Danish mortgage borrowers can save up to 30,000 kroner annually as three major lenders ignite a fierce price war. Realkredit Danmark and Totalkredit began the competition last week, with Jyske Realkredit joining this week, marking a significant shift for Denmark's stable mortgage market. This sudden rivalry promises lower monthly payments for homeowners but signals a new competitive era for a cornerstone of the Danish welfare system.

The Major Players Enter the Fray

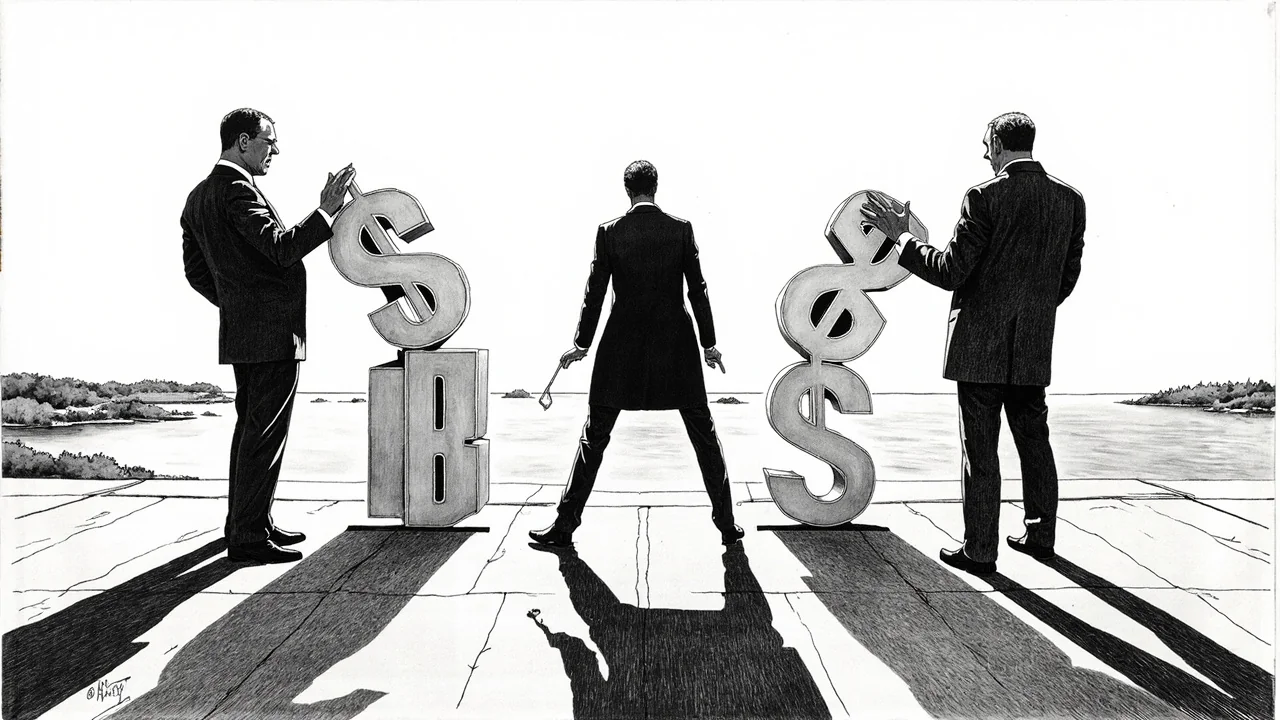

The conflict started when Realkredit Danmark and Totalkredit, two of the market's largest players, unveiled aggressive new pricing strategies. Their moves directly challenged the long-established pricing models that have characterized Denmark's real credit sector. Jyske Realkredit's decision to follow suit this week confirms the battle is industry-wide. This triad of institutions holds a dominant share of the market, meaning their pricing decisions will affect a vast number of Danish families. The competition centers on offering lower interest rates and more favorable terms on real credit loans, which are the primary method of financing home ownership in Denmark.

Understanding the Danish Mortgage Model

To grasp this price war's impact, one must understand the unique Danish mortgage bond system. It is a fundamentally stable and transparent model where loans are funded by issuing bonds sold to investors. This structure has historically prevented the risky lending practices seen elsewhere. Borrowers have the right to refinance their loans at par value, allowing them to easily switch lenders when better rates appear. The current price war exploits this feature, as lenders now aggressively court their competitors' customers. This system is a pillar of Danish social stability, enabling widespread home ownership which is intrinsically linked to successful integration and family security.

Direct Savings for Homeowners

The most immediate effect is quantifiable savings for consumers. Analysts estimate that borrowers switching to the new, more competitive rates could see substantial reductions in their annual expenses. For a typical family with a large mortgage, the yearly saving could reach tens of thousands of Danish kroner. This directly increases household disposable income. In a broader social policy context, reduced housing costs can be a significant factor in economic integration for new residents. Housing affordability remains a critical challenge in Copenhagen and major cities, impacting where families can afford to live and put down roots.

A Shift in Market Culture

This price war represents a cultural shift for the Danish real credit industry. The sector has been known for its consensus and stability rather than cutthroat competition. The move by these three giants suggests a prioritization of market share growth. It may pressure smaller, local real credit institutions to follow suit or risk losing their customer base. This could lead to wider industry consolidation over time. The Danish Financial Supervisory Authority (Finanstilsynet) will likely monitor the situation to ensure the competition does not compromise lending standards or financial stability, which are hallmarks of the system.

The Broader Social Implications

While the story is financial, its implications touch core areas of Danish society news and social policy. Affordable housing is a prerequisite for the successful integration stressed by municipalities and social centers. High housing costs in urban centers can segregate communities and strain the welfare system. Any market movement that reduces the cost of home ownership can have a ripple effect on social cohesion. Community leaders often cite housing stability as the foundation for family wellbeing and participation in society. Therefore, this mortgage price war is not just a business story but one with potential downstream effects on the social fabric that integration policies strive to strengthen.

What Borrowers Should Consider

Homeowners are now advised to actively review their current mortgage agreements. The right to refinance at par value is a powerful tool in this new competitive environment. However, experts caution that the lowest rate may not always be the best overall product. Borrowers must consider terms, service levels, and their long-term financial relationship with an institution. Contacting one's current lender to discuss matching better offers is a recommended first step. This proactive financial engagement is itself a form of economic integration, empowering individuals to navigate complex systems.