Finland receives billions in international transfers each year. Many expatriates, remote workers, and businesses need to move money into the country. Choosing the right service can save hundreds of euros annually.

Key Factors for Finland Transfers

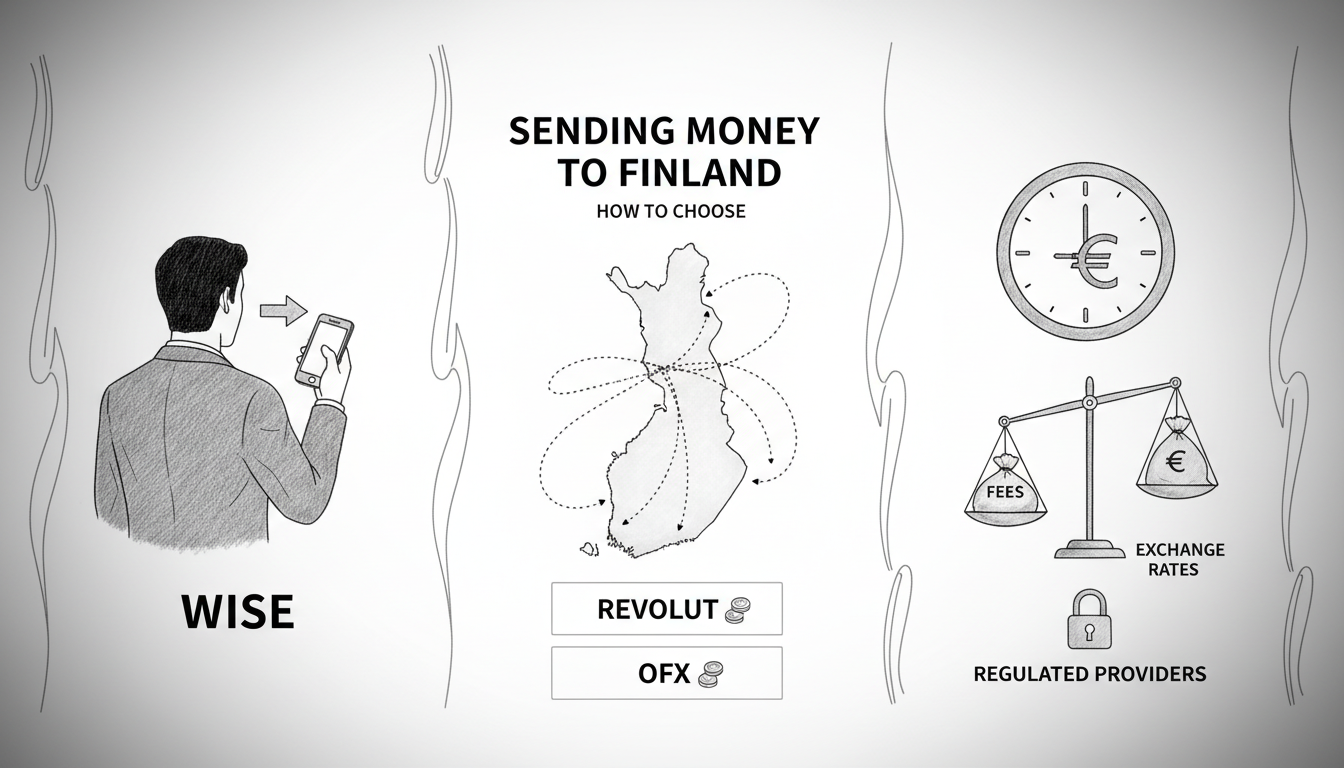

Transfer speed matters for urgent payments. Some services deliver euros to Finnish bank accounts in minutes. Others take three business days. Exchange rates vary dramatically between providers. A small difference in the rate can cost you fifty euros on a thousand-euro transfer.

Hidden fees are common. Banks often add fixed charges and poor exchange rates. Dedicated transfer services usually offer better value. Always check the total cost before sending money.

Top Services for Finnish Recipients

Wise provides transparent pricing and mid-market exchange rates. It supports transfers to all major Finnish banks. A thousand-euro transfer from Britain typically costs about five euros. Funds often arrive within one business day. Wise works well for regular transfers like salary payments.

Revolut offers fee-free transfers in many currencies. Its premium plans include unlimited exchanges at interbank rates. Transfers between Revolut accounts are instant. Converting pounds to euros then sending to a Finnish account usually incurs no fee. Revolut suits tech-savvy users who value speed.

OFX specializes in large transfers over ten thousand euros. It provides personalized service and competitive rates for big amounts. OFX charges no transfer fees for amounts above that threshold. The company assigns a dedicated account manager. Businesses and property buyers often use OFX.

Avoiding Common Pitfalls

Never use a bank's walk-in service for international transfers. Banks typically add margins of three to five percent on exchange rates. Online platforms almost always offer better rates. Check the real exchange rate on XE.com before transferring.

Always compare the total cost, not just the advertised fee. Some services promote zero fees but offer poor exchange rates. Calculate how many euros the recipient will actually get. Use comparison tools like Monito or MoneyTransferComparison.

Consider setting up regular transfers if you send money monthly. Many services offer better rates for scheduled transactions. Automating transfers saves time and often reduces costs.

Security and Compliance

Finland has strict anti-money laundering regulations. Reputable transfer services verify customer identities thoroughly. They require photo ID and proof of address. This process protects both sender and recipient.

Choose services regulated by the Financial Supervisory Authority of Finland. These include Wise and Revolut. Regulation ensures consumer protection and operational standards. Avoid unregulated services despite attractive rates.

Frequently Asked Questions

What is the cheapest way to send money to Finland?

Wise typically offers the lowest total cost for transfers under ten thousand euros. Its transparent fee structure shows exact costs upfront. For larger amounts, OFX often provides better exchange rates.

How long do transfers to Finland take?

Instant transfers work between accounts on the same platform, like Revolut to Revolut. Bank transfers usually take one to three business days. Some services offer expedited transfers for higher fees.

Can I send money to Finnish mobile wallets?

Most transfer services send funds directly to bank accounts. Some Finnish banks offer mobile wallet integration. Check if your recipient's bank supports this feature.

What documents do I need to send money?

You need government-issued photo ID. A passport or driver's license works. You also need proof of address, like a utility bill. The recipient needs their Finnish bank account details.

Are there limits on transfer amounts?

Most services have daily and monthly limits. Wise allows transfers up to one million euros. Revolut's limits depend on your account type. Business accounts typically have higher limits.

What exchange rate will I get?

Check the mid-market rate on financial websites. Reputable services show their rate margin clearly. Avoid services that hide their exchange rate markup.

Can I cancel a transfer to Finland?

You can cancel transfers before the money leaves your account. Once processing begins, cancellation becomes difficult. Contact customer service immediately if you need to stop a transfer.