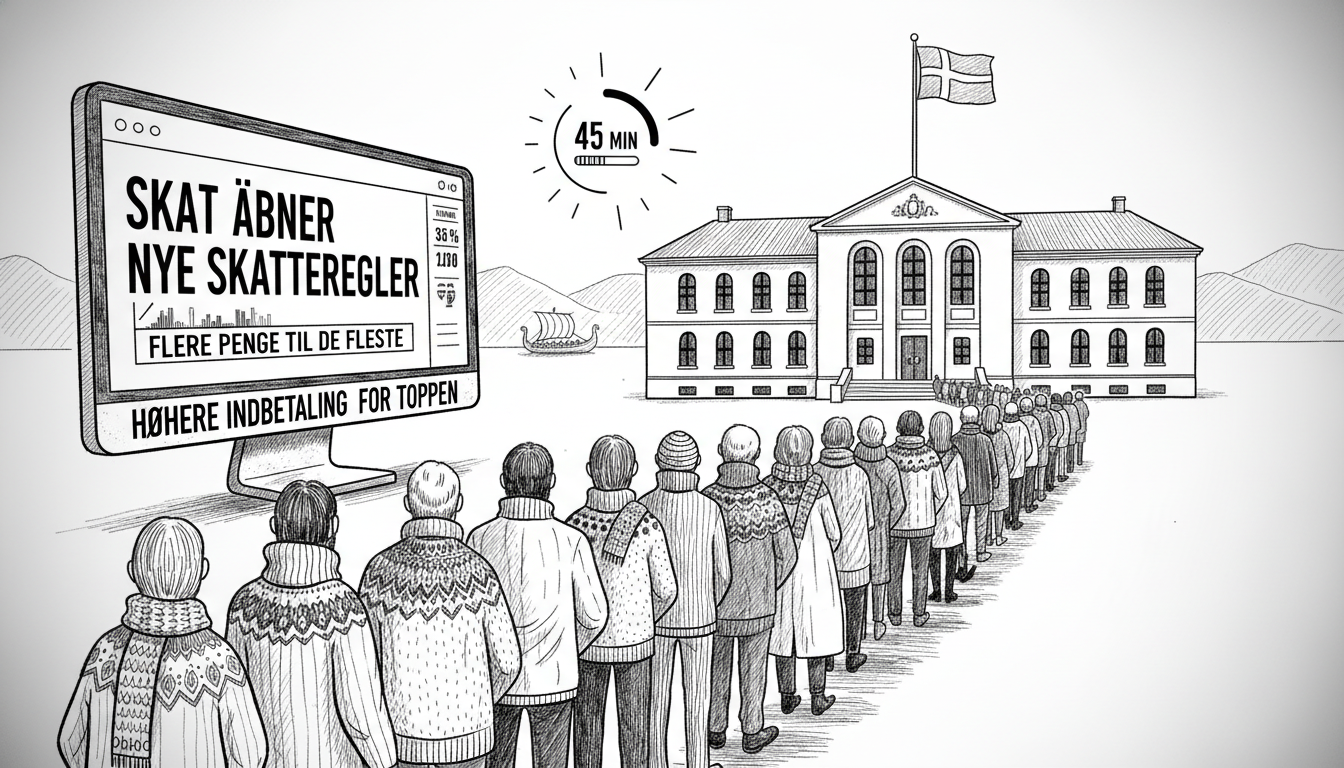

Danish taxpayers faced significant digital queues early Tuesday morning as the country's tax authority opened access to preliminary tax assessments for the upcoming year. More than 11,000 citizens waited in virtual lines reaching 45 minutes at peak times on the official tax website skat.dk.

The preliminary tax assessment serves as a budget for expected income and taxes, while the annual tax return available each March provides the final accounting of actual income, deductions, and taxes from the previous year. The annual return typically generates substantial public interest as Danes check whether they'll receive tax refunds.

Several important changes take effect in the upcoming tax year that require taxpayer attention. Senior citizens within five years of retirement age should pay particular notice to a new employment deduction specifically designed for older workers. This senior employment deduction amounts to 1.4 percent of work income up to a maximum of 6,100 Danish kroner.

The deduction expands significantly under the new financial legislation, extending from two to five years before retirement age. The deduction will also gradually increase through 2030. For 2026, this translates to tax relief up to 7,950 kroner for those within two years of retirement and up to 9,500 kroner for those three to five years from retirement.

Major tax reform also takes effect next year, replacing the current top tax bracket with three separate taxes: a middle tax, a new top tax, and a super top tax. This restructuring means most Danes will keep more of their earnings, while higher earners will contribute more. Only individuals with personal income exceeding 2,592,700 kroner after labor market contributions will pay the five percent super top tax on income above that threshold.

Young workers under 18 will benefit from another change starting next year. They will no longer need to pay labor market contributions on their income. This exemption applies through December 31 of the year they turn 17.

The substantial morning queues reflect both public interest in the new tax changes and the ongoing digital challenges facing government services. Tax authorities typically experience peak traffic during assessment periods, though 45-minute waits indicate persistent system capacity issues. These annual tax assessment openings serve as important financial planning tools for Danish households budgeting for the coming year.

The Danish tax system operates on advanced payment based on expected income, with adjustments made annually. This approach helps maintain stable government revenue while allowing taxpayers to spread payments throughout the year. The current reforms represent continued evolution of Denmark's progressive tax structure, balancing revenue needs with economic incentives for different demographic groups.