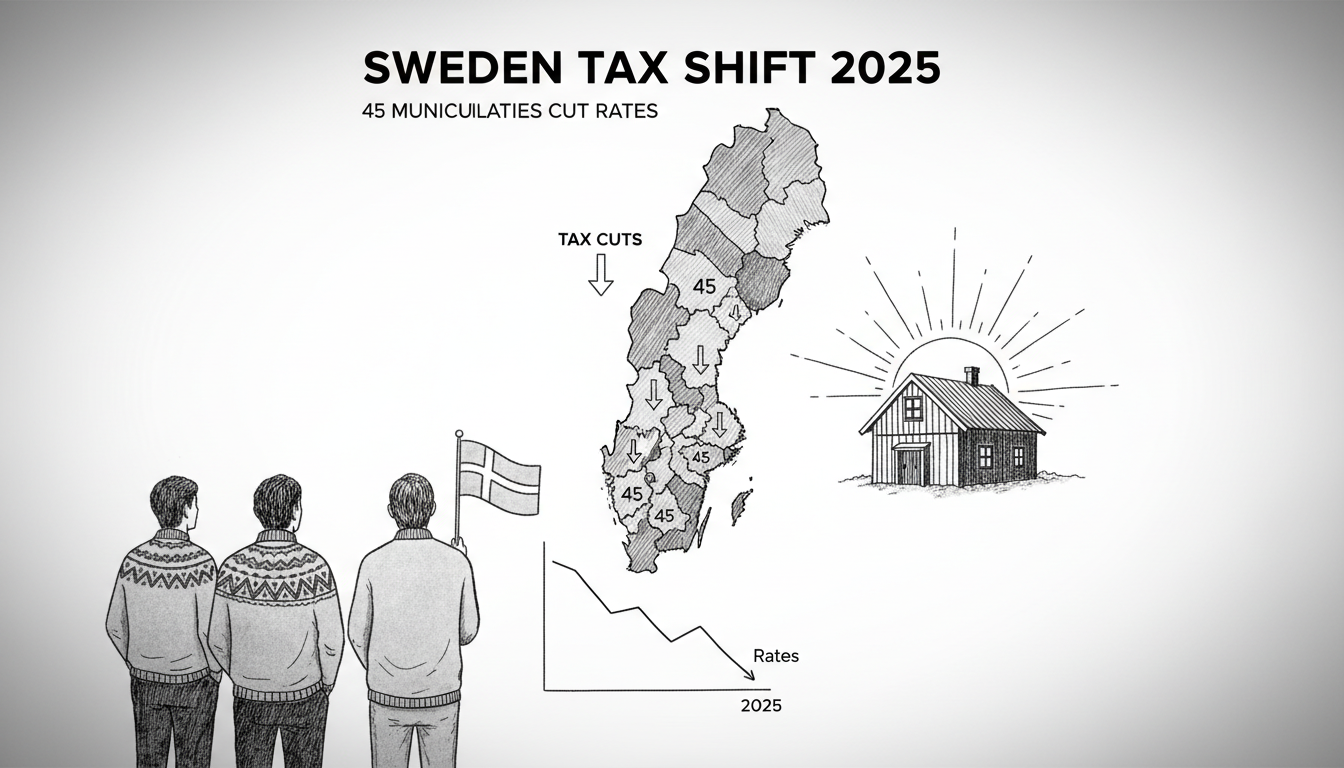

Sweden's municipal tax landscape is shifting for 2025, with residents in 45 municipalities set to see their local income tax rate decrease. In 16 municipalities, the rate will rise, according to new data from Statistics Sweden. The average municipal tax rate across the country will dip slightly by 0.03 percentage points to 32.38%. For many Swedes, this annual adjustment is a direct signal about their local economy and the cost of living in Sweden.

"Every hundredth of a percent matters when you're budgeting for the family," says Erik Lundström, a teacher living in Sundbyberg, one of the municipalities planning a cut. "It might mean an extra week of summer vacation or finally replacing that old washing machine. It's tangible." His sentiment echoes in coffee shops and online forums where Swedes dissect the kommunkarta (municipal map) each year, comparing their town's financial decisions with their neighbors'.

A Patchwork of Local Decisions

The Swedish municipal tax system creates a financial patchwork across the country. Each of the 290 kommuner sets its own rate, which funds everything from preschools and elderly care to local roads and leisure facilities. This decentralization means your financial experience of the Swedish welfare state can vary significantly based on your postal code. The announced changes for 2025 show a clear trend toward relief, with nearly three times as many municipalities cutting taxes as raising them.

However, the news isn't positive everywhere. A significant cluster of increases is concentrated in the north. In 15 of the 16 municipalities facing higher taxes, the primary driver is a major 0.50 percentage point hike by Region Västerbotten. This regional tax, which funds healthcare, stacks on top of the municipal tax, creating a heavier combined burden for residents in places like Umeå, Skellefteå, and Lycksele.

The Northern Equation: Healthcare Costs vs. Household Budgets

"Region Västerbotten is facing substantial cost increases, particularly within healthcare," explains a regional finance officer in a public statement. "An aging population and the need to maintain quality service across a vast geographic area require difficult decisions." This reasoning offers little comfort to locals like Mia Pettersson, a nurse in Umeå. "It's ironic," she says. "I work in the healthcare system that's causing my taxes to go up. My salary isn't rising by 0.5%, but my cost of living is. It feels like we're being penalized for living here."

This tension highlights a core challenge in the Swedish model. High-quality, accessible public services are a cornerstone of society, but funding them requires a sensitive balance. Experts note that demographic pressures are felt acutely in regions with sprawling, rural areas and older populations. "Municipalities and regions with declining or aging populations often face higher costs per capita for services like elderly care and infrastructure maintenance," says financial analyst Karin Möller. "A tax increase can be a symptom of those structural challenges, not just poor management."

Winners and the Stockholm Context

For the 45 municipalities lowering rates, the story is one of cautious optimism. Many are smaller towns or suburban areas around major cities, often with growing populations and healthier economic bases. The cuts, while often modest, are politically popular and signal stability. In Stockholm County, several suburban municipalities are using slight cuts to attract young families priced out of the inner city, competing on a combination of housing costs, school quality, and now, tax rates.

It's crucial to understand that the 'municipal tax' is just one part of the total income tax Swedes pay. On top of the kommunalskatt, workers pay a national income tax on earnings above a certain threshold and a mandatory fee for the public pension system. When politicians debate the 'tax rate,' they are usually referring specifically to this local municipal component, which averages just over 32%.

What a Few Öre Really Means

So, what does a change of a few tenths of a percent mean in real terms? For a single person with an average Swedish salary of about 38,000 SEK per month, a 0.03 percentage point cut in the municipal tax translates to roughly an extra 100 SEK per year—enough for a couple of coffees. The 0.50 point increase in Västerbotten, however, would cost that same average earner about 2,280 SEK annually. That's a noticeable dent in a household budget, equivalent to a month's worth of grocery spending for many.

These calculations are at the heart of the political debate. Local politicians must weigh investments in schools, elderly care, and climate adaptation against the immediate financial pressure on their constituents. In an era of high inflation and interest rates, the pressure to provide relief is intense. "We are seeing a clear political awareness of the strain on household economies," Möller notes. "Even small tax cuts are a symbolic and practical gesture that says, 'We hear you.'"

Looking Beyond the Headline Rate

Smart Swedes look beyond the headline tax rate when choosing where to live. A municipality with a slightly higher tax might offer superb schools, well-maintained public pools, and efficient waste management, providing value for money. Another with a lower rate might have crowded classrooms and potholed roads. The annual tax announcement sparks comparisons of service quality on local Facebook groups and community forums.

The data for 2025 suggests a nation cautiously navigating economic uncertainty. The broad trend toward slight reductions indicates many local governments are finding ways to tighten their belts or are benefiting from increased tax bases due to population growth. The concentrated pain in the north underscores the geographic inequalities that persist, where vast distances and demographic trends create unique financial hurdles.

As the new rates take effect in January 2025, the real-world impact will unfold in quiet ways: a slightly higher disposable income for a family in Eskilstuna, a tighter monthly budget for a retiree in Vilhelmina, and ongoing political debates in town halls across the country about the price of a good society. The question remains: can the quality of the famed Swedish welfare state be maintained if the pressure to lower its visible cost continues to grow?