Swedish homeowners face substantial differences in mortgage rates across major banks. The gap can mean thousands of kronor in annual costs for typical borrowers. Financial authorities confirm these variations persist in the current market.

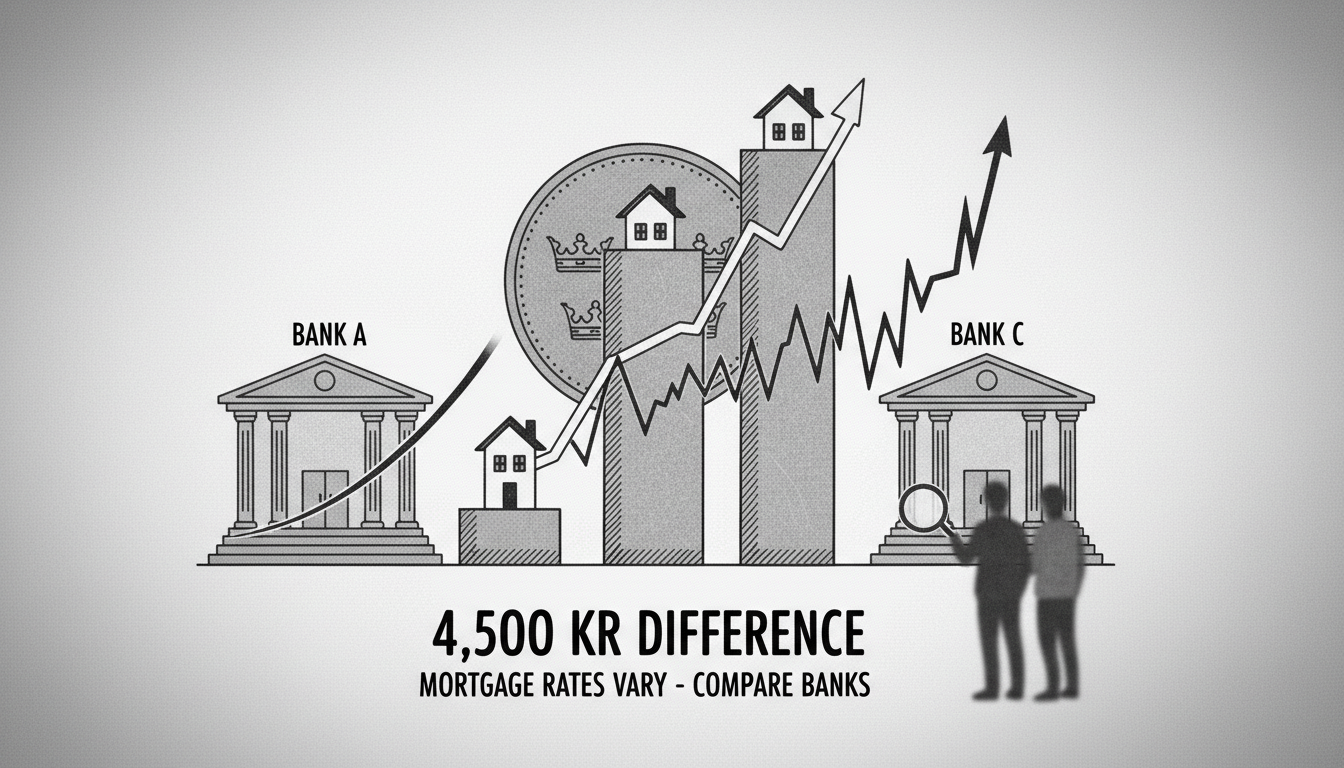

For a standard 2 million krona mortgage, the annual cost difference reaches 4,500 kronor between institutions. This substantial gap highlights the importance of shopping around for mortgage deals. The Swedish Financial Supervisory Authority compiled these findings in their latest review.

Average mortgage rates stood at 2.76 percent in September. Among the eight largest mortgage lenders, the spread between highest and lowest rates reached 0.23 percentage points. This differential creates meaningful financial consequences for Swedish families.

Interest rate discounts have grown dramatically in recent years. The average discount reached 96 basis points in September. Five years ago, average discounts measured just 54 basis points. This expansion reflects increased competition among Swedish banks.

Why do these rate differences matter for international readers? Sweden's mortgage market operates differently than many other countries. Most Swedish mortgages have variable rates rather than fixed long-term rates common elsewhere. This makes borrowers more sensitive to rate changes and bank policies.

Swedish housing costs represent a major portion of household budgets. The country's high home ownership rates mean mortgage terms affect most families. Recent interest rate increases by the Riksbank have amplified these financial pressures.

What should potential borrowers consider? The advertised rate often differs from the actual rate after discounts. Banks negotiate discounts based on customer relationships and total banking business. Homebuyers should compare both headline rates and achievable discounts.

The Swedish mortgage system allows considerable flexibility but requires active management. Borrowers can typically switch lenders without major penalties. This mobility theoretically encourages competitive pricing, yet significant rate gaps persist.

Financial advisors recommend reviewing mortgage terms annually. Many Swedes remain with their original lender despite better offers elsewhere. This loyalty costs households substantial money over time.

Looking ahead, market analysts expect continued rate volatility. Global economic conditions and domestic inflation will influence future mortgage costs. Borrowers should prepare for potential rate fluctuations in coming quarters.