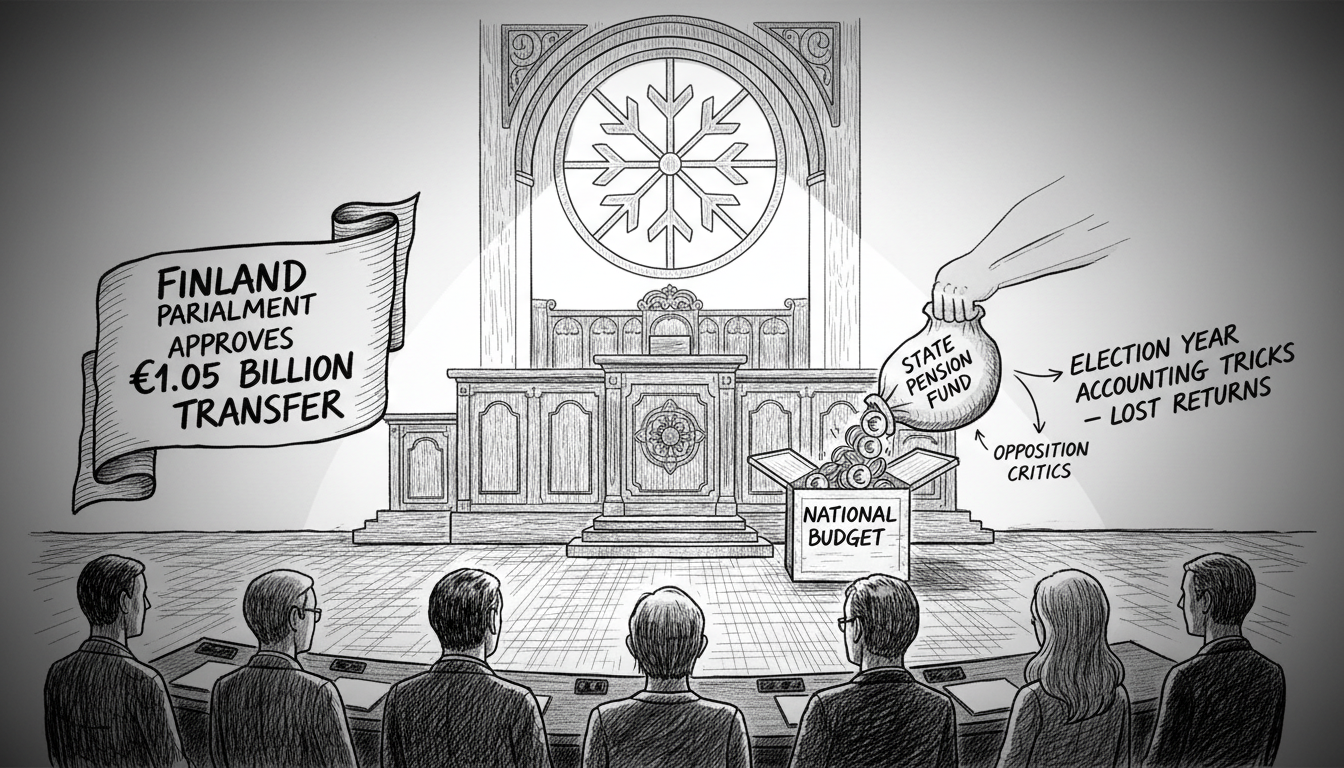

Finland's Parliament approved a controversial bill allowing a 1.05 billion euro additional transfer from the state pension fund to the national budget. The decision passed on Friday with 102 votes in favor and 75 against, sparking intense political debate about fiscal responsibility and intergenerational equity.

The opposition parties unanimously voted against the measure, comparing it to taking out a payday loan from future generations. They argued the government is using accounting tricks to temporarily improve budget figures during an election year while creating long-term financial risks.

This substantial transfer represents 18.7 percentage points of the pension fund's assets. While it reduces immediate government borrowing needs, it will lower the pension fund's buffer reserves and potentially cost taxpayers over 100 million euros in lost investment returns between 2026 and 2029 according to parliamentary committee estimates.

The Finance Committee acknowledged that using accumulated pension fund wealth to cover growing retirement expenses during peak payout periods has some justification. However, they warned about the significant opportunity costs when the government loses expected investment returns and compounding gains on those returns.

Political tensions flared during Thursday's parliamentary session where opposition members delivered harsh criticism without any defense from government coalition parties. Only Juha Hänninen from the National Coalition Party briefly praised what he called responsible economic management, arguing the measure protects pension sustainability while reducing debt and ensuring intergenerational fairness.

Opposition leaders accused the government of violating previous agreements about fiscal discipline. Markus Lohi, chair of the Finance Committee, specifically criticized funding permanent corporate tax cuts through temporary accounting maneuvers. He noted the state will lose approximately 35.5 million euros in 2027 alone from reduced pension fund returns.

Former Economic Affairs Minister Mika Lintilä called the move pure trickery designed to conceal corporate tax reductions. Similarly, former SAK union leader Lauri Lyly described it as the most unreasonable proposal overall—a billion euro election year gambit that contradicts recent agreements to avoid such one-time financial manipulations.

Social Democratic Party representative Joona Räsänen condemned the action as truly reprehensible, noting that this payday loan approach makes 2027 look slightly better than reality while creating a billion euro gap that the next government must immediately address in 2028. He emphasized that permanent tax reductions should be covered by permanent revenue increases, not temporary transfers.

The controversy highlights Finland's challenging fiscal position as the population ages and pension costs rise. This marks another chapter in the ongoing debate about how to balance current budget needs against long-term financial stability and intergenerational responsibility in Nordic welfare states.