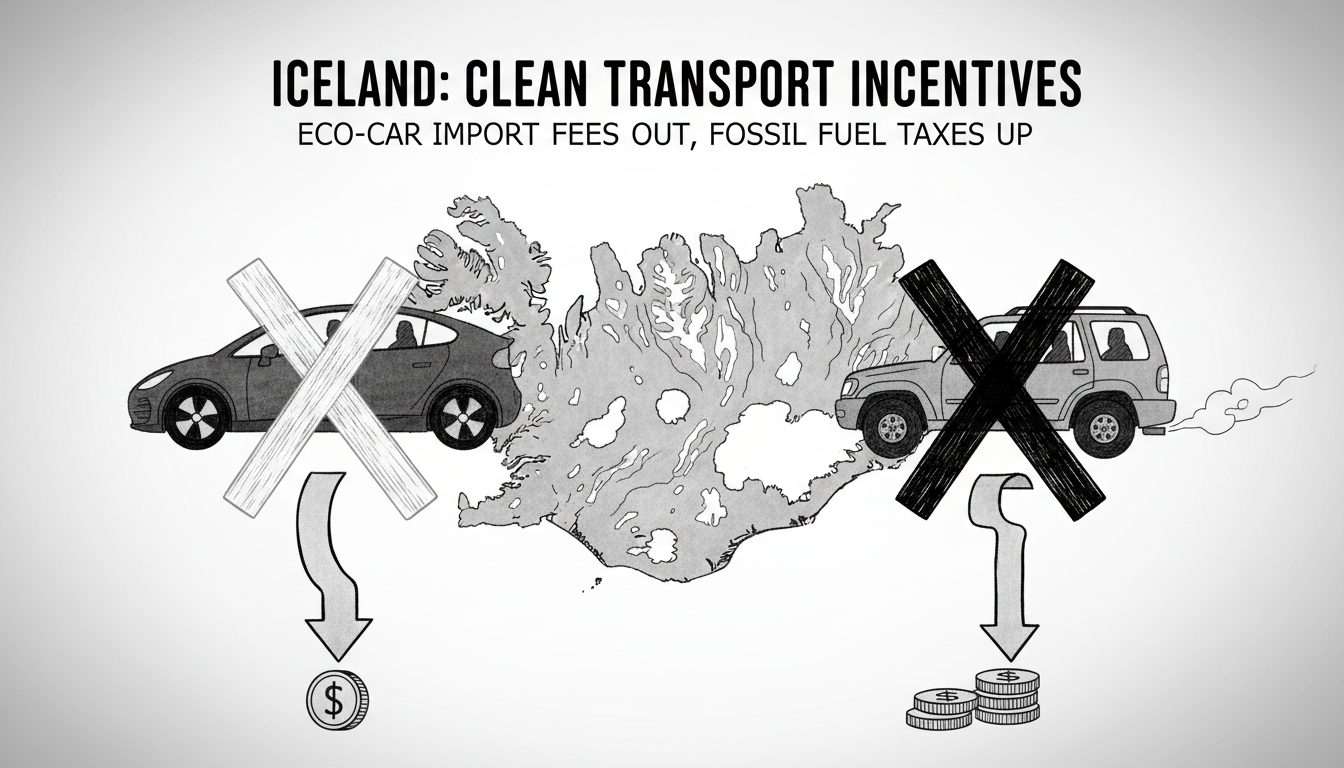

Iceland's finance minister proposes eliminating import taxes on clean energy vehicles next year. The tax removal will apply to electric, methane, and hydrogen-powered cars. Import fees will increase for vehicles running on fossil fuels.

The minister's proposal ties to budget-related legal changes. The goal creates permanent incentives for choosing vehicles using clean domestic energy over imported fuels. The five percent import tax on electric cars would disappear completely.

These changes do not affect direct subsidies from Iceland's Energy Fund for electric car purchases. That subsidy previously reached 900,000 Icelandic króna maximum but drops to 500,000 króna next year.

Import taxes on regular passenger cars jump from five percent to fifteen percent. Emissions standards will tighten for vehicles releasing carbon dioxide. Methane vehicles escape these tighter standards despite emitting CO2.

Vehicles running entirely or partially on fossil fuels face tax increases from thirteen to twenty percent. This category includes work machinery and specialized vehicles according to the ministry announcement.

Why eliminate taxes on clean vehicles while reducing purchase subsidies? The government appears betting that long-term tax savings matter more to consumers than temporary cash incentives. This creates predictable financial advantages for green transportation choices.

Iceland generates nearly 100% of its electricity from renewable geothermal and hydropower sources. The policy shift aligns with the country's unique ability to power vehicles with domestic clean energy rather than imported oil.