Finland faces European Union excessive deficit procedures after breaching fiscal rules governing public debt and budget shortfalls. The European Commission formally recommended placing Finland under heightened financial monitoring this week, with EU finance ministers expected to finalize the decision in early next year. This marks Finland's return to EU fiscal supervision after more than a decade since its previous monitoring episode in 2010.

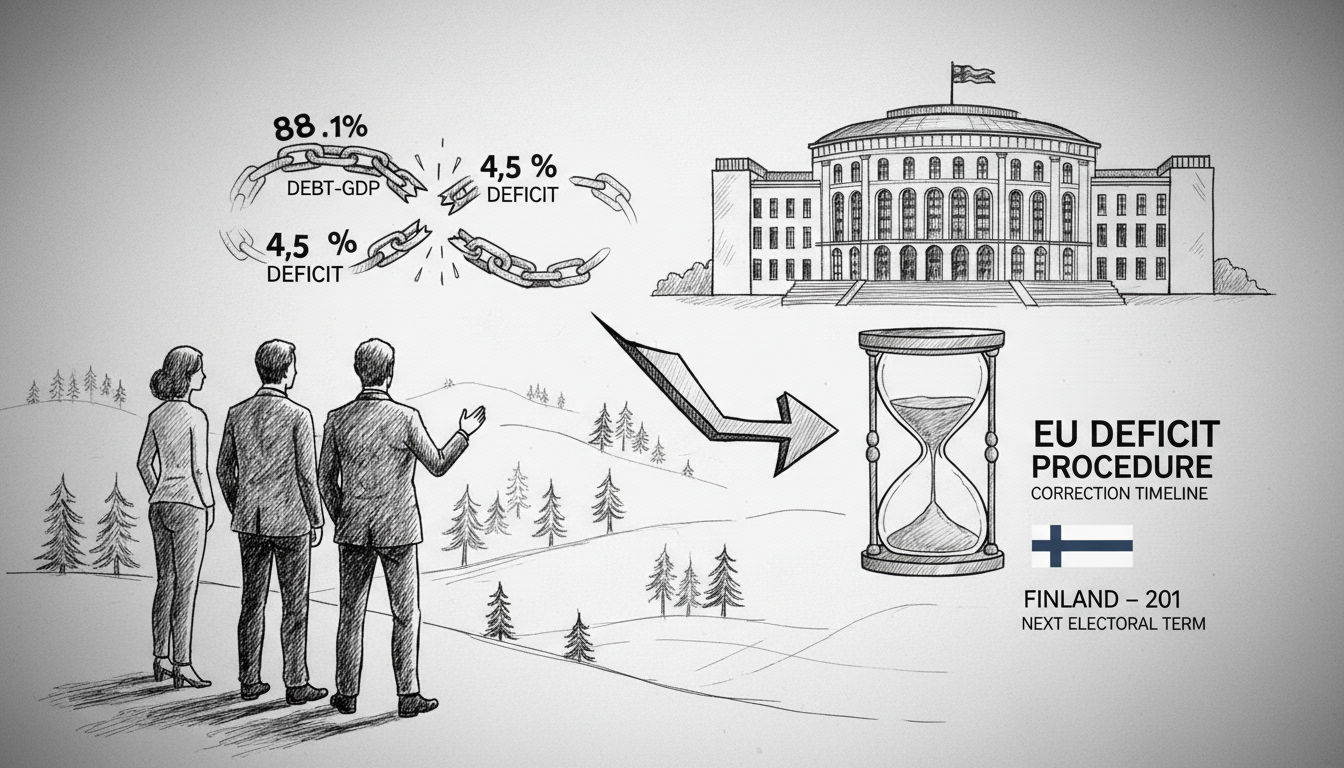

Finance Minister Riikka Purra acknowledged that potential additional spending cuts and tax adjustments would likely impact the next electoral term rather than immediate government operations. Finland's current public debt stands at 88.1 percent of GDP while the budget deficit reaches 4.5 percent, both figures substantially exceeding EU thresholds of 60 percent for debt and 3 percent for deficits. These violations trigger automatic EU scrutiny mechanisms designed to enforce budgetary discipline among member states.

The EU monitoring framework aims to ensure member states commit to fiscal responsibility through structured correction plans. In practical terms, Brussels will establish a specific timeline requiring Finland to reduce its annual deficit below the 3 percent GDP threshold through measured fiscal adjustments. This process represents more than technical compliance—it signals Finland's challenging economic position within European economic governance structures.

Unlike bailout programs, the excessive deficit procedure does not mandate specific austerity measures. The Commission refrains from dictating exact spending cuts or tax increases, instead providing general guidance about necessary fiscal consolidation. This approach allows national governments to determine their own policy mix while meeting agreed deficit reduction targets. Finland must submit its first progress report within three months of the procedure's formal activation.

Historical context reveals Finland previously entered deficit monitoring in 2010 during the European debt crisis, though that procedure was suspended quickly when statistical revisions improved the country's fiscal picture. Currently, nine EU nations including France, Italy, and Poland undergo similar deficit monitoring, placing Finland among significant European economies requiring fiscal correction. Germany narrowly avoided joining this group despite its own 3.1 percent deficit, benefiting from temporary exemptions related to defense spending increases.

What distinguishes Finland's situation is the limited explanatory power of defense expenditures for its fiscal deterioration. Commission analysis indicates only partial justification from security spending increases and temporary flexibility clauses. This assessment suggests structural budget challenges beyond temporary geopolitical factors, requiring more fundamental fiscal reforms. The Commission will publish preliminary savings targets in December, clarifying the specific deficit reduction timeline Finland must follow.

The political implications extend beyond technical budget management. Finland's coalition government now faces balancing domestic political priorities against international fiscal commitments. Minister Purra's acknowledgement that adjustments would affect the next electoral term indicates the government's preference for postponing difficult decisions, though EU procedures might accelerate this timeline. The Economic and Financial Affairs Council will make the final determination about Finland's monitoring status in January.

International observers note the symbolic significance of traditionally fiscally conservative Finland requiring EU supervision. This development reflects broader European economic challenges including sluggish growth, aging demographics, and increased defense spending across the continent. Finland's situation illustrates how even historically disciplined economies face structural pressures testing EU fiscal frameworks.

Looking forward, Finland likely faces several years of controlled fiscal consolidation regardless of specific monitoring requirements. The country's debt-to-GDP ratio is projected to reach 92.3 percent by 2027 without policy changes, indicating underlying sustainability concerns. While the EU monitoring procedure brings additional scrutiny, it primarily formalizes existing fiscal challenges rather than creating new ones. The real test will come in implementing politically viable adjustments that satisfy both domestic constituencies and international obligations.