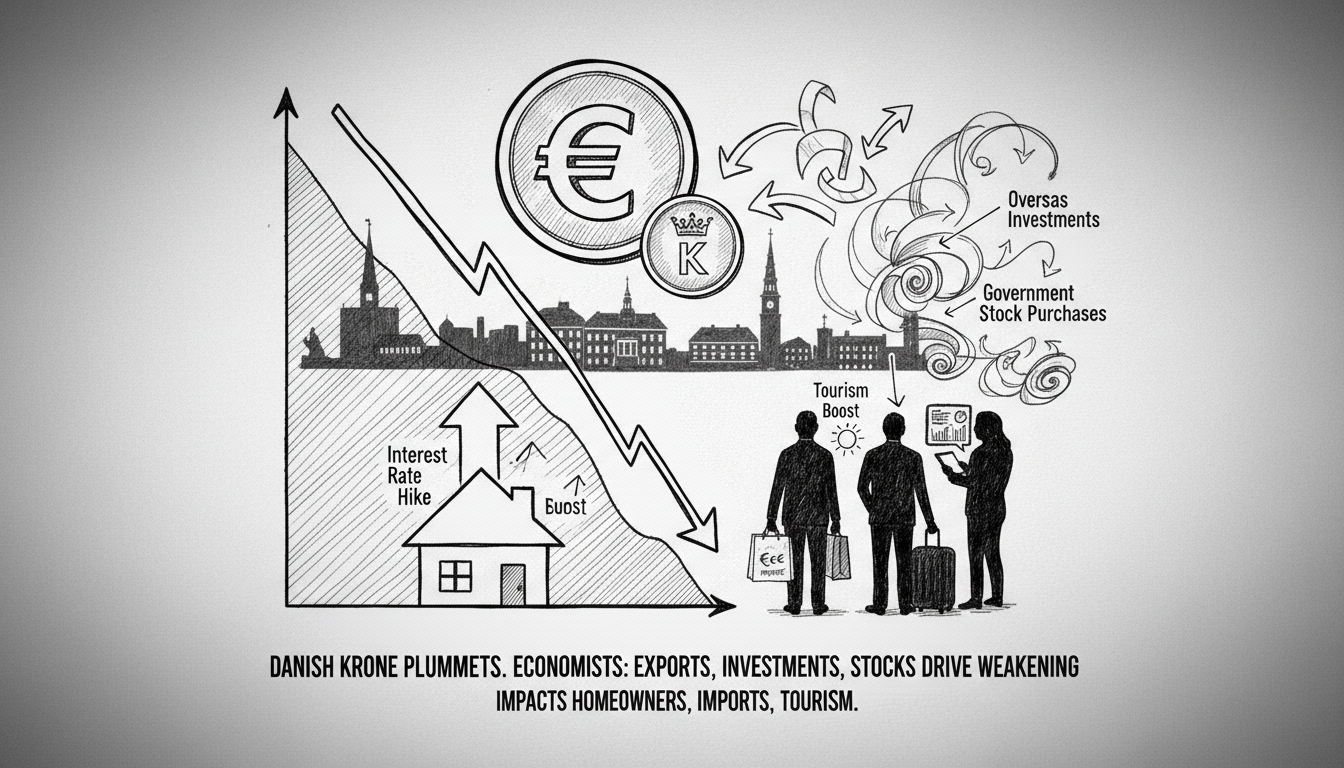

The typically strong Danish krone has weakened significantly in recent trading. This development could eventually lead to independent Danish interest rate hikes. Such moves would directly impact Danish homeowners through higher mortgage costs.

Economists point to three main factors behind the currency's decline. Danish exports have shown recent weakness, reducing foreign demand for kroner. Danish companies are increasing their overseas investments, moving capital abroad. The government's major acquisitions of Copenhagen Airport and Ørsted shares have also affected currency flows.

What does this mean for Denmark's economy? The krone's drop makes imports more expensive for Danish consumers. It could boost tourism by making Denmark cheaper for foreign visitors. The central bank now faces pressure to intervene if the trend continues.

Danish homeowners should watch this situation closely. Interest rate increases would raise monthly payments for variable-rate mortgages. The housing market might cool if borrowing costs rise substantially.

The government's recent stock purchases represent substantial public spending. Buying major stakes in Copenhagen Airport and energy company Ørsted required significant capital. These transactions have contributed to the krone's current position.

This currency shift shows how even stable Nordic economies face global market pressures. Denmark maintains its own currency rather than using the euro, giving it monetary policy independence but also exposure to currency fluctuations.