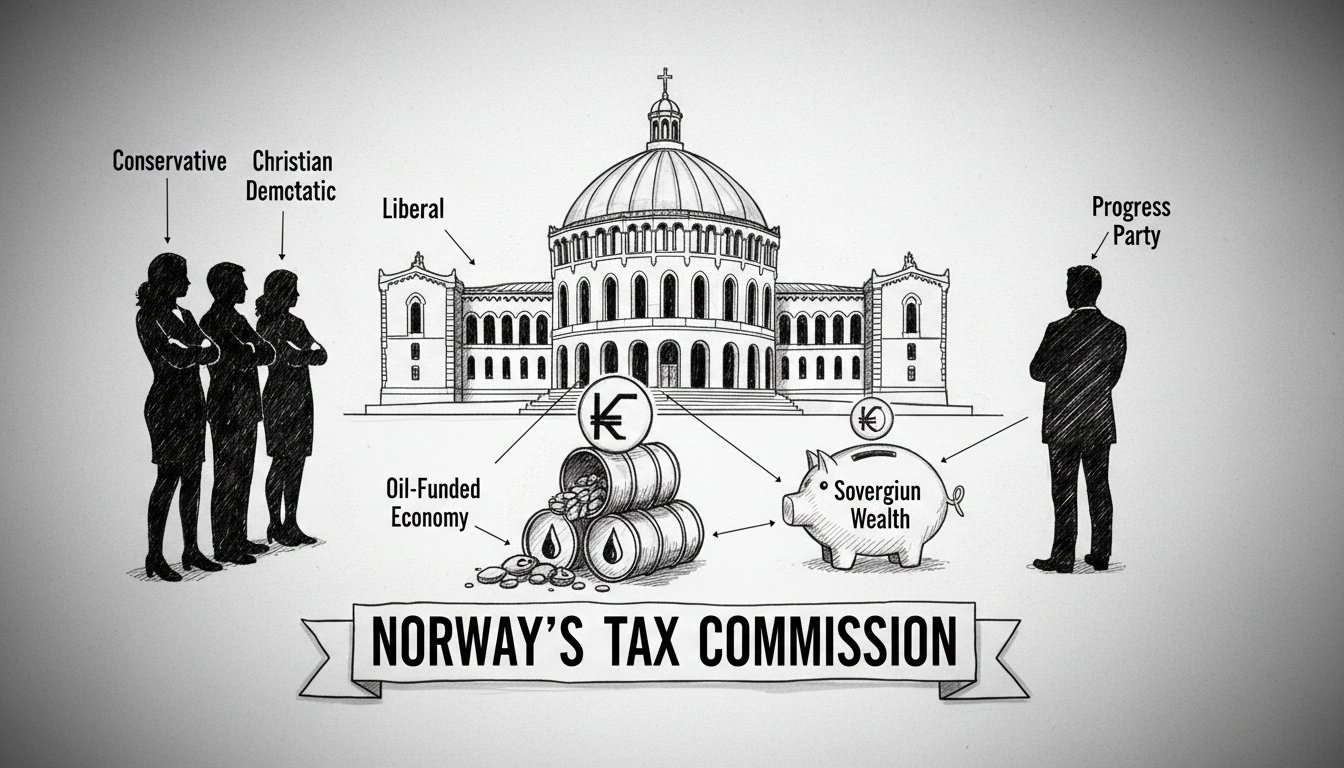

Three major opposition parties in Norway have accepted the Finance Minister's invitation to join a special tax commission. The Conservative Party, the Christian Democratic Party, and the Liberal Party confirmed their participation in a joint statement. Their decision creates a significant cross-parliamentary dialogue on the nation's fiscal future. The commission aims to build broader political consensus on key elements of the tax system. Finance Minister Jens Stoltenberg stated the goal is not full agreement on all tax policy details. He emphasized the need for greater stability around fundamental tax principles. The Progress Party, however, has declined to participate in the commission process.

The opposition parties expressed a clear preference for direct negotiations on a comprehensive tax settlement within the Storting. They argued this approach would be more effective and yield faster results. The Finance Minister did not accept that proposal, according to the parties' release. They now view the commission as the necessary foundation for a potential tax agreement in the current parliamentary period. This move signals a pragmatic shift in Norwegian politics, where opposition blocs often engage with minority government initiatives. The Storting building in Oslo will host these critical discussions that could shape Norway's economic direction for years.

This tax commission holds substantial implications for Norway's sovereign wealth fund and long-term oil revenue management. The Government Pension Fund Global, the world's largest, is directly affected by fiscal policy stability. Norway's oil and gas sector, centered on fields like Johan Sverdrup and Troll, generates the tax revenues under discussion. Policy stability is crucial for major energy investments in the Barents Sea and the Norwegian Sea. The commission's work may influence development timelines for new projects near Lofoten and Vesterålen. International energy companies monitor Norwegian tax policy closely for investment decisions.

The political dynamics here are classic for Norway's consensus-driven model. Minority governments frequently seek broad agreements on major economic matters. The absence of the Progress Party from the commission highlights a clear ideological divide on taxation. Their refusal underscores the challenge of achieving true national consensus. The commission's success will depend on whether it can bridge the gap between left and right on wealth, consumption, and environmental taxes. Past tax commissions have sometimes led to major reforms, while others produced limited results. The current political composition makes a moderate compromise the most likely outcome.

For international observers, this process demonstrates Norway's distinctive approach to resource wealth management. The country consistently balances immediate budgetary needs with intergenerational equity concerns. The commission must consider the tax burden on Norway's vital maritime and supply industries. Ports from Bergen to Kirkenes depend on predictable fiscal frameworks. The outcome will also affect Norway's ambitious green transition goals and Arctic policy implementation. A stable tax system is foundational for both the offshore wind initiatives and the High North development plans. The next few months of commission work will reveal much about Norway's post-oil economic vision.