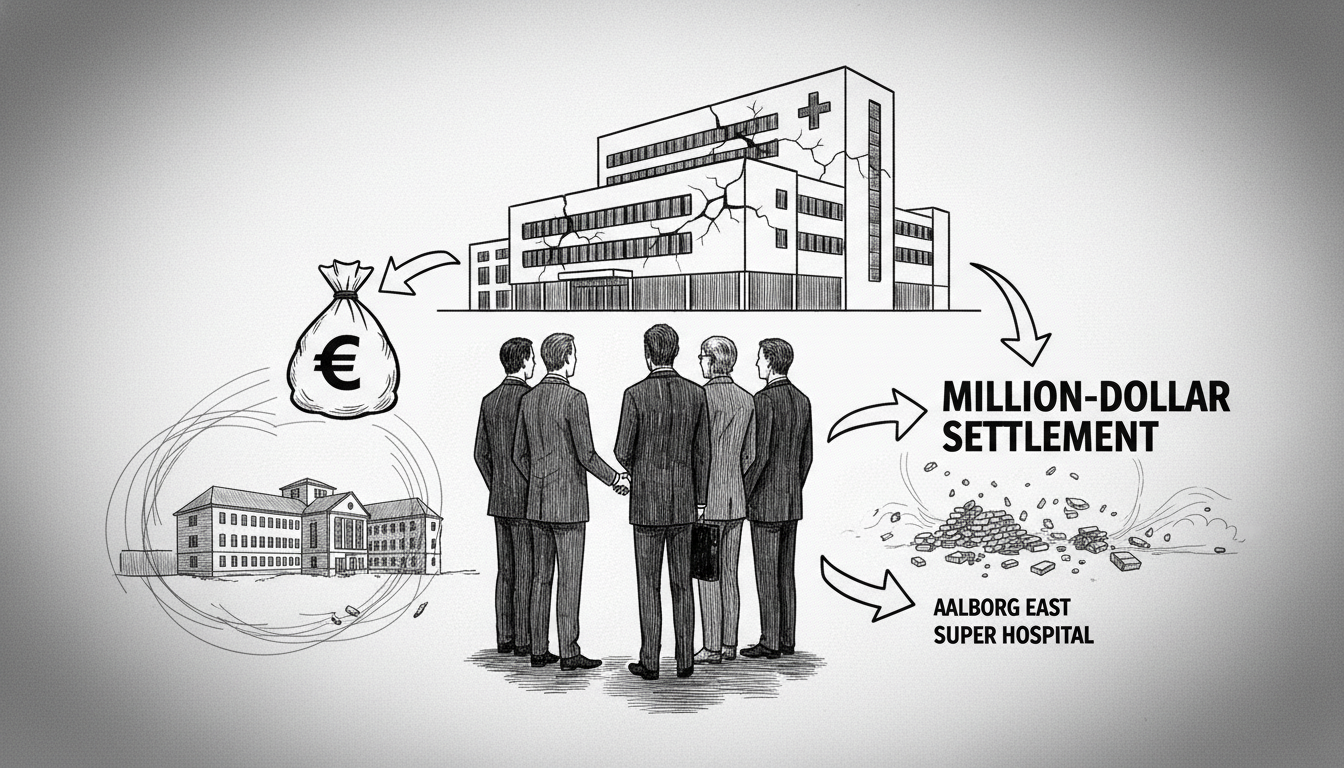

The company behind a billion-krone development project in Aalborg considered withdrawing from the deal entirely. Instead, they negotiated a secret settlement that reduced the purchase price by millions.

The gray-white high-rise building has dominated Aalborg's Vestbyen skyline since the late 1950s. The 14-story structure previously housed Sygehus Nord, a major regional hospital. In what was described as one of North Jutland's largest property transactions, the hospital was sold in 2021.

The full payment never materialized. Region North Jutland breached a crucial clause in the purchase agreement when they failed to vacate the premises by early 2023. The buyers, led by prominent property investor Carsten Enggaard, agreed to postpone the takeover by four years.

This accommodation came at a substantial cost to the public. Previously confidential settlement documents reveal the region was forced to reduce the purchase price by a significant seven-figure amount. These funds were originally earmarked for financing the heavily delayed new super hospital in Aalborg East.

Instead, the money will now benefit a consortium of wealthy property investors. This development raises questions about public financial management and the opportunity costs of such settlements. The diverted funds represent resources that could have improved healthcare infrastructure for the entire region.

Danish hospital projects have faced numerous delays and budget overruns in recent years. The Aalborg University Hospital project has been particularly problematic, experiencing multiple setbacks since its initial planning phases. This compensation payment adds another layer of complexity to an already challenging healthcare infrastructure development.

Regional authorities face increasing scrutiny over their handling of major public projects. The secret nature of the settlement until now suggests officials were aware of the potential public reaction to such a financial arrangement. Taxpayers may reasonably question why public funds are compensating private investors for delays in a public healthcare project.

The situation highlights the tension between commercial real estate transactions and public healthcare priorities. As Denmark continues to modernize its hospital infrastructure, balancing these competing interests remains a significant challenge for regional governments.

What does this mean for the future of healthcare funding in North Jutland? The region must now proceed with its super hospital project with reduced financial resources. Local residents may experience the consequences through longer wait times or reduced services if budget constraints tighten further.

The property investors, meanwhile, secured a valuable asset at a reduced price while receiving compensation for the delay. This arrangement demonstrates the considerable leverage private investors can wield in public-private partnerships.