standard rate.

OP Pohjola revealed changes to its owner-customer benefits package today. The overhaul affects both the bonus system and other customer benefits. Starting next year, customers can invest their bonuses in funds for the first time.

These changes follow a tax reform affecting OP bonuses. Beginning next year, OP bonuses will be subject to capital gains tax.

The tax revision means benefits from loans, savings, and investments lose their tax-free status. This applies when customers use them for services other than their original purpose. For example, bonuses earned from mortgages will no longer be tax-free if used for insurance payments.

OP has paid nearly four billion euros in bonuses to owner-customers since 1999. Last year alone, the bank distributed 314 million euros in bonuses.

The changes will affect just over two million owner-customers across Finland.

While the bank promotes the rate increase as an improvement, the actual numbers show customers will receive less money. The timing coincides with new tax regulations that eliminate previous benefits.