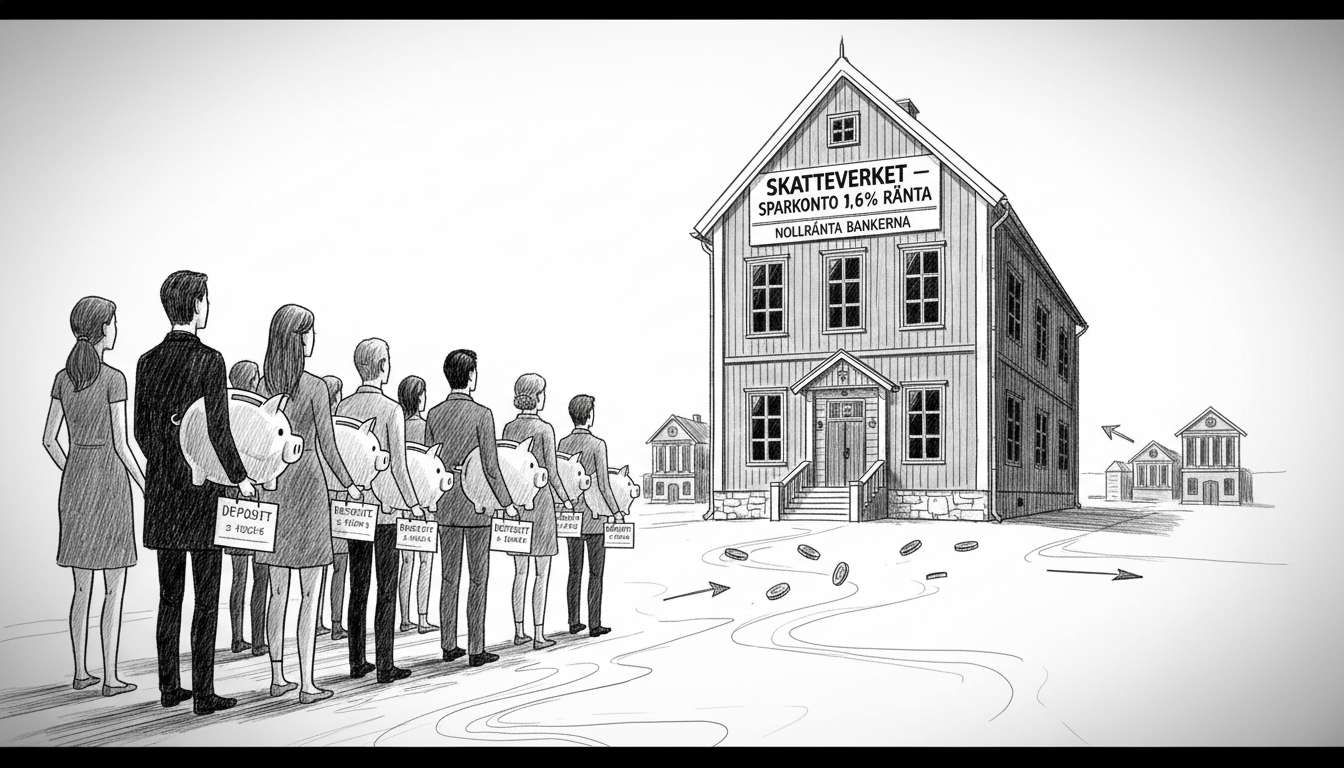

Swedish savers tired of zero interest on regular bank accounts are discovering an unexpected alternative. The Swedish Tax Agency now offers better returns than most commercial banks. The agency pays 1.6 percent effective interest on funds held in tax accounts.

Johan Schauman, a declaration expert at the agency, confirmed this option. He noted that while not the primary purpose, nothing prevents people from using tax accounts for savings. The official interest rate stands at 1.12 percent, but since it's tax-free, this equals 1.6 percent for regular taxable bank interest.

Major Swedish banks currently pay zero percent on standard savings accounts. Some offer around 1.6 percent only if customers lock funds for at least three months. A few niche banks provide approximately one percent interest on regular savings.

The tax account option beats most commercial offerings. Unlike fixed-term deposits, money in tax accounts remains fully accessible. Withdrawals require written procedures, but no locking periods apply.

Tax accounts originally served to manage tax payments and refunds. Schauman explained their comfort for people facing large tax bills. They can overpay slightly and earn interest while waiting for final settlement.

Substantial sums now sit in these accounts purely as capital investments. Estimates suggest about 50 billion kronor represents intentional savings, mostly from companies. Total holdings reach 140 billion kronor from both households and businesses.

This trend began accelerating about ten years ago. When Sweden's central bank introduced negative interest rates, commercial banks stopped paying returns. Both companies and households then moved liquid funds to tax accounts where interest remained available.

The amounts grew so large that the government intervened. Officials temporarily reduced the tax account interest rate to zero. Rates have since recovered, making tax accounts competitive again.

Since 2022, tax account returns have consistently exceeded bank rates. The interest calculation follows the base rate derived from six-month government treasury bills.

Current Swedish bank rates show stark contrasts. Major banks pay nothing on salary or standard savings accounts. Their fixed three-month deposits offer 1.5 to 1.8 percent. Niche banks like SBAB pay 1.25 percent on regular savings, while Skandiabanken offers just 0.20 percent. Their fixed-term accounts reach 2 to 2.90 percent.

This situation reveals unusual market dynamics. Savers essentially lend money to the government through tax accounts rather than traditional banks. The arrangement highlights how unconventional solutions emerge when conventional systems fail to serve public needs.

The trend also reflects Sweden's unique financial landscape. High digitalization and trust in government institutions enable such alternatives. Other countries might see similar developments as traditional banking models evolve.

For international readers, this demonstrates Swedish pragmatism in financial matters. When banks don't meet needs, people find creative alternatives within existing systems. The approach shows how public institutions can sometimes compete effectively with private sector offerings.