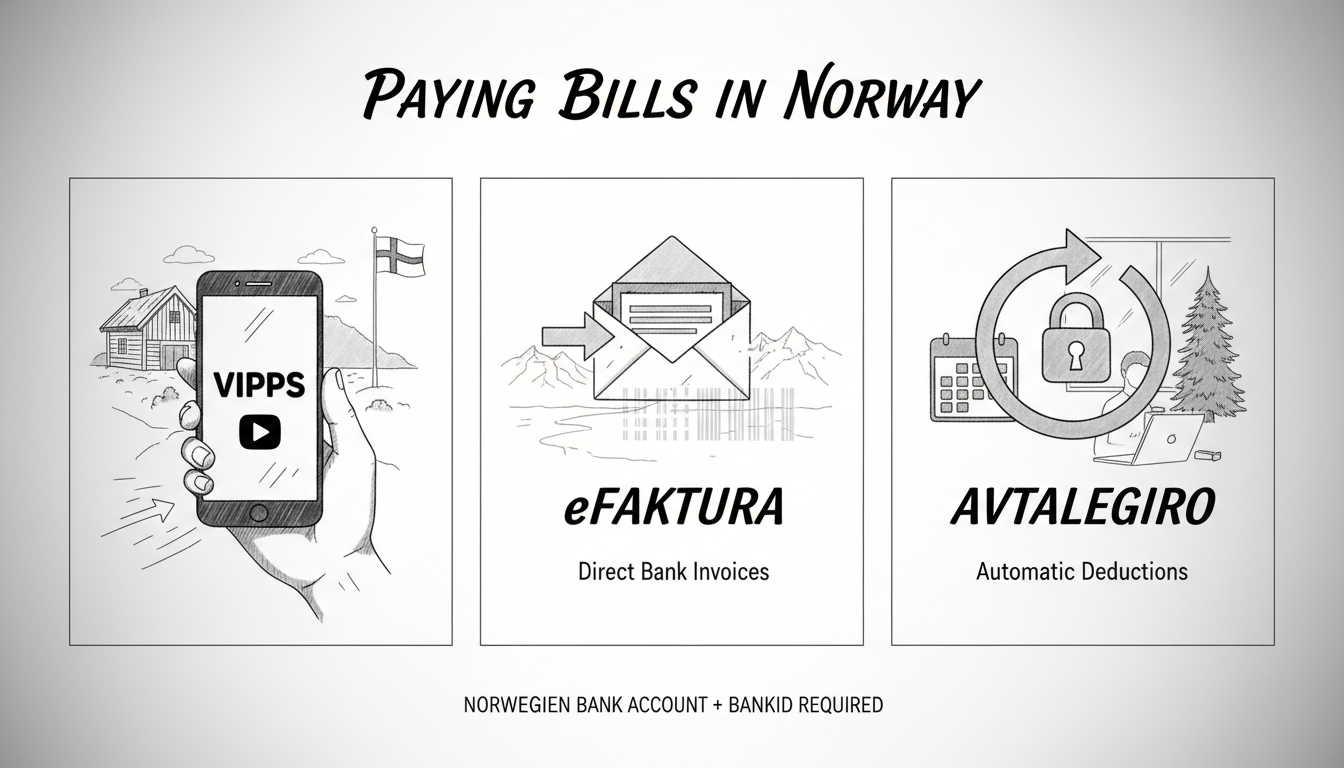

Norway processes over 90% of its consumer payments digitally. Cash transactions account for less than 4% of the total. This shift creates a streamlined but specific system for managing bills. Newcomers must navigate three primary methods: Vipps, eFaktura, and AvtaleGiro. Understanding these tools is essential for daily life in Norway.

The Digital Payment Ecosystem

Norway's banking infrastructure enables near-universal digital adoption. Nearly all adults have a BankID for secure online identification. This system underpins every major payment platform. The country's high smartphone penetration drives mobile-first solutions. Businesses and government agencies expect digital payments. Paper invoices are increasingly rare and often incur extra fees.

Vipps: The Mobile Payment Giant

Vipps dominates person-to-person payments in Norway. Over 4.2 million Norwegians use the app regularly. It also handles bill payments for thousands of companies. Users link Vipps directly to their Norwegian bank account. The app sends a push notification for each incoming invoice. A single tap confirms the payment. This method requires no manual entry of account numbers. Vipps is free for consumers to receive and pay bills. Businesses pay a small transaction fee to the platform. Major utility providers like Hafslund Strøm and Tibber use Vipps. So do telecom companies such as Telenor and Telia. The app also works for public services like the Norwegian Tax Administration (Skatteetaten).

eFaktura: The Direct Bank Invoice

eFaktura sends invoices directly into your online bank. This system bypasses email and paper entirely. You log into your bank's website or app. Invoices appear in a dedicated eFaktura section. You review the details and approve the payment. The bank then transfers funds on your chosen date. This method offers high security through BankID verification. It also provides clear records within your banking history. Most Norwegian banks support eFaktura including DNB, Nordea, and SpareBank 1. Setting it up requires registering your email address with each biller. Some companies charge a small fee for paper invoices. eFaktura avoids this extra cost.

AvtaleGiro: Automated Recurring Payments

AvtaleGiro sets up automatic deductions for regular bills. You authorize a company to withdraw fixed amounts from your account. This is ideal for subscriptions with stable pricing. Examples include Netflix, Spotify, and gym memberships. The payment occurs on a predetermined date each month. You receive a notification before each transaction. Changes or cancellations require contacting the company directly. AvtaleGiro reduces manual payment tasks. It also helps avoid late fees for forgotten bills. Setup involves signing an agreement with the service provider. This often happens through their website using BankID.

Choosing the Right Method

Select a payment method based on bill type and personal preference. Use Vipps for one-off bills from familiar companies. Its speed and simplicity are unmatched. Choose eFaktura for detailed invoices requiring review. This includes complex utility bills or insurance statements. Opt for AvtaleGiro for predictable monthly subscriptions. It automates payments you would approve every time. Many Norwegians use all three systems simultaneously. They manage them through their primary banking app. DNB's mobile app consolidates Vipps, eFaktura, and AvtaleGiro in one interface. Check your bank's features to streamline management.

Security and Consumer Rights

Norwegian payment systems prioritize security. BankID provides two-factor authentication for every transaction. Users must approve payments on their registered mobile device. This prevents unauthorized transfers. Consumer protection laws apply to all digital payments. The Financial Supervisory Authority (Finanstilsynet) regulates these services. Disputes go through the bank's complaint process first. Escalate unresolved issues to the Norwegian Consumer Council (Forbrukerrådet). Always verify invoice details before approving payments. Report suspicious activity to your bank immediately.

Setting Up Your Payments

Follow these specific steps to configure your bill payments. First, open a Norwegian bank account. This is mandatory for all three systems. Major banks like DNB, Nordea, and SpareBank 1 offer English services. Second, install BankID on your smartphone. Your bank provides activation codes. Third, download the Vipps app from the App Store or Google Play. Link it to your bank account during setup. Fourth, log into your online bank. Navigate to the eFaktura section. Register the email address you share with billers. Fifth, for AvtaleGiro, visit service provider websites. Look for the AvtaleGiro signup option during checkout. Use BankID to authorize the agreement. Complete these steps within your first month in Norway.

Frequently Asked Questions

Is Vipps free to use for paying bills?

Yes. Vipps charges no fees to consumers for bill payments. Businesses pay Vipps approximately 1.5% per transaction. Some companies might add a small service fee to invoices. Always check the bill details for any extra charges.

Can I use eFaktura without a Norwegian phone number?

No. You need a Norwegian mobile number for BankID. BankID requires SMS verification for secure login. This is mandatory for accessing eFaktura in your online bank. Get a local SIM card from providers like Telenor or Telia first.

What happens if I miss an AvtaleGiro payment?

The company will attempt the deduction again. Most try three times over ten days. Failed payments incur a late fee of around 50 NOK. The service may suspend your account after multiple failures. Update your payment information promptly to avoid disruption.

How do I cancel an AvtaleGiro agreement?

Contact the company directly. Do not just block payments at your bank. Use the company's website or customer service line. Provide your BankID for verification. Request written confirmation of cancellation. Keep this record for at least six months.

Are paper invoices still available in Norway?

Yes, but they often cost extra. Companies charge 20-50 NOK per paper invoice. This fee encourages digital adoption. You can request paper bills by calling customer service. Some providers like the postal service (Posten) still use paper by default.

Which method is safest for large payments?

Use eFaktura for payments over 10,000 NOK. It provides the strongest audit trail within your bank. The verification process involves multiple BankID checks. You also get detailed records for tax purposes. Never use Vipps for transactions with unfamiliar recipients.

Can tourists or short-term residents use these systems?

No. These systems require a Norwegian national identity number (fødselsnummer). You also need a resident Norwegian bank account. Short-term visitors must use international credit cards or cash. Some hotels and shops accept foreign payment apps like Apple Pay.