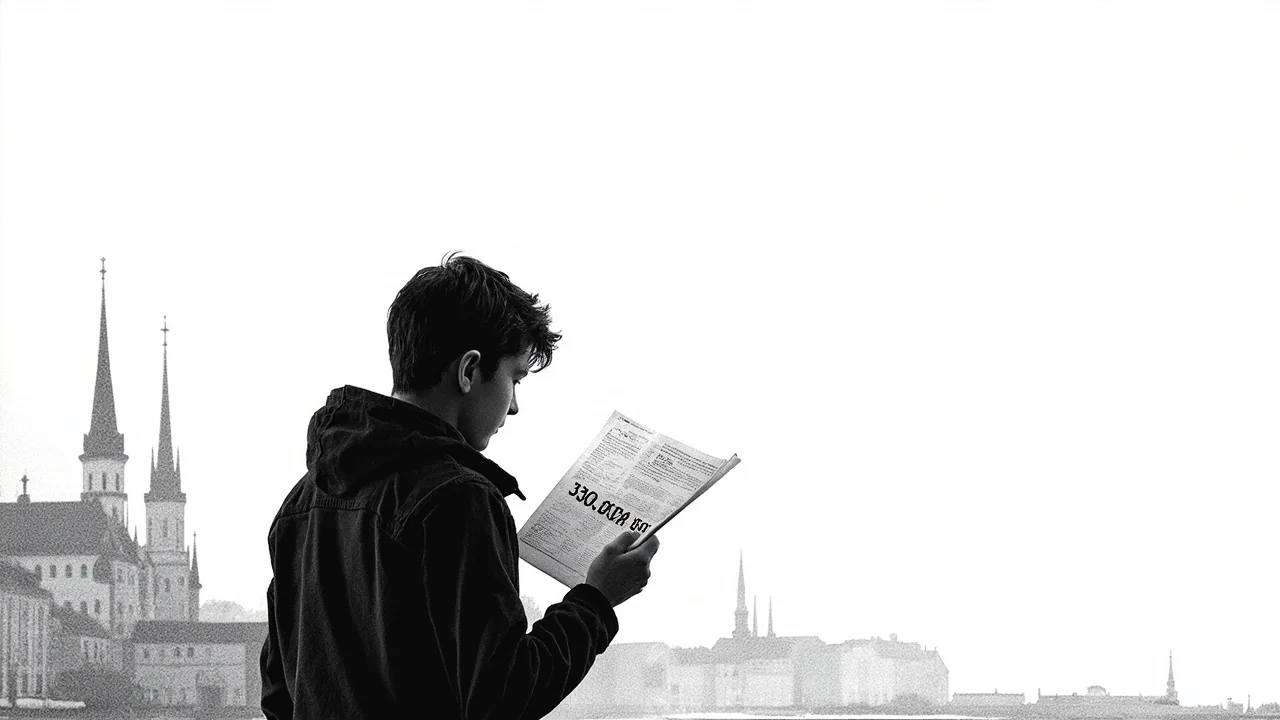

Sweden's student loan debt has reached a historic high, with fresh graduates carrying more debt than any previous cohort. The latest statistics from the Swedish Board of Student Finance (CSN) reveal a growing financial burden on young Swedes, sparking a national conversation about the cost of education and future financial security. In the corridors of Stockholm University, 21-year-old law student Yagmur Akgul is acutely aware of the numbers. She expects to owe around 350,000 Swedish kronor by graduation. "It's a lot of money, but it still feels okay. I should be able to pay it back," she says during a break between lectures. Her calm acceptance masks a deeper societal shift, where taking on substantial debt for education has become the new normal for an entire generation.

The New Normal on Campus

Walking through the student union building at Stockholm University in Frescati, the atmosphere is one of focused ambition. Yet, a quiet anxiety about finances lingers beneath the surface. For students like Yagmur, the loan is a calculated investment. "I'm studying law. I look at the repayment plan, the interest rates. It's an investment in my future earning potential," she explains. This pragmatic view is common among her peers in professional programs like medicine, engineering, and economics. They see the debt not as a burden, but as a necessary ticket to a stable career. The Swedish system, with its low-interest government-backed loans and income-based repayment, is designed to mitigate risk. But the sheer size of the debt is new. A decade ago, the average student debt at graduation was significantly lower. Today, it's not uncommon to hear of sums approaching half a million kronor for those pursuing longer degrees.

A Growing Gender Divide

The CSN data hints at a subtle but important trend: a potential gender gap in borrowing attitudes. While comprehensive breakdowns are still emerging, early analysis suggests young women like Yagmur are often more willing to take on strategic debt for education. Conversely, some reports indicate young men might be more debt-averse, sometimes opting for quicker entry into the workforce instead. "I have friends, guys, who decided not to study further because they didn't want the loan," Yagmur notes. "They started working right after gymnasium." This divergence could have long-term implications for career paths and earning parity. If one demographic is more readily investing in higher education through loans, it may accelerate existing professional divides. Social economist Lena Pettersson, who has studied youth finance trends, observes this pattern. "We see a more instrumental approach among some female students. The debt is a tool. For others, particularly young men in certain socio-economic groups, debt carries a heavier psychological weight, a fear of being tied down," she explains.

The Stockholm Pressure Cooker

The debt figures feel most palpable in Stockholm, where the cost of living adds another layer of complexity. Many students rely on CSN's loan and grant combination not just for tuition, but for survival. Rent in neighborhoods like Kungsholmen, Södermalm, or even the student-dense areas near Frescati is high. The grant portion, intended to cover basic living costs, often falls short. The loan fills the gap. "Without the loan, I couldn't live in Stockholm and study," says Marcus, a computer science student from Gothenburg. "The grant covers maybe my rent in a corridor room. Food, books, a coffee with friends? That comes from the loan." This reality turns the student loan from a purely educational investment into a essential lifeline for urban academic life. It allows for the cultural and professional opportunities Stockholm offers, but at the price of a larger financial footprint upon graduation.

Cultural Shifts and the 'Framtidsutsikter'

The Swedish concept of 'framtidsutsikter' – future prospects – is central to this debate. For generations, Sweden's education system was a near-free ladder to social mobility. While university remains largely tuition-free for EU citizens, the ancillary costs of living have skyrocketed. Taking a large loan now is a bet on those 'framtidsutsikter.' The calculation depends heavily on one's chosen field. A future lawyer or engineer has a different risk profile than someone pursuing degrees in the humanities or arts, where career paths can be less linear. This creates an invisible pressure channeling students toward 'safe' degrees that justify the debt, potentially at the expense of other passions. The traditional Swedish value of 'bildning' – education for personal and societal development – bumps against the modern economics of student finance.

Life After Graduation: The Payback Reality

What does life look like with 350,000 SEK in debt? The repayment system is designed to be manageable. Repayments are capped at a percentage of your income, and after 25 years, any remaining debt is forgiven. "It's not like the stories you hear from the United States," Yagmur is quick to point out. "The system protects you." However, it still impacts major life decisions. Getting a mortgage, for instance, becomes more complicated as banks assess your total debt burden. The dream of buying an apartment in a competitive Stockholm market is deferred even further for many graduates. It also influences career choices, pushing new graduates toward higher-paying jobs immediately, rather than accepting lower-paid but potentially more meaningful traineeships or roles in the non-profit sector. The debt, while manageable, casts a long shadow over the first decade of a professional's life.

A Sustainable Model or a Ticking Clock?

Experts are divided on the long-term sustainability of this trend. Some argue the Swedish model remains one of the world's most generous and fair, ensuring access to education regardless of family wealth. The debt is an investment in human capital that benefits the entire society. Others see a warning sign. "When record debt becomes normalized, we must ask if the state's support for student living has kept pace with reality," argues economist Anders Lundström. "We risk creating a generation that is financially cautious in their 20s and 30s, delaying family formation, home ownership, and risk-taking in entrepreneurship." The question is whether this is a temporary spike or a permanent new plateau for how Sweden finances its higher education. With inflation having eroded the value of the study grant in recent years, the reliance on loans has inevitably grown.

The Human Balance Sheet

Back at Stockholm University, Yagmur packs her law books. Her focus is on her next exam, not her balance sheet in five years. For her and thousands like her, the loan is a present-day fact that enables a future dream. The Swedish social contract is being tested: education is still a right, but its financing is increasingly a personal responsibility. The record debt levels are more than a statistic; they represent a fundamental shift in how young Swedes plan their lives. They calculate, they invest, and they hope the numbers work out in the long run. As graduation ceremonies approach each spring, the diplomas handed out are also promissory notes. The true cost of Sweden's knowledge economy is now written, quite clearly, in the ledgers of its youngest professionals. Will this generation's investment pay the dividends they expect, or will the weight of their ambition become a chain on their future choices? Only time, and the Swedish economy, will tell.