The Finnish Parliament is debating a controversial proposal to grant the Tax Administration broader access to citizens' bank account information. The government argues this expansion would strengthen efforts against gray economy activities and financial crimes. Critics raise serious privacy concerns about the potential overreach.

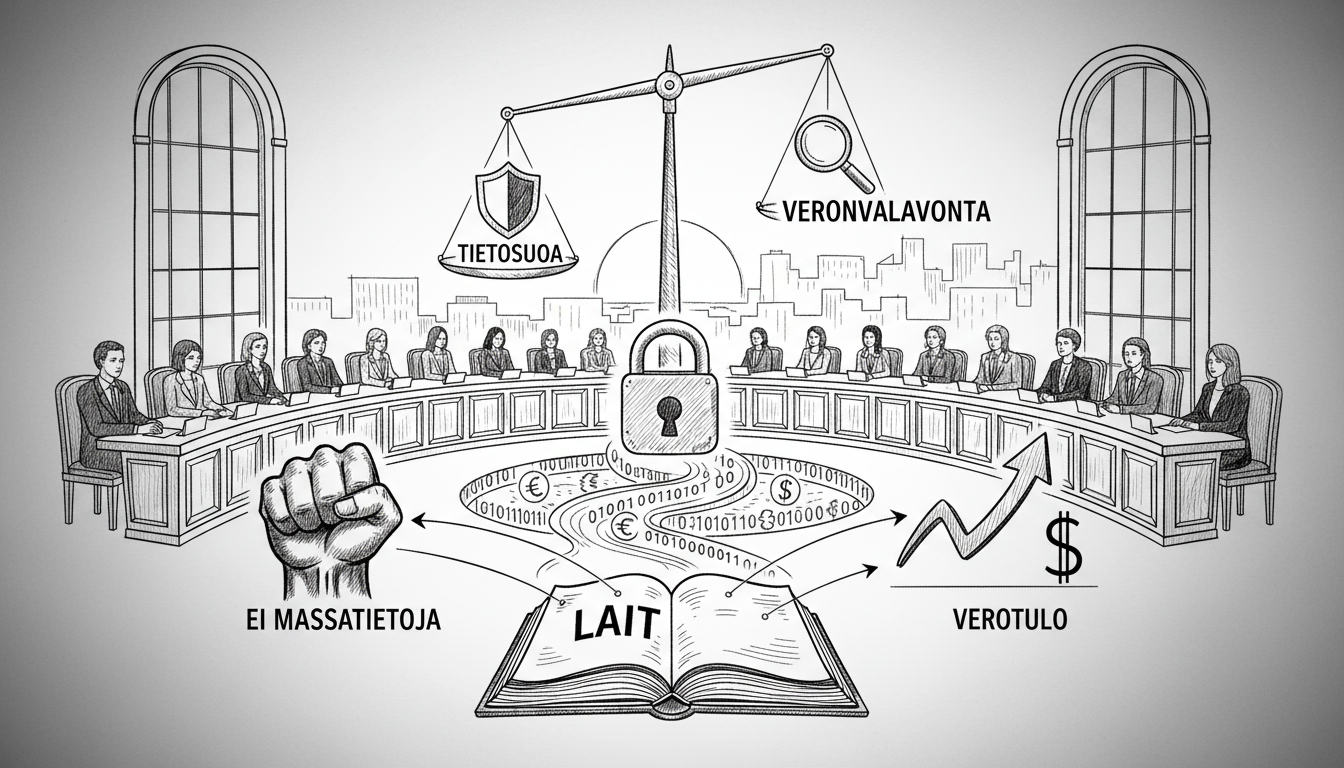

The legislation would allow tax authorities to collect mass data for comparison audits. Currently, officials must request information about specific individuals' foreign transfers, card purchases, and payments. The new system would permit data collection based on risk phenomena rather than individual targeting. All requests would still require precise justification and narrow focus.

Financial sector representatives strongly oppose the changes. The Finnish Finance Industry association calls the proposal problematic for data protection regulations. They express deep concerns about privacy implications. The association provides gift taxation as an example of potential overreach. Under the new system, authorities could analyze all customer transactions to identify anyone gifting over 7,500 euros to their close circle within three years.

Business organizations join the criticism. The Confederation of Finnish Industries questions whether mass data processing would be proportionate. They note that individual case assessments appear to rely entirely on the Tax Administration's discretion. The organization also challenges revenue projections, calling current estimates overstated and unrealistic.

The Tax Administration defends the proposal in its statement. Officials claim only they can properly assess proportionality since the matter involves public authority exercise and tax supervision. They argue they cannot share sufficiently detailed risk information for external evaluation.

Revenue estimates show substantial variation. The Tax Administration projects annual tax revenue increases reaching 50-80 million euros initially, growing to 100 million euros by 2028. Business organizations counter with a much lower estimate of approximately 10 million euros annually.

This debate reflects Finland's ongoing balancing act between effective tax collection and individual privacy rights. The Nordic country has traditionally maintained strong data protection standards while ensuring robust public revenue systems. The current proposal tests these competing priorities in an era of increasing digital surveillance capabilities.

The legislation now moves to the Finance Committee for detailed consideration. The government aims for implementation beginning next year. The outcome will significantly impact how Finnish authorities balance financial oversight with fundamental privacy rights in the digital age. International observers watch closely as Finland's approach could influence similar debates across Europe.

Privacy advocates note the proposal represents a substantial shift in government access to personal financial data. The mass data approach differs fundamentally from targeted investigations. Banking industry representatives warn about potential chilling effects on legitimate financial activities if customers fear constant monitoring.

The parliamentary process will likely see heated debates about the proper limits of state authority. Finland's coalition government faces pressure from both sides - from fiscal hawks demanding better tax enforcement and from privacy advocates protecting civil liberties. The final legislation will reveal which priority prevails in this crucial policy decision.